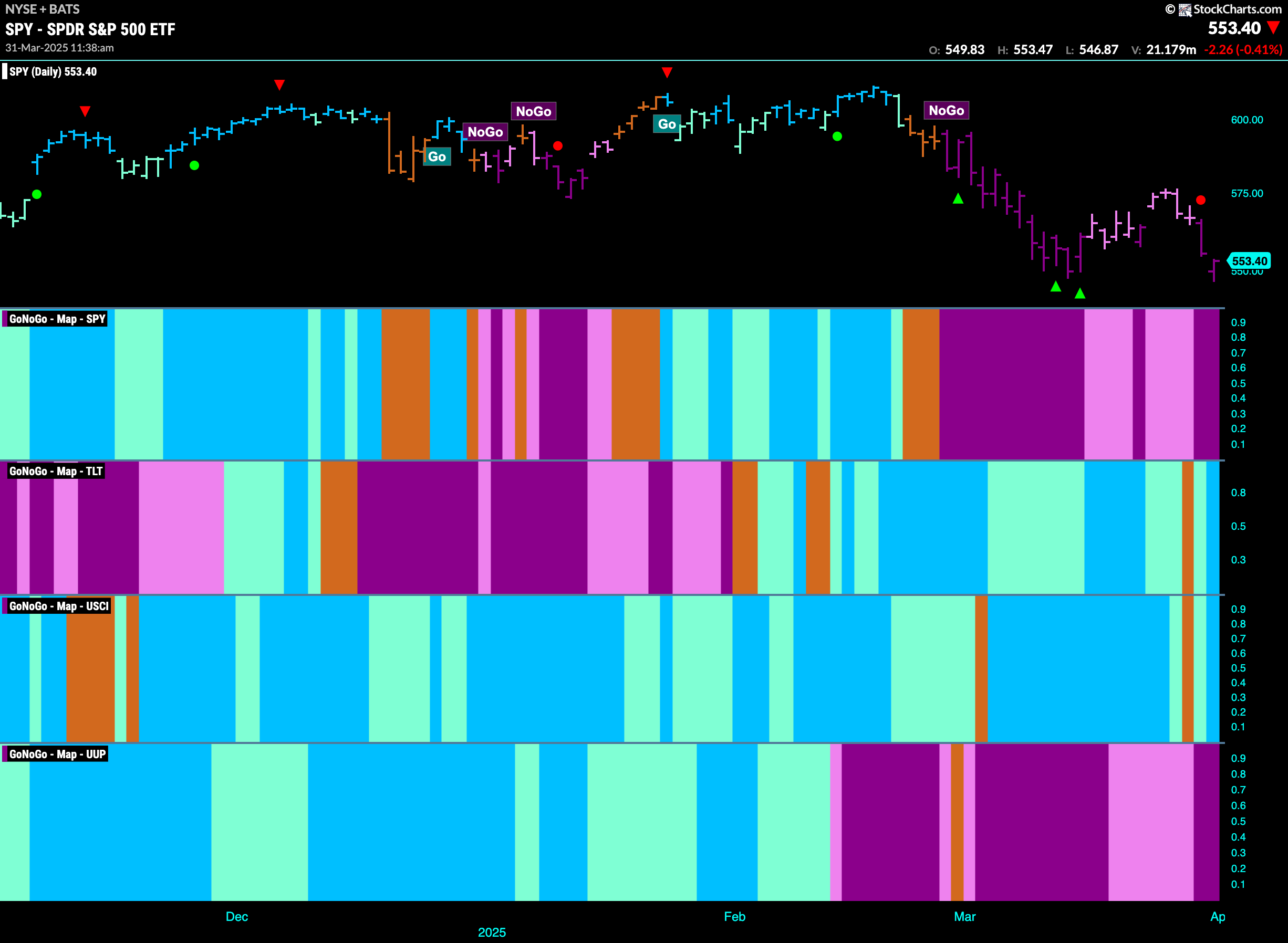

Good morning and welcome to this week’s Flight Path. The equity trend remained a “NoGo” and as the week came to a close we saw new purple bars. GoNoGo Trend showed that treasury bond prices regained the “Go” trend after an uncertain amber “Go Fish” bar. The same is true for U.S. commodities this week while the dollar saw a return to “NoGo” strength with dark purple bars.

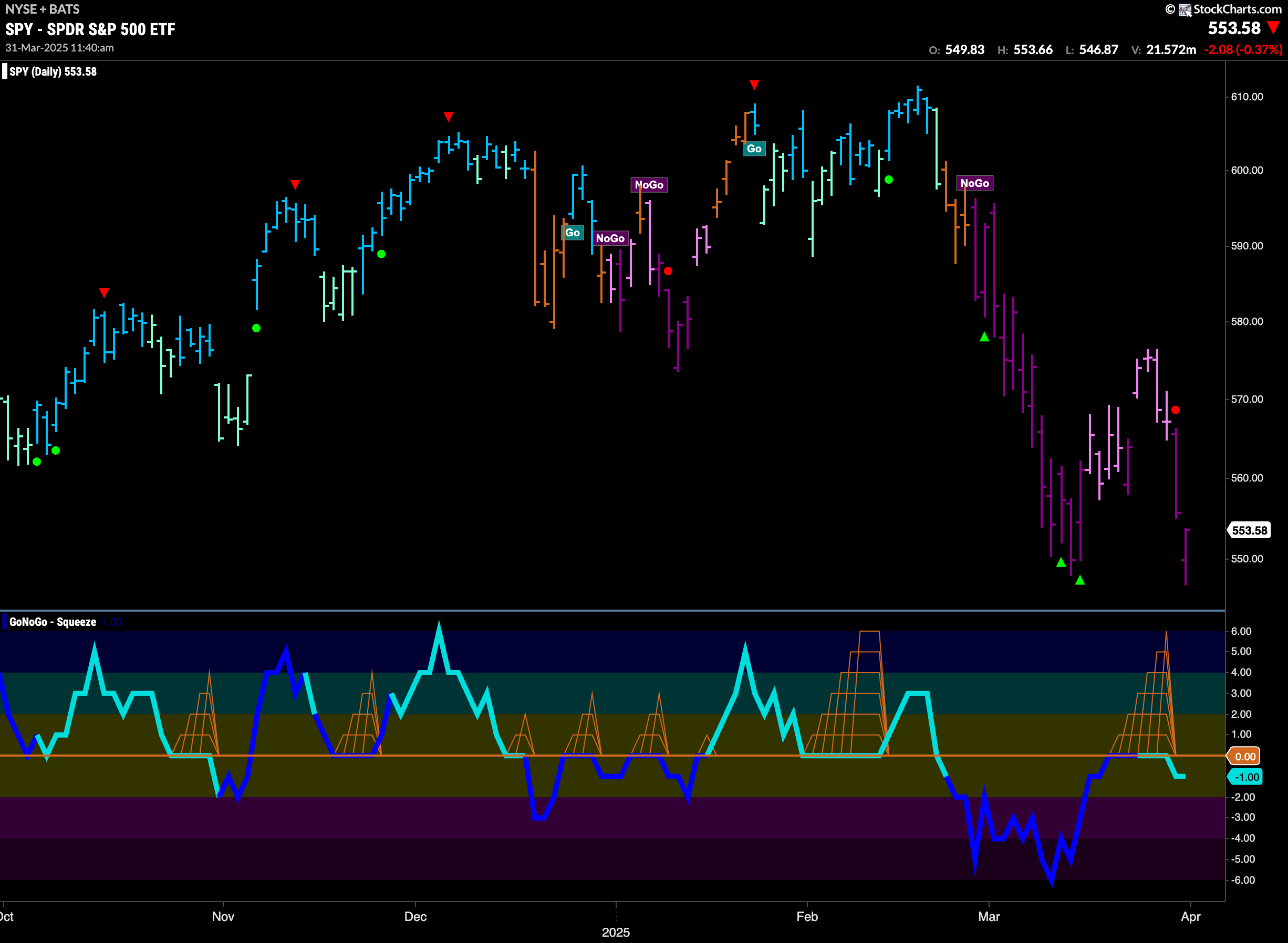

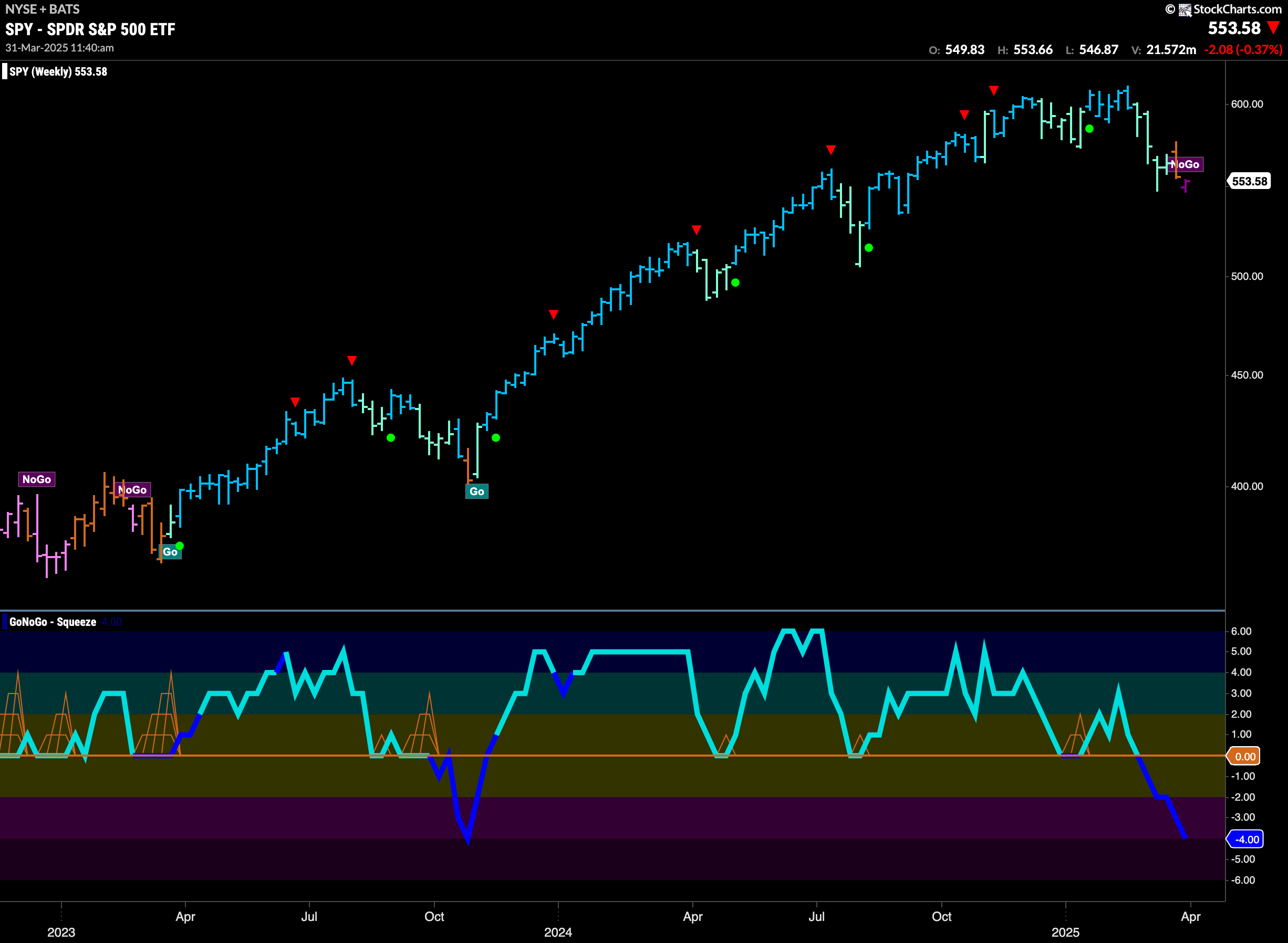

$SPY Sees Strong Purple “NoGo” Bars at Lows

The GoNoGo chart below shows that the “NoGo” trend has survived this week and indeed after setting a lower high we see price fall again to test prior lows on strong purple bars. GoNoGo Oscillator shows that price has broken out of a Max GoNoGo Squeeze into negative territory and that triggered a NoGo Trend Continuation Icon (red circle). We will watch to see if this gives price the push it needs to set a new low.

A new “NoGo” trend is flagged this week as the long “Go” trend gives way to first an amber “Go Fish” bar and now a “NoGo” bar. This comes after GoNoGo Oscillator fell through the zero line on heavy volume. Now with momentum on the side of the new “NoGo” trend we will watch to see if price falls further.

Treasury Rates Remain in “NoGo” Trend

GoNoGo Trend shows that the “NoGo” trend remains in place as the indicator paints fresh strong purple bars. GoNoGo Oscillator has fallen back into negative territory after briefly spending some time in positive territory. This triggered a NoGo Trend Continuation Icon (red circle) and we will watch to see if rates fall further from here.

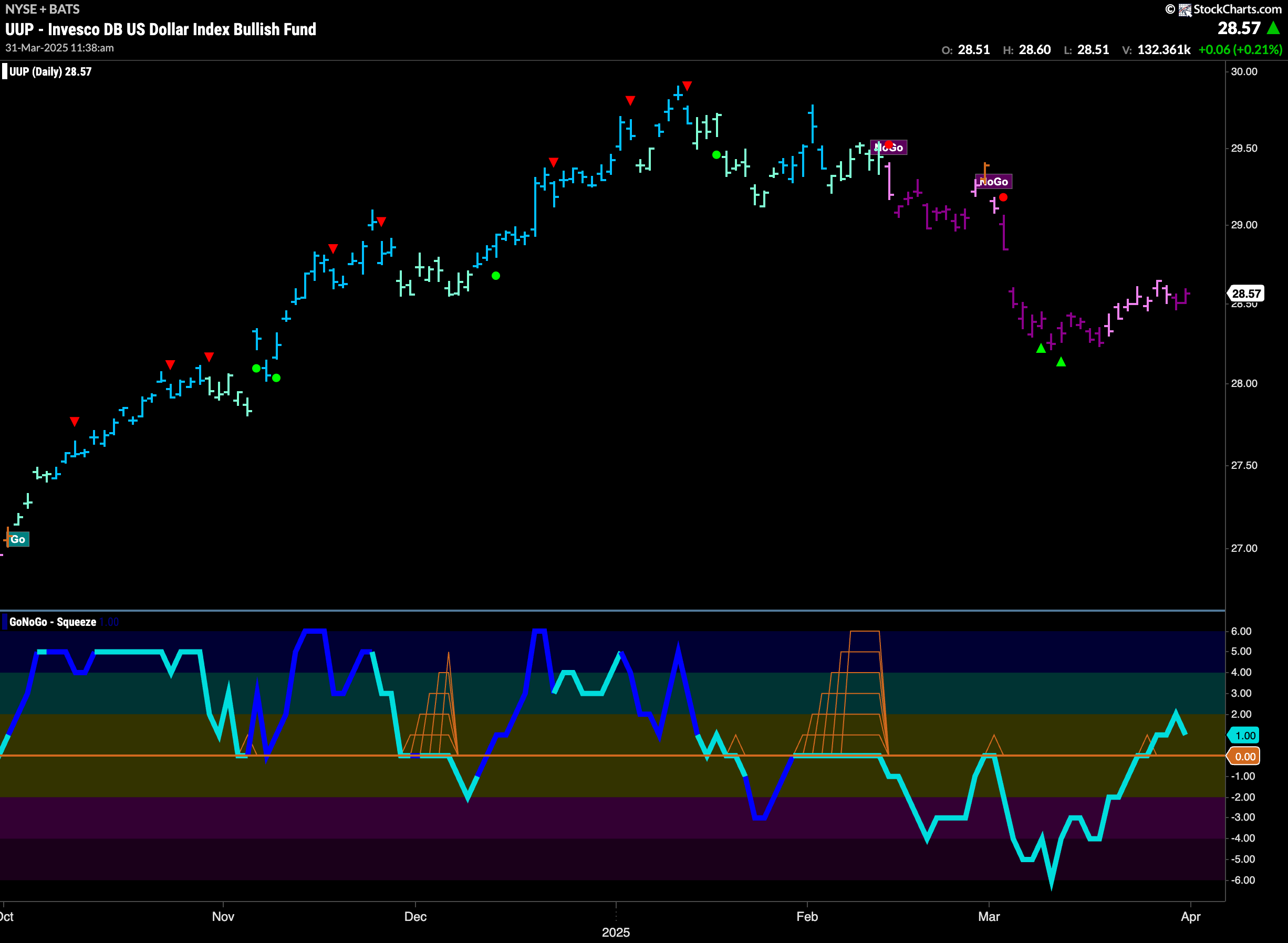

“NoGo” Hangs on As Dollar’s Rally Stalls

The “NoGo” trend continued this week and we even saw the indicator paint two stronger purple bars as the week came to a close. We will watch to see if this becomes a new lower high. GoNoGo Oscillator is in positive territory which tells us momentum is out of step with the “NoGo” trend. We will look to see what happens as the oscillator falls toward the zero line.

$USO Flashes Amber “Go Fish” Bar of Uncertainty

The “NoGo” trend gives way to an amber “Go Fish” bar as price continues to climb off the lows. This comes after GoNoGo Oscillator broke into positive territory out of a GoNoGo Squeeze last week. With momentum now positive and approaching overbought we will look for trend change in the panel above.

Gold “Go” Trend Persists

Another week another higher high for gold. We have seen uninterrupted strong blue “Go” bars for several weeks now. Price gapped higher again this week. This came after GoNoGo Oscillator found support at the zero line and bounced quickly back into positive territory indicating Go Trend Continuation (green circle).

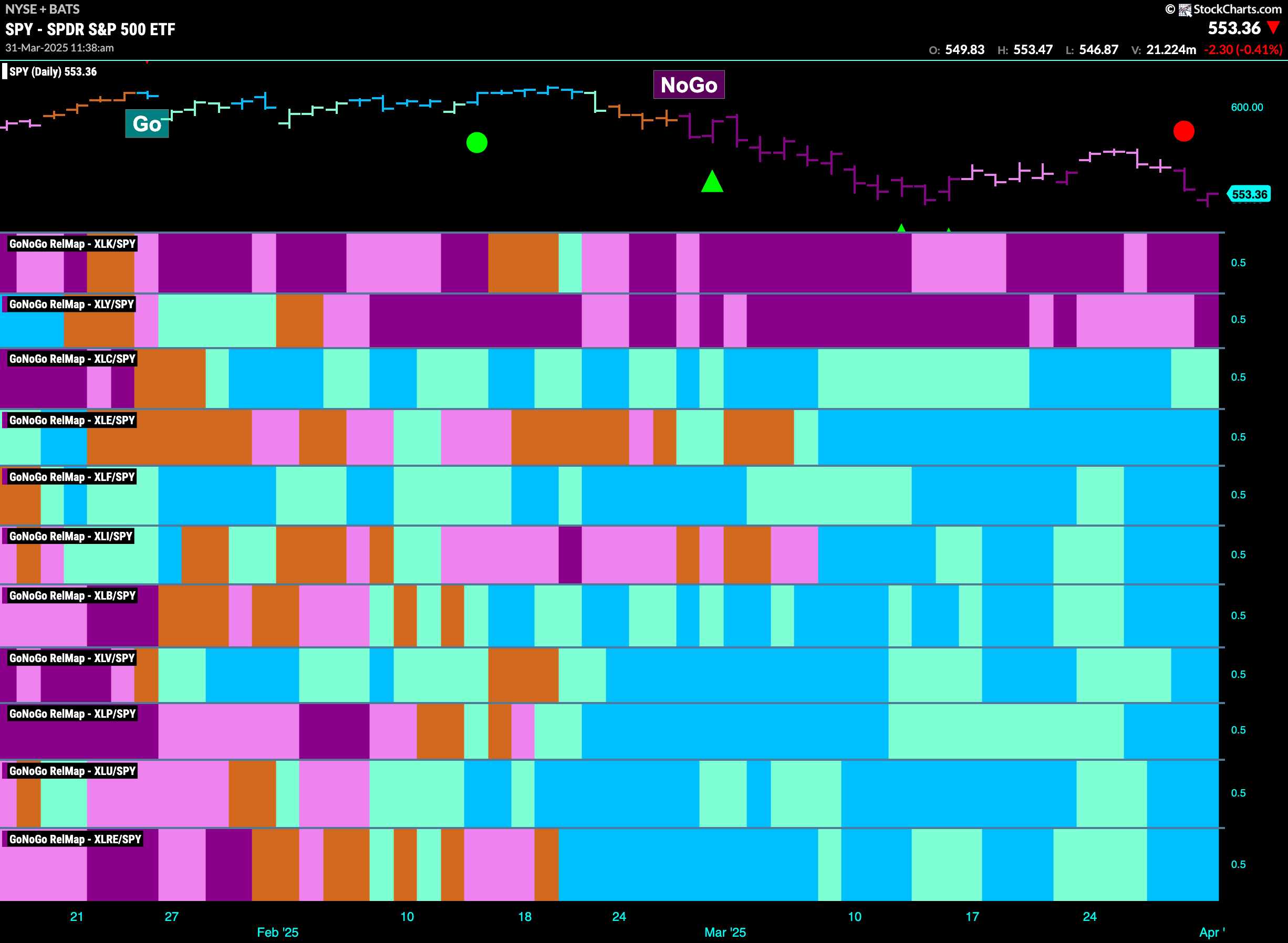

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 9 sectors are in relative “Go” trends. $XLC, $XLE, $XLF, $XLI, $XLB, $XLV, $XLP, $XLU, and $XLRE are painting relative “Go” bars.

Energy Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the energy sector this week. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLE. We saw in the above GoNoGo Sector RelMap that $XLE is strong relatively speaking as it paints bright blue relative “Go” bars to the S&P 500. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. In the top panel, we see consistent strong blue bars for the integrated oil and gas index.

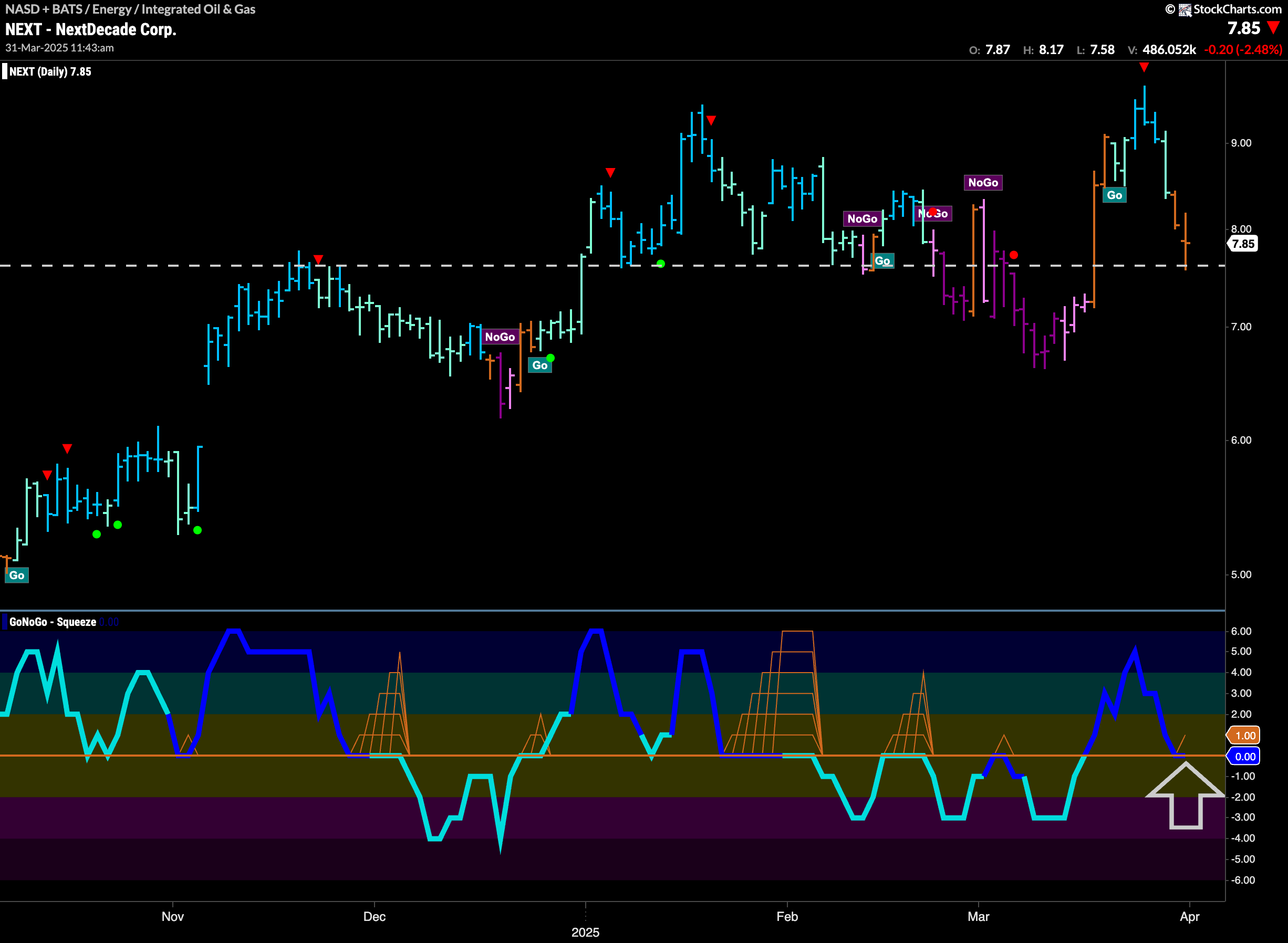

What’s $NEXT?

GoNoGo Trend shows that the trend is uncertain for $NEXT. After a higher high, price has quickly retreated following the Go Countertrend Correction Icon (red arrow) and we see amber “Go Fish” bars of uncertainty. We do see a natural area of price support on the chart represented by the horizontal line. This lines up with GoNoGo Oscillator testing the zero line from above on heavy volume. If we see support at this level, we will see signs of Go Trend Continuation and expect price to climb.

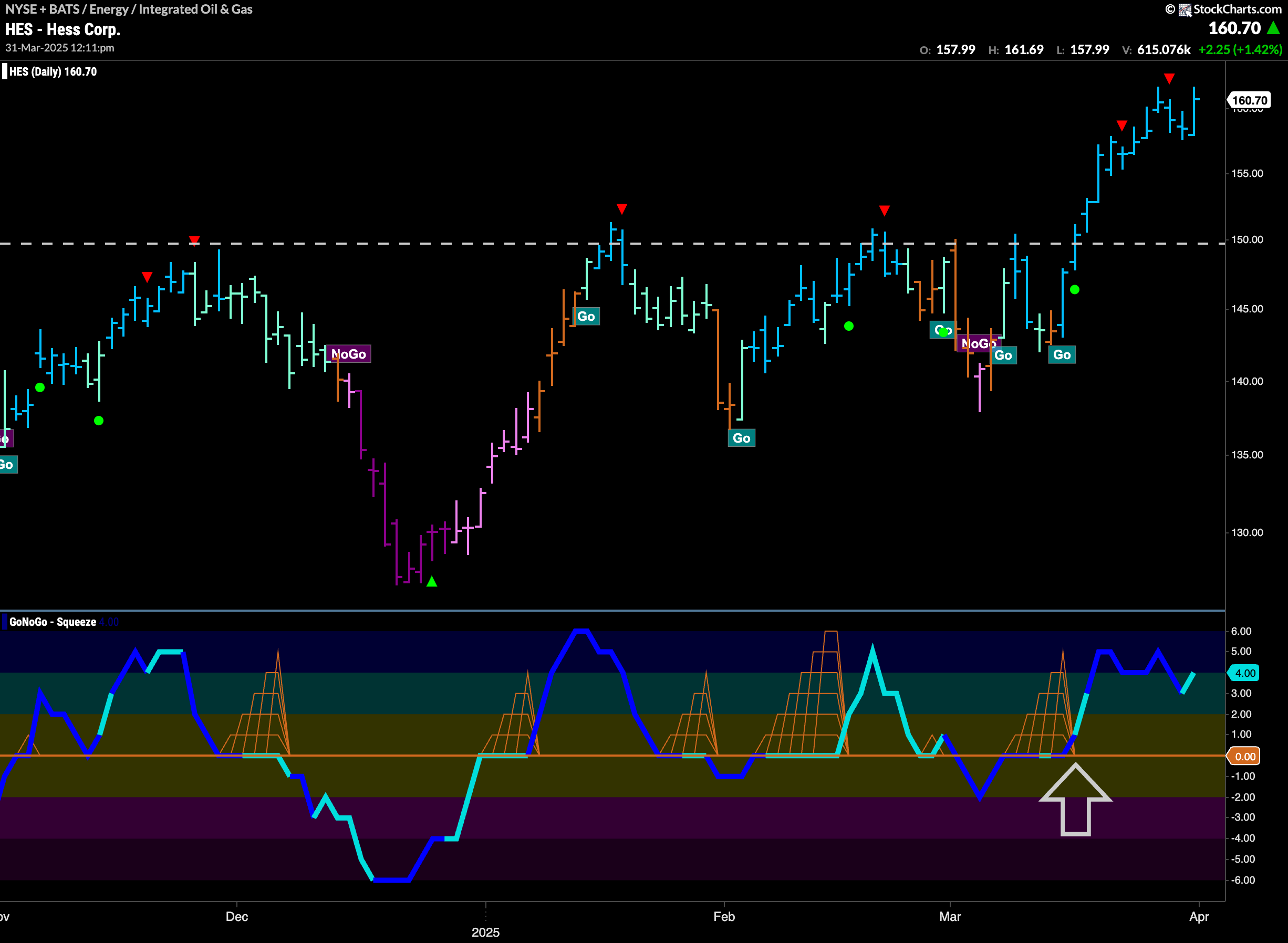

$HES Has Climbed to New Highs

After a few weeks of chop it seems that $HES is further ahead than $NEXT. With GoNoGo Oscillator finding support at zero and breaking out of a GoNoGo Squeeze into positive territory as price broke through horizontal levels that were resistance we saw signs of Go Trend Continuation. Now, with momentum in positive territory but no longer overbought we will watch to see if price can consolidate at these elevated levels.