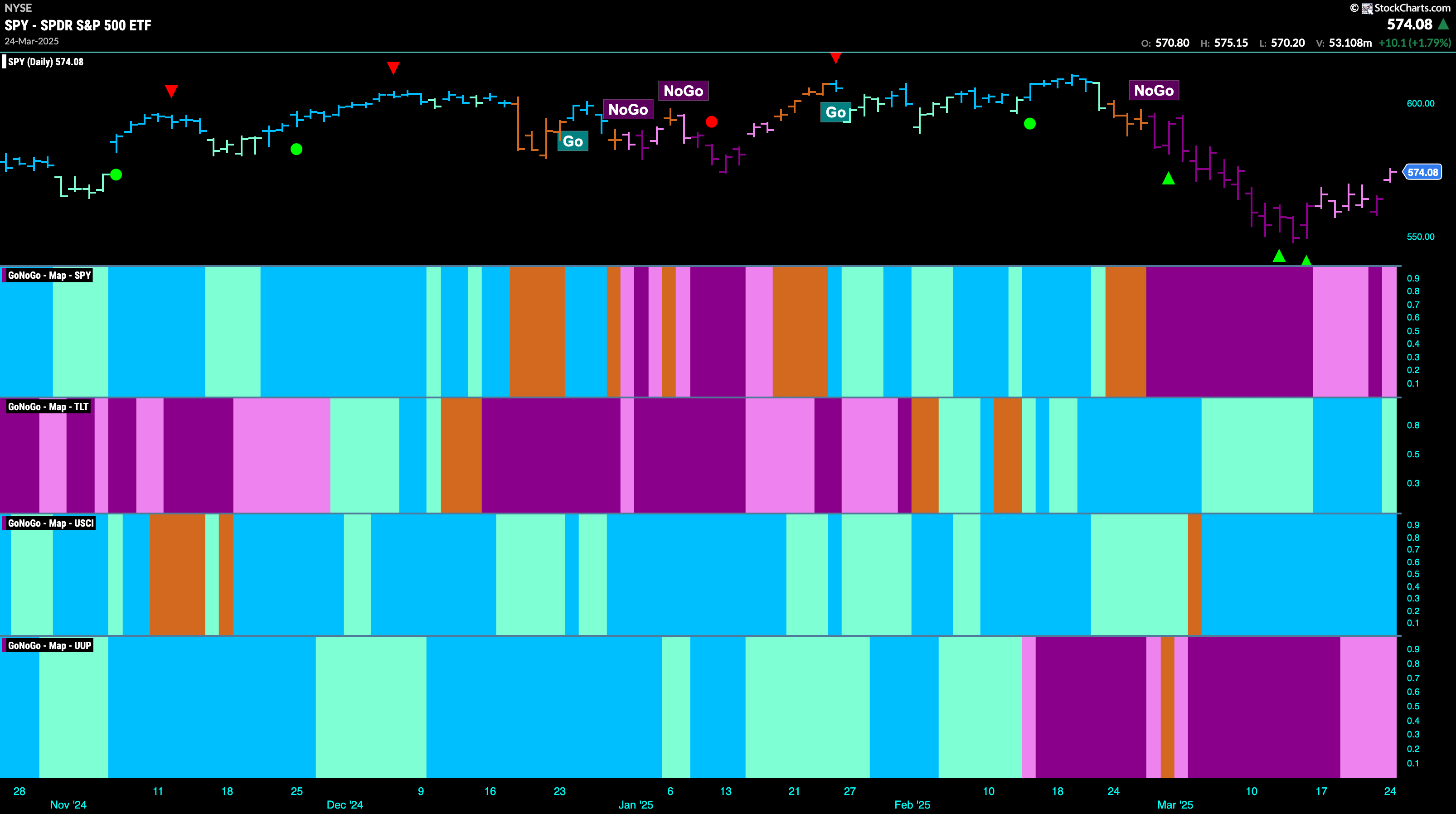

Good morning and welcome to this week’s Flight Path. The equity trend remained a “NoGo” but we do see a majority of weaker pink bars as price tries to rally off the lows. Treasury bond prices are in a “Go” trend but paint a weak aqua bar. U.S. commodities are showing nothing but strength this past week with an uninterrupted string of bright blue “Go” bars. The dollar is stuck in a “NoGo” but we are seeing that trend weaken with pink bars.

