The stock market rose through light trading posting all-around good performance across the market-cap curve this week. The trend was enough to help the S&P lock in a small gain for the month. As a reminder, the US Stock Market and Bond Market will both be closed on Monday, May 31st in observance of Memorial Day. Welcome to GoNoGo Research Launch Conditions for the week ending May 28, 2021.

We don’t see things as they are, we see them as we are. - Anaïs Nin

Review your weekly chart pack here:GoNoGo LC 052921

Rising Equities Amidst Calm Treasury Markets

Treasury Markets showed strength this week resulting in lower yields – the 10-yr yield declined five basis points to 1.58%. Risk assets appeared to draw support from the relative calm, which staved off pestering inflation concerns and accompanying valuation concerns. The Nasdaq Composite (+2.1%), Russell 2000 (+2.4%), and iShares Micro-Cap ETF (IWC, +3.3%) rose more than 2.0%. The S&P 500 (+1.2%), Dow Jones Industrial Average (+0.9%), and S&P Mid Cap 400 (+1.4%) each advanced closer to 1.0%.

See the GoNoGo chart of $SPY below which depicts the steady climb back towards the high of May 7. GoNoGo Oscillator shows the return of positive momentum for US Equities, though delivered on lighter volume.

Rotation Theme About to Come Full Circle?

Empirically, we have seen the relative outperformance of cyclical sectors for months. The fundamental analysts will tell you that the biggest positive earnings surprises in first-quarter results came from cyclical sectors and value-style investments, including energy and financials. Positive earnings momentum suggests further tailwinds for the industrial economy through the second quarter. The question is whether the market has already priced in forward earnings expectations?

This week, absolute performance from a sector perspective favored a reversion to the mean. Facebook and Google parent Alphabet helped communication services stocks outperform within the S&P 500, and a rebound in Tesla boosted consumer discretionary shares. The consumer discretionary (+2.2%), communication services (+2.5%), information technology (+1.6%), and real estate (+2.1%) sectors finished atop the leaderboard. Conversely, the utilities (-1.6%), health care (-0.7%), consumer staples (-0.4%), and energy (-0.02%) sectors closed lower.

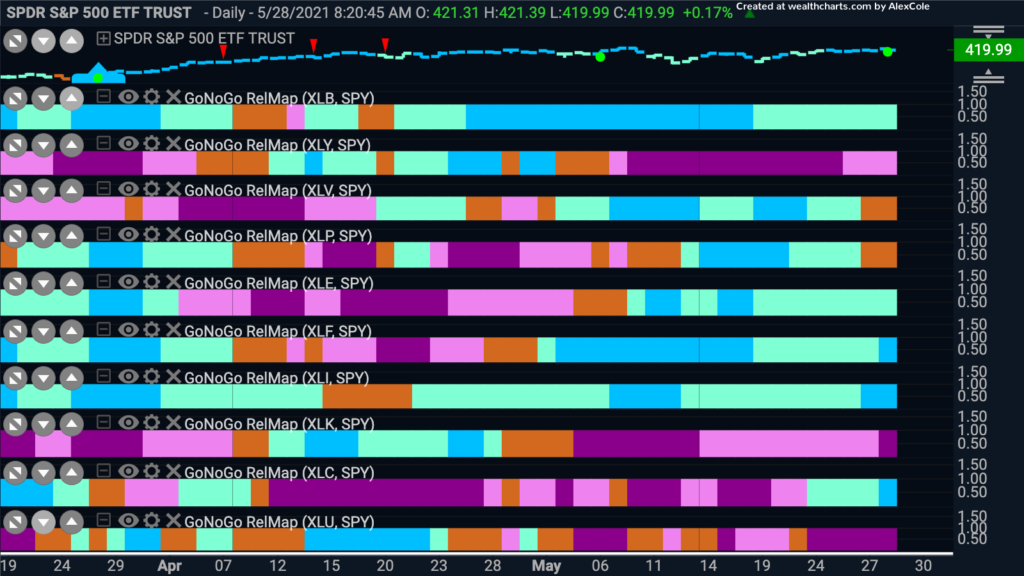

See the daily GoNoGo Relmap below of the S&P Sector ETF relative strength against the S&P benchmark. The trend conditions of their relative performance remain largely unchanged as cyclical sectors continue to lead the index: Materials $XLB, Energy $XLE, Financials $XLF, and Industrials $XLI are all in continuous “Go” Trends on a relative basis to the index. Most notably we saw the Communications sector $XLC reverse this week from laggard to leader, and the healthcare $XLV and Staples $XLP fell to neutral withdrawing some concern about defensive sectors leadership as a signal for risk-off dynamics:

Senate Republicans confirmed a $928 billion infrastructure counteroffer to the Biden administration’s $1.7 trillion American Jobs Plan while the White House confirmed a $6 trillion budget for FY22, which would include both the American Jobs Plan and American Families Plan. Could inflation really be as transitory as the Fed claims in to be? The Treasury Market seems to think so…

The Durability of “Fake Internet Money”

For all you investors with a propensity for trading, we hope you have remained on the right side of trends in digital assets. Fascinating to watch a pure supply/demand game play out in a less efficient, less regulated emerging asset class. It is worth noting that cryptocurrencies, unlike nearly every other passing bubble (tulips, beanie babies, etc… managed to come back to all time highs after cracking the parabolic move in the final months of 2017. They have shown durability despite their volatility. Here is a quick reminder of the importance of the $30k to $40k levels for Bitcoin $XBTUSD. NoGo trend still in place, but less clear now as to the opportunity on the short side: