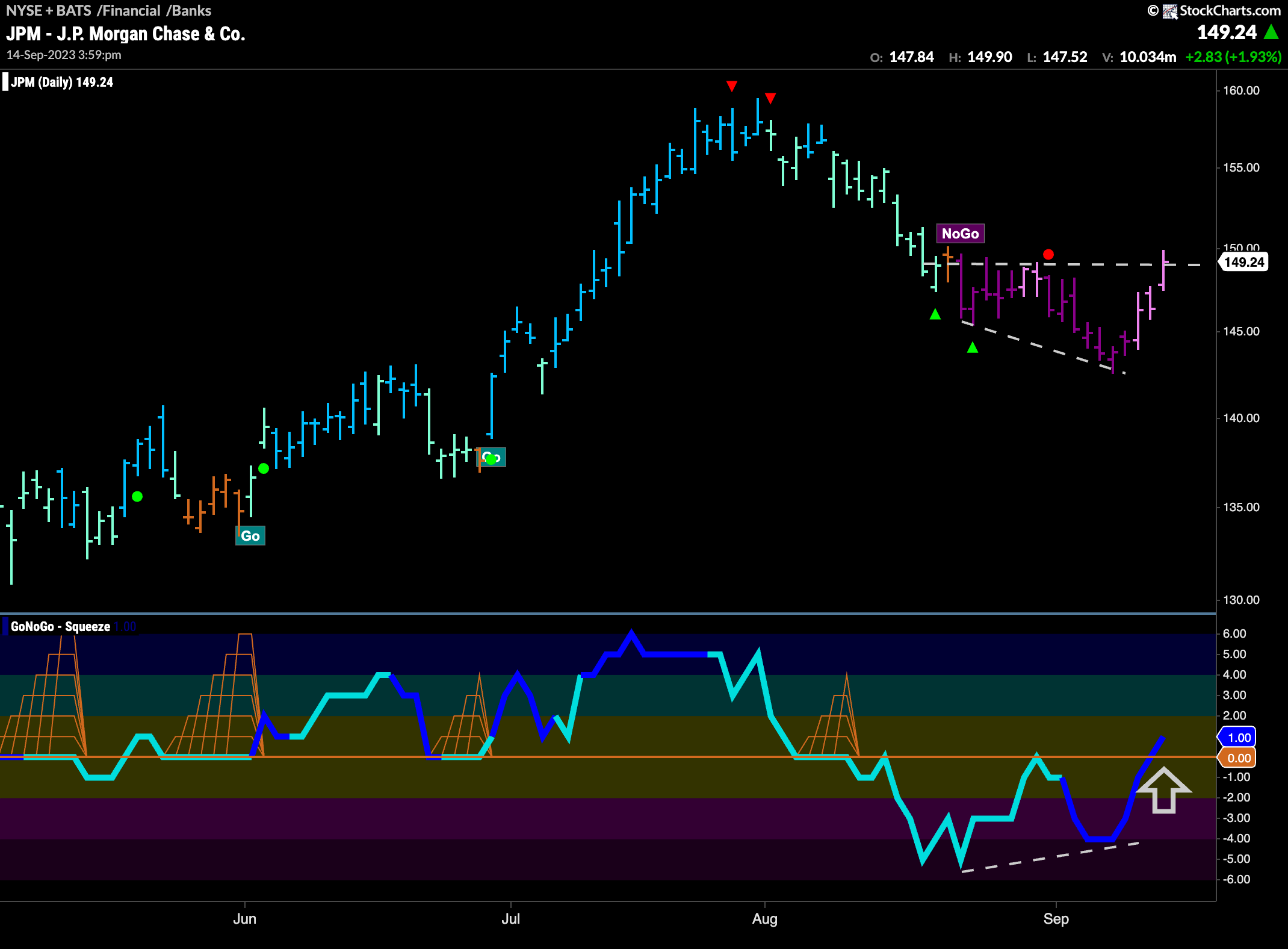

$JPM has been in a “NoGo” since late August.

We are now seeing some signs that are threatening the health of that “NoGo” trend. From a traditional technical analysis perspective there are two things to pay attention to. First, we are seeing price trying hard to break above horizontal resistance as price rallies this week. Second, we see bullish divergence between price and momentum as price made lower lows not confirmed by the oscillator making a higher low. Through the GoNoGo lens, the obvious point to note is that GoNoGo Oscillator is breaking above the zero line into positive territory. We know that if the “NoGo” is to remain healthy, there should be no positive momentum as that is out of sync with the current trend. We also see that volume is heavier than its average on this price rally. We will look to see if the oscillator is able to stay in positive territory and then look for GoNoGo Trend to potentially identify a trend change