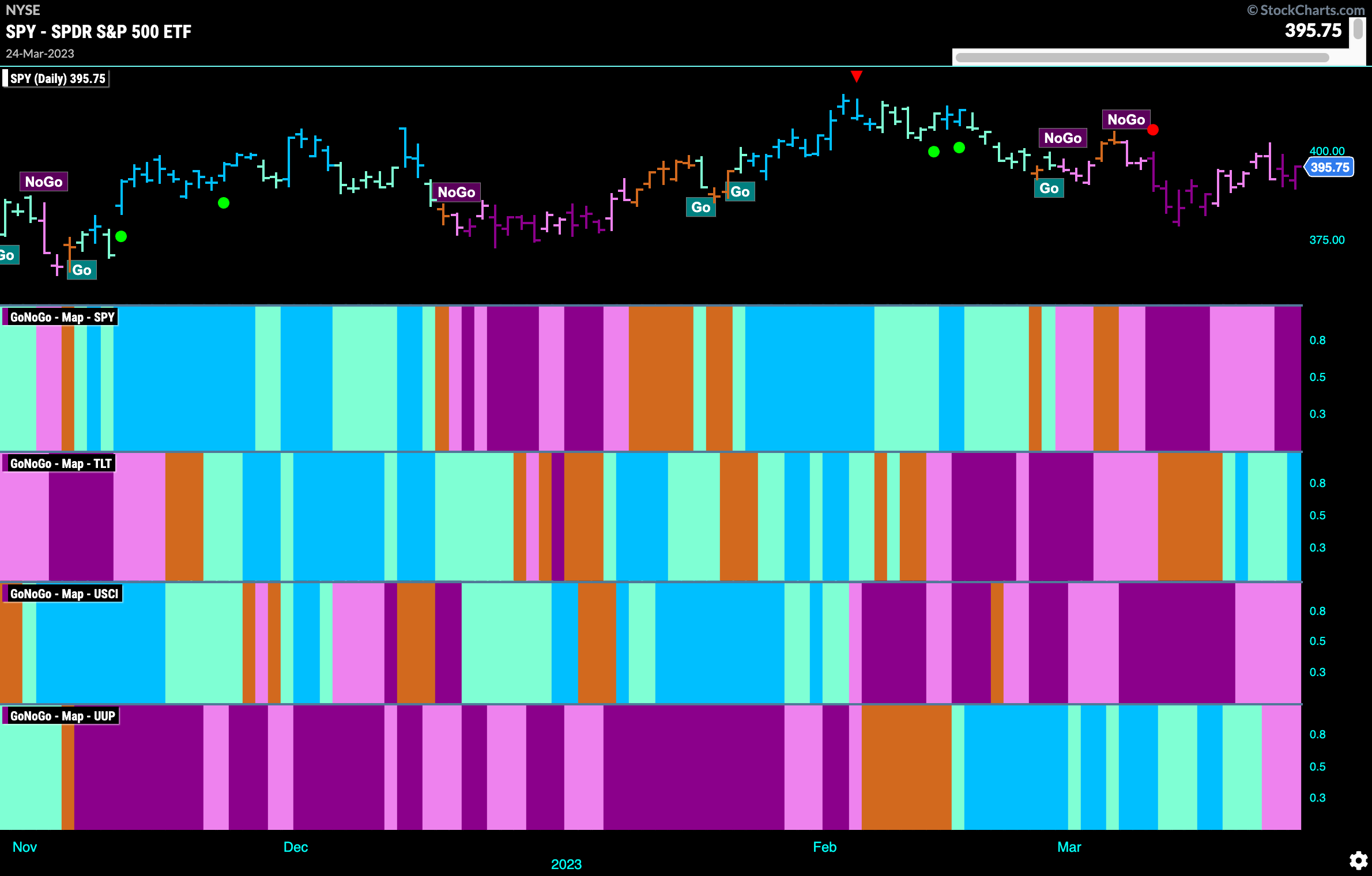

Good morning and welcome to this week’s Flight Path. Let’s take a look at the GoNoGo Asset map below. Equities remain in a “NoGo” and we saw the GoNoGo Trend strengthen to strong purple bars as the week came to a close. Treasuries are in a “Go” trend while commodities remain under pressure. The dollar took a turn for the worse this week as it reversed trend and is now painting “NoGo” bars.

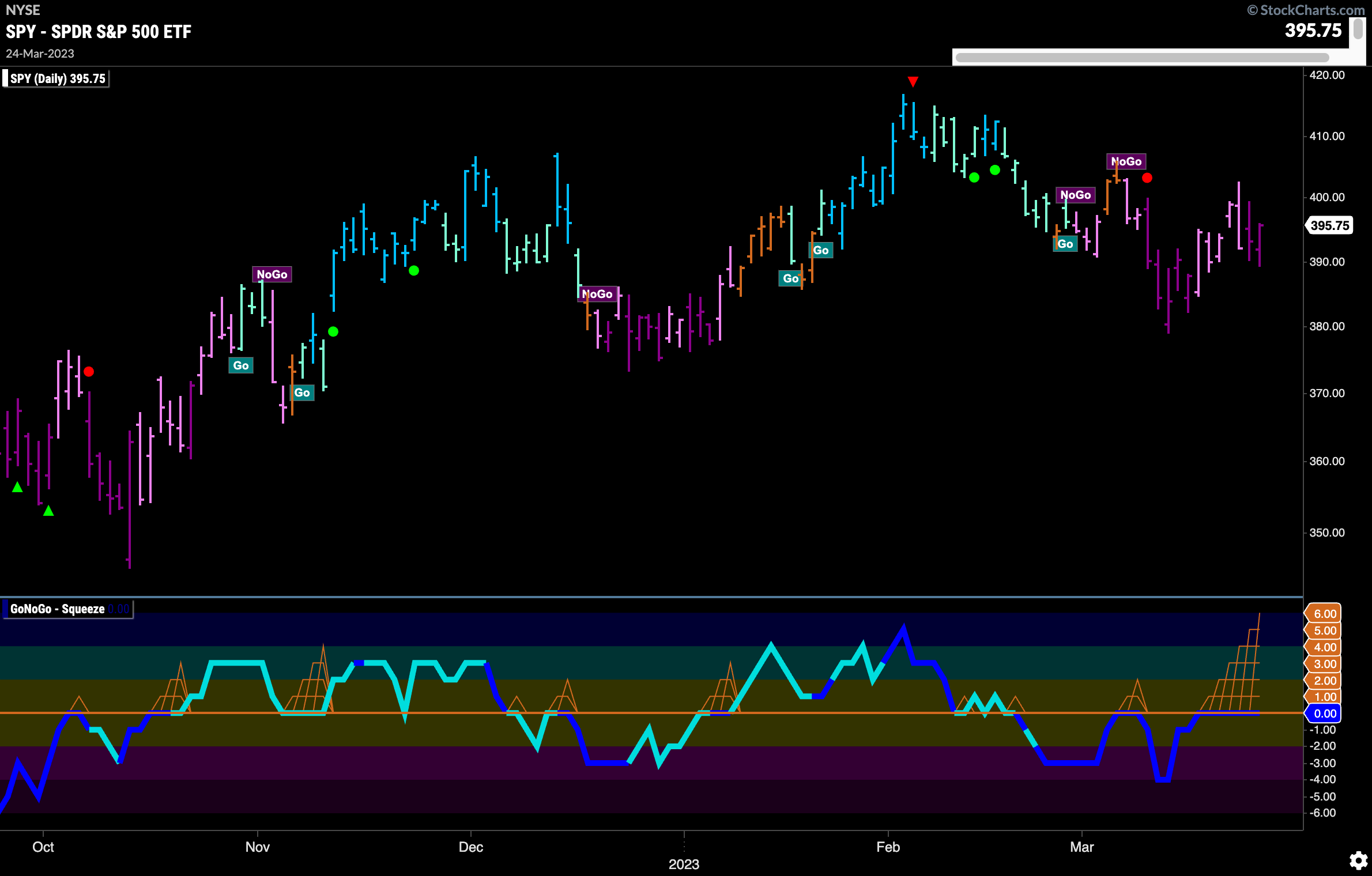

Equities in Max GoNoGo Squeeze

The “NoGo” trend remains in place for U.S. equities and we saw the indicator paint a couple of strong purple bars to end the week. GoNoGo Oscillator has been stuck at the zero line the entire week and that caused the climbing grid of GoNoGo Squeeze to rise to its max. It will be important to pay attention to which direction the squeeze is ultimately broken. If we see the oscillator break out of the Squeeze back into negative territory that would suggest continuation of the “NoGo”. On the other hand, a break above zero would suggest positive momentum, a divergence from the trend.

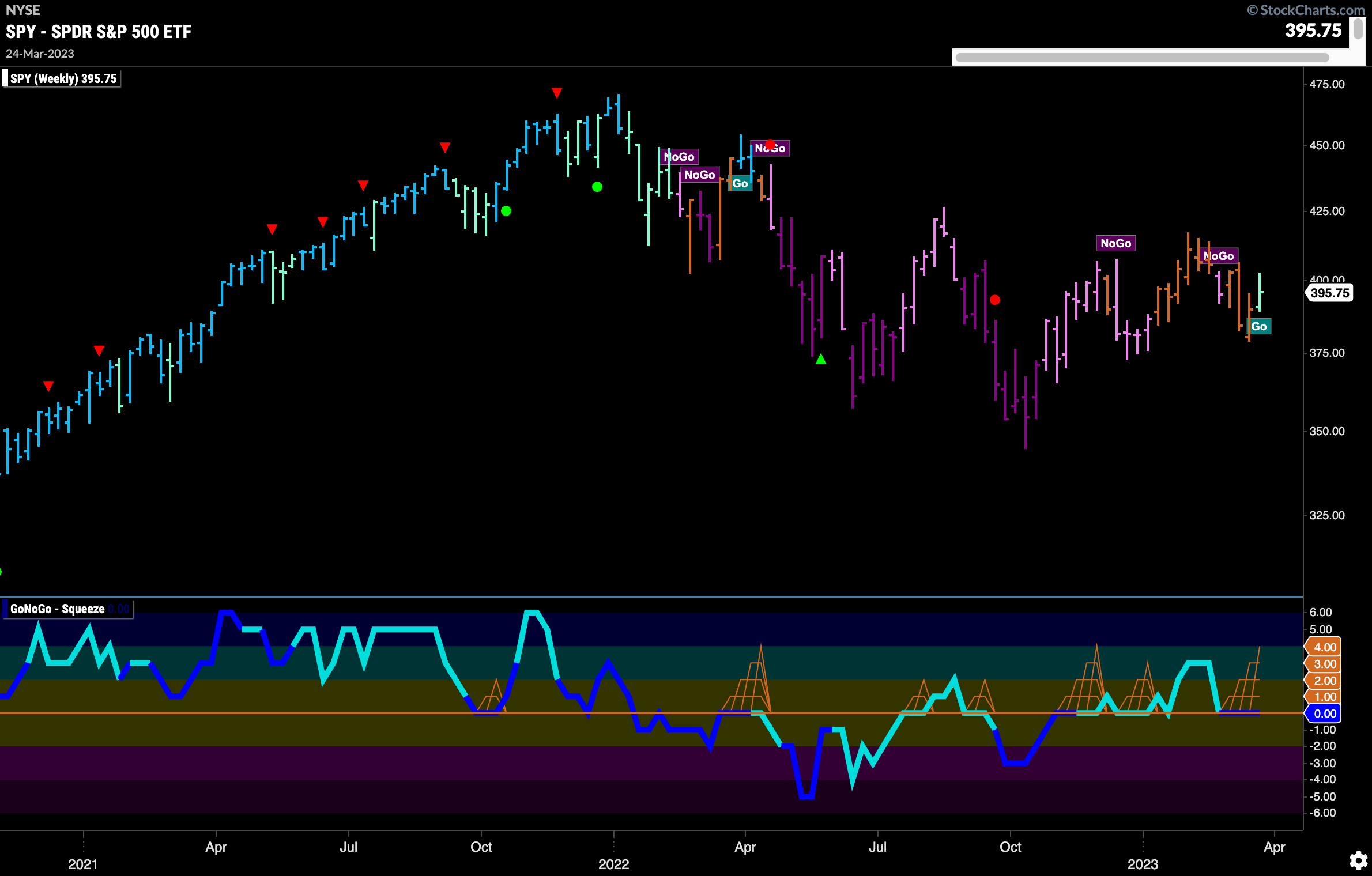

Big news on the weekly chart. We see a first aqua “Go” bar at the close of the week. This comes as price makes another higher low. GoNoGo Oscillator is riding the zero line on the weekly chart as well and so we will need to see the oscillator find support here. A rally back into positive territory would confirm the new “Go” trend we see in the price panel and suggest an attempt at a new higher high.

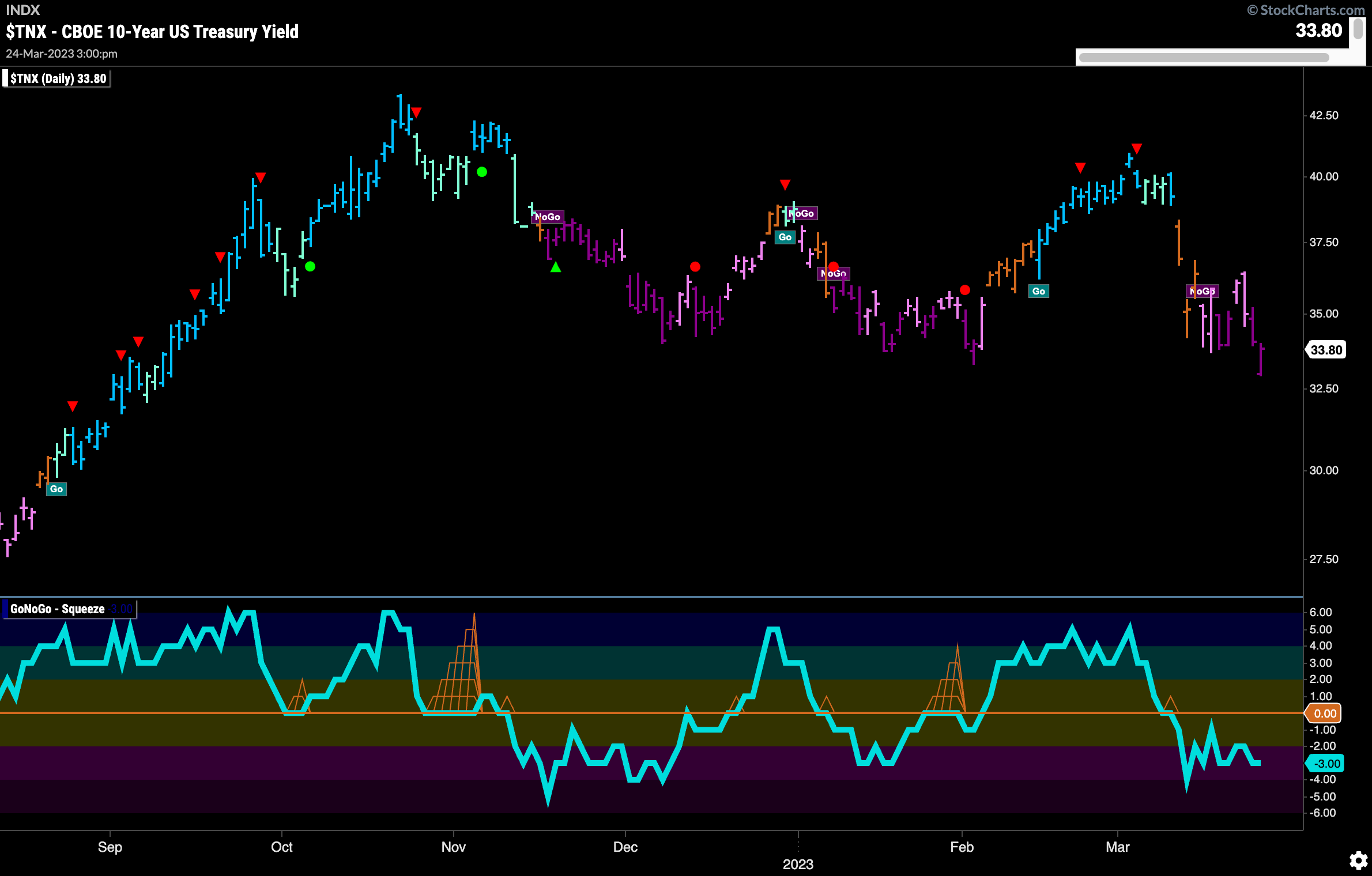

Treasury Rates Fall Lower

Treasury rate continue to paint “NoGo” bars and strong purple ones at that. We see the week end with a s bar that threatened prior lows as GoNoGo Oscillator remained in negative territory but not oversold. We will look to see if a new low is set this week.

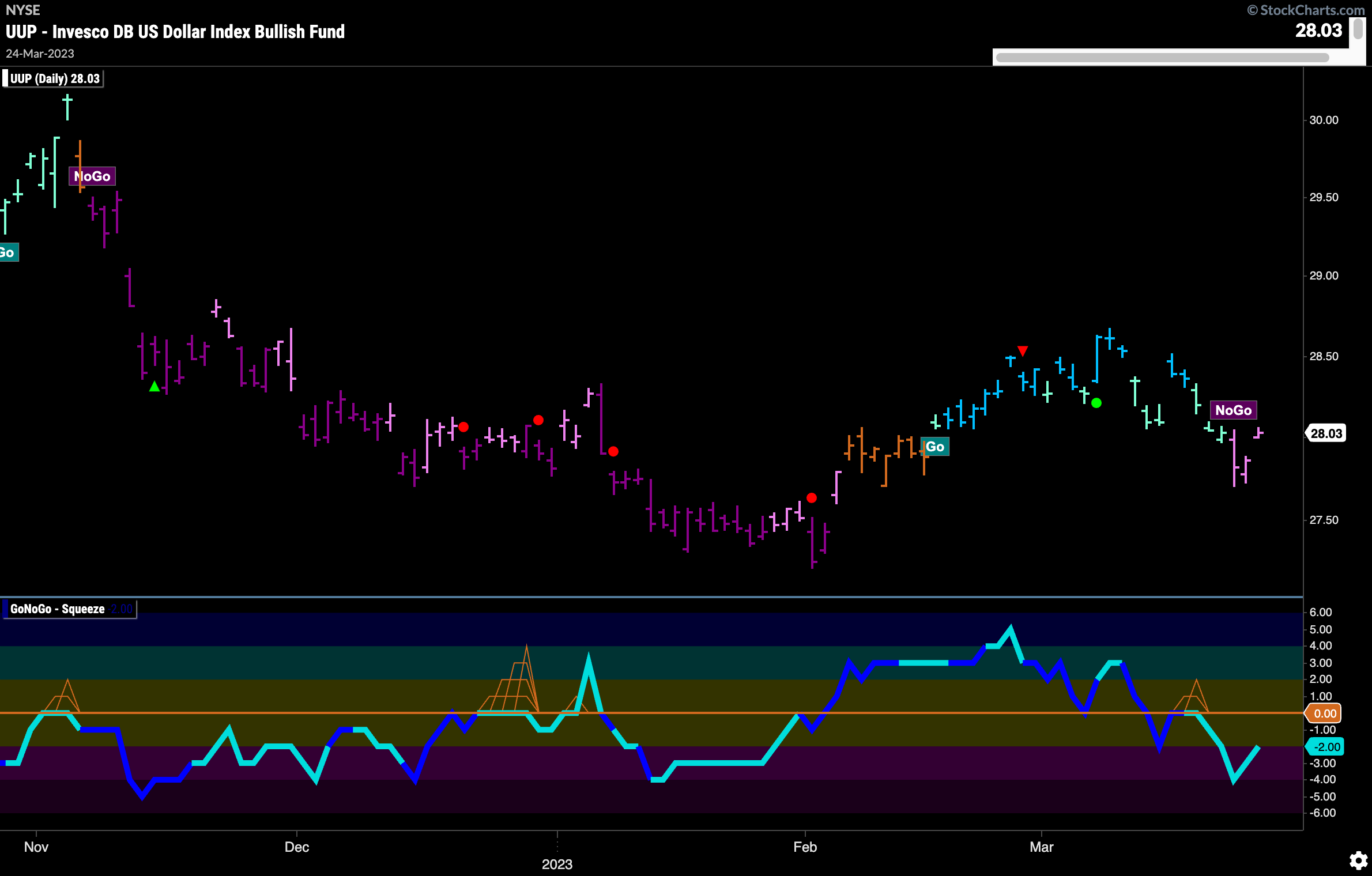

Dollar Reverses Trend

GoNoGo Oscillator retested the zero line after it had broken into negative territory and was clearly rejected last week. This preceded the change in trend that we then saw in the price panel. Now, a “NoGo” trend is in place and GoNoGo Oscillator is in negative territory but not yet oversold. We will see if the dollar struggles further this week.

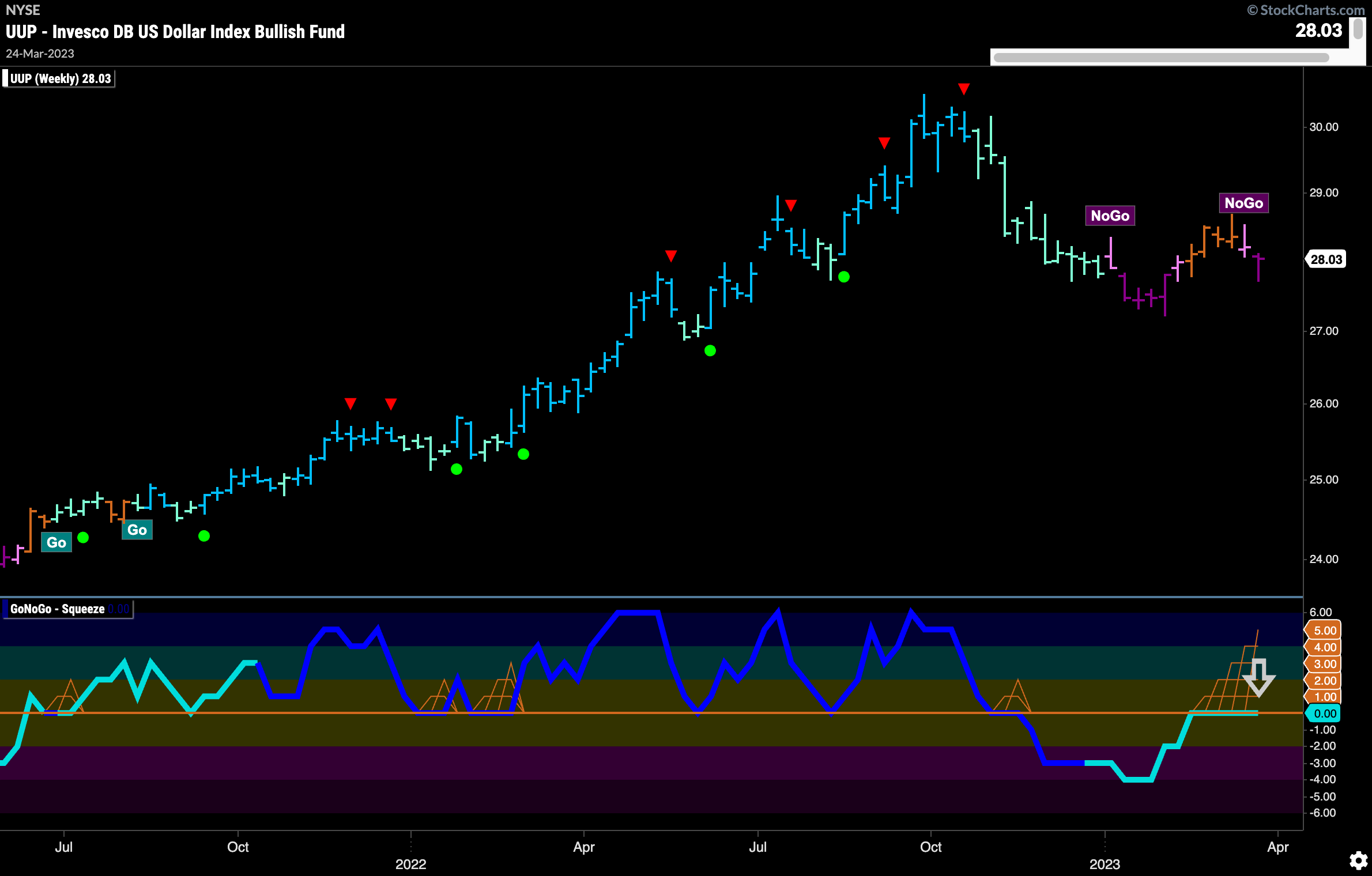

The weekly chart shows that the larger time frame trend is a “NoGo”. After a few bars of uncertain amber “Go Fish” bars we see the “NoGo” take hold again. As we watch for further signs of price deterioration we will watch the GoNoGo Oscillator as it continues to ride the zero line. This is causing the climbing grid of GoNoGo Squeeze to rise to its max. A break out of the squeeze into negative territory would confirm the “NoGo” in price and suggest trend continuation.

Oil Sees No Change to “NoGo” Trend

$USO stayed in the “NoGo” this week as the GoNoGo Trend indicator painted another strong purple bar at new lows. GoNoGo Oscillator was soundly rejected by the zero line last week and we are currently in negative territory and volume is heavy.

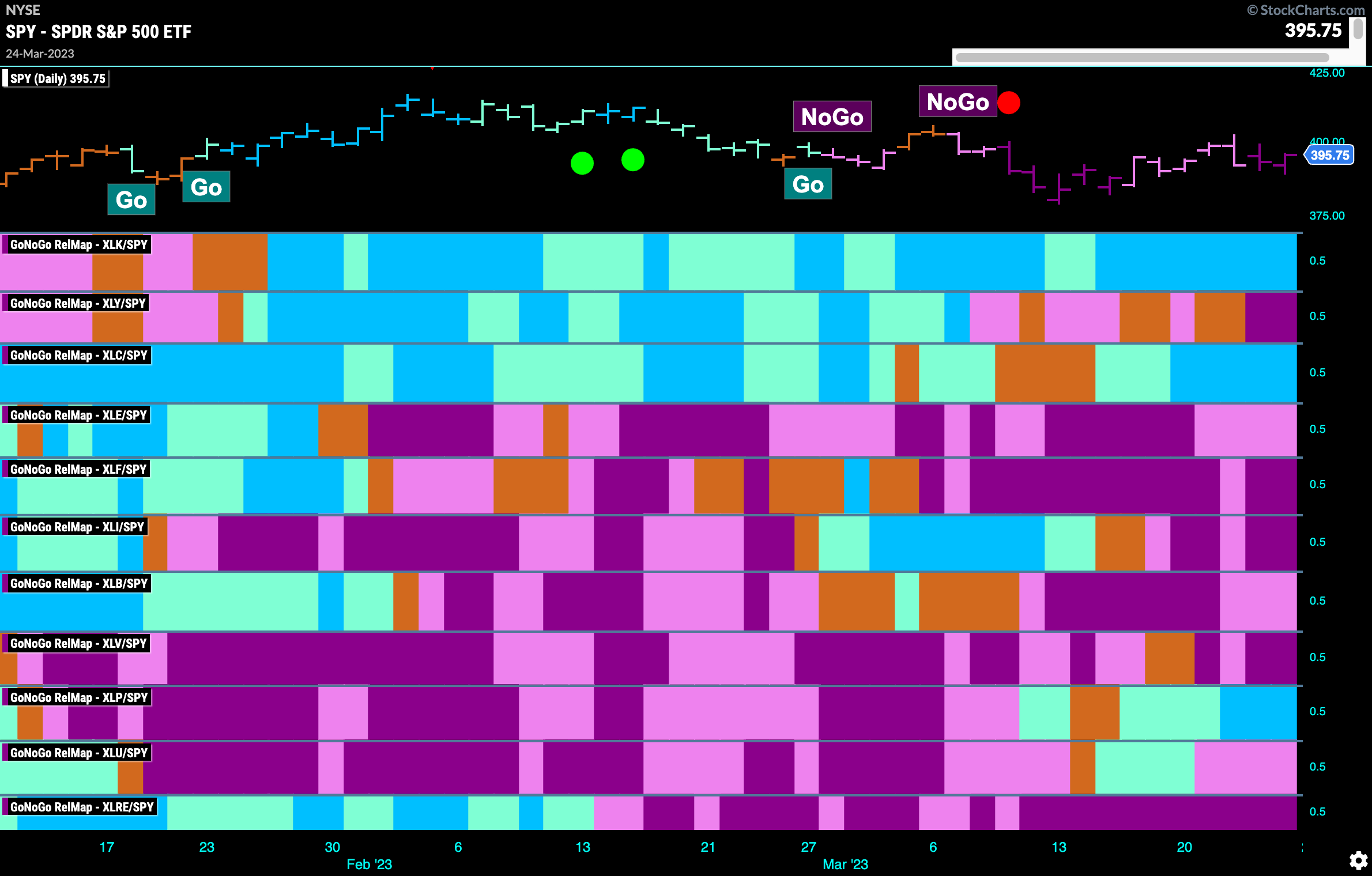

Sector RelMap

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. Looking at this map, we can quickly see where the relative outperformance is coming from as well as which sectors are lagging on a relative basis. 3 sectors are outperforming the base index this week. $XLK, $XLC, and $XLP are painting “Go” bars.

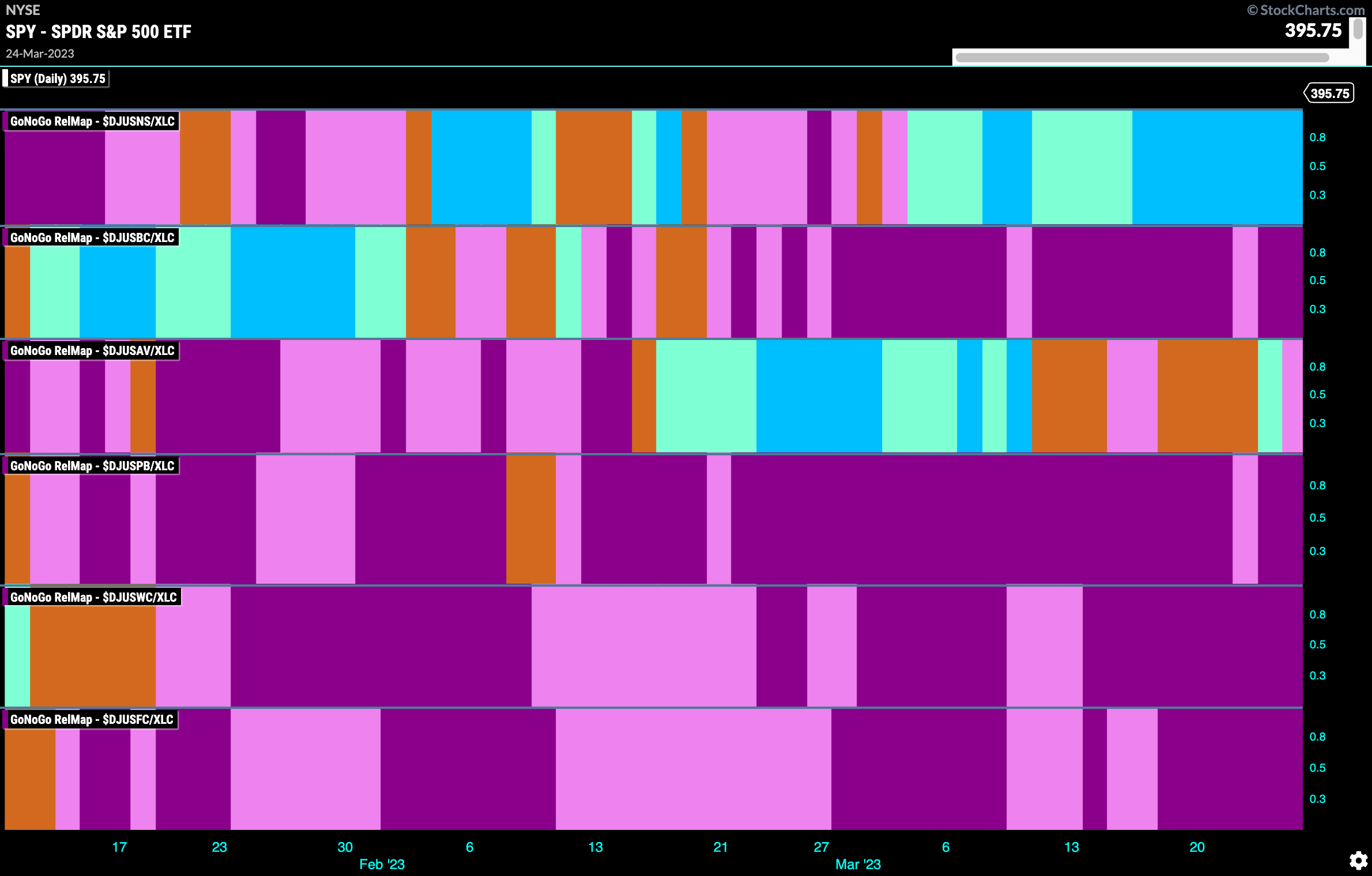

Communications Telling us Where the Trend Is

Diving deeper into the communications sector we can see that there is only one sub group that is in a persistent “Go” trend and driving the outperformance therefore of the sector. The top panel is the Internet Index. We can see a string of strong blue “Go” bars this week.

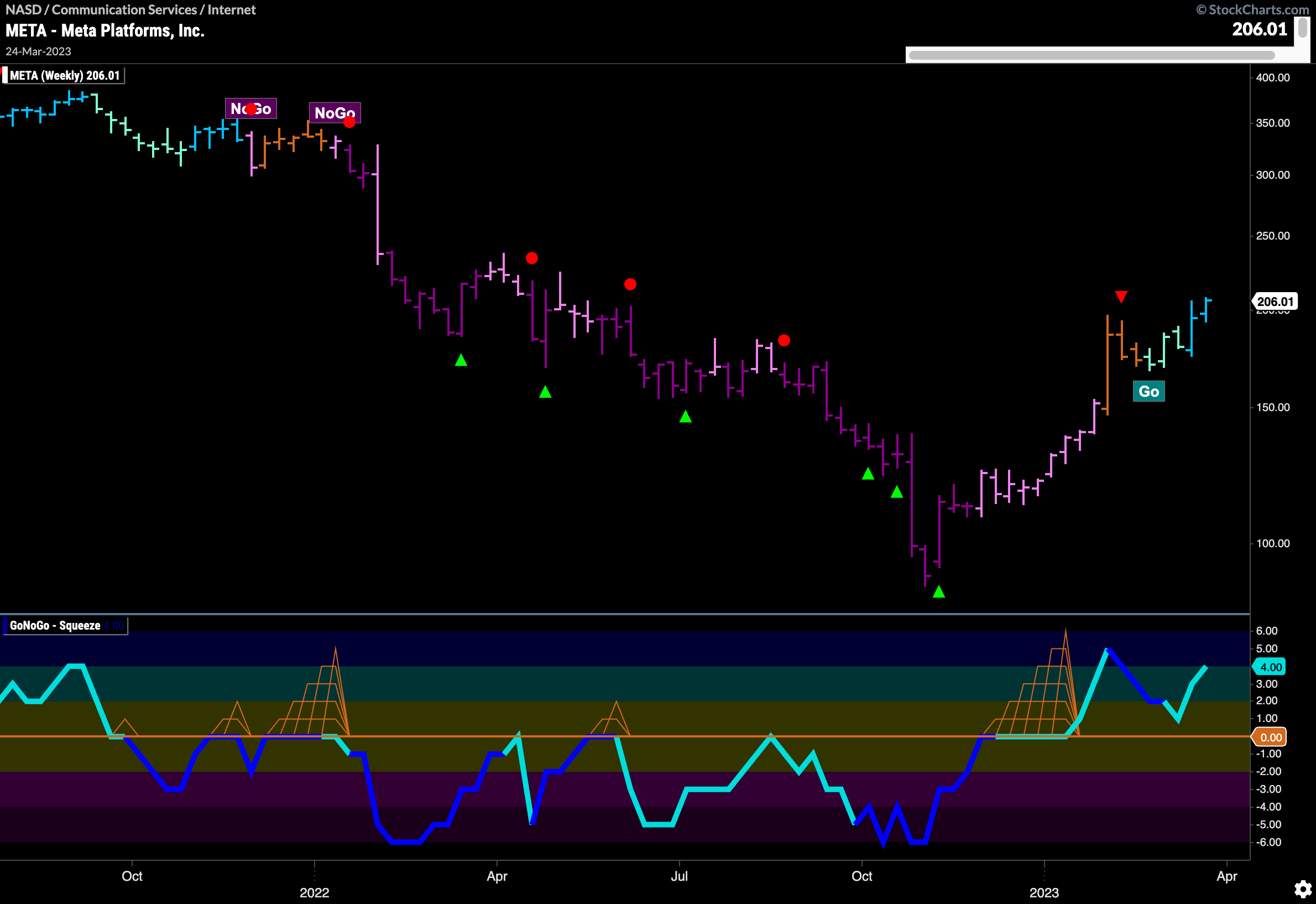

Multi Timeframe Meta

As we can see from the RelMap above, internet stocks should be a place to look for opportunity. Let’s take a multi timeframe look at $META. The Chart below shows daily prices and we can see that the trend has persisted for some time now. Having found support at the top of the large gap from February we have seen two Go Trend Continuation Icons (green circles) indicating that momentum was resurgent in the direction of the “Go” trend. Currently, we are seeing strong blue “Go” bars and GONoGo Oscillator is above the zero line.

If we zoom out to the weekly chart, we can see that on this timeframe we are also in a “Go” trend with the last couple of weeks seeing strong blue “Go” bars. GoNoGo Oscillator broke out of a Max GoNoGo Squeeze several weeks ahead of the change of trend. GoNoGo Trend painted some amber “Go Fish” bars before settling into the “Go” colors. Now, the trend is clearly in place with the oscillator in positive territory confirming the trend in price.

Given that the daily and the weekly charts are in agreement we can now step down in periodicity to look for an entry into the trend that is in place. The chart below is a 2hr chart of $META and we can see that we are poised for movement again. GoNoGo Trend shows that the trend is a “Go” on this timeframe as well as price makes higher highs and higher lows. Of interest to us is that GoNoGo Oscillator has fallen to test the zero line from above and this could give an opportunity to participate in the trend should the zero line hold as support. If we see the oscillator rally back into positive territory that would let us know that momentum remains on the side of the “Go” trend and we would see a Go Trend Continuation Icon (green circle) appear under the price bar.