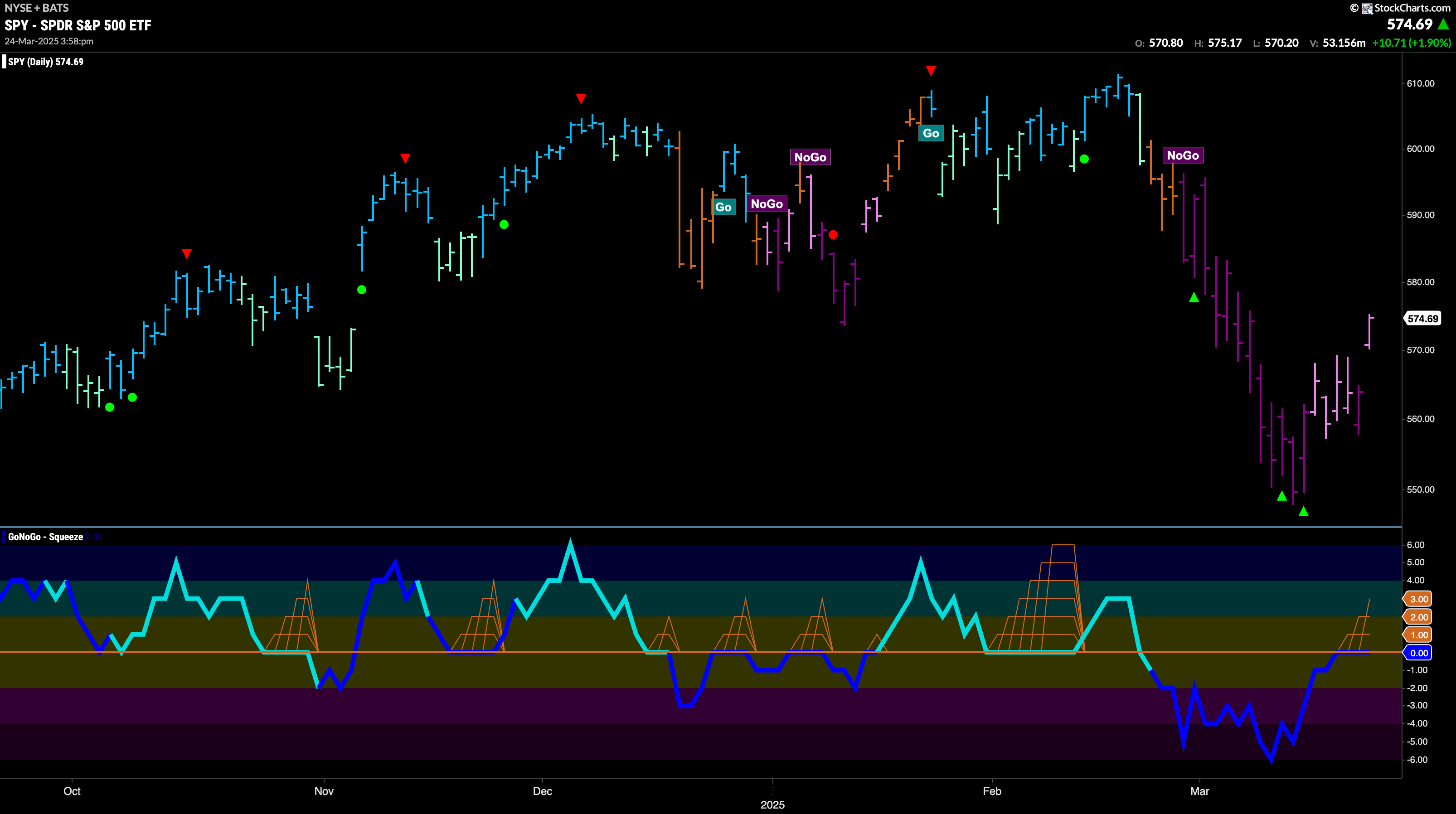

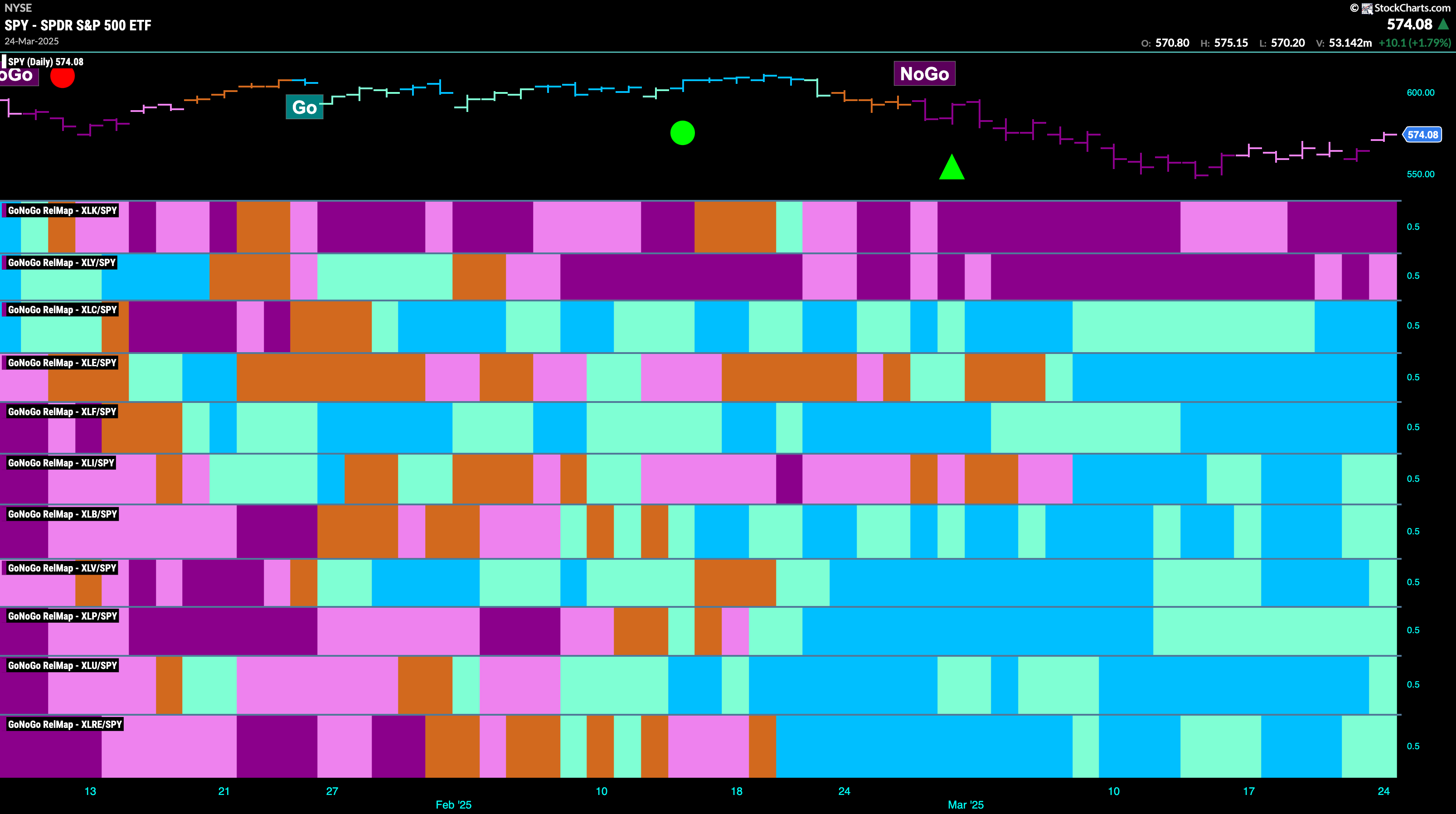

$SPY Sees Prices Climb and Indicator Paints Pink Bars

The GoNoGo chart below shows that the trend is still a “NoGo” but the trend continues to weaken as it paints pink bars and higher prices. GoNoGo Oscillator shows that it is testing the zero line from below and volume is heavy. We will watch to see if it finds resistance here or if it breaks through into positive territory. If the oscillator is turned away from the zero line then we would know that momentum remains in the direction of the “NoGo” trend.

The “Go” trend on the weekly chart survives again this week and prices have climbed but the indicator still paints a weaker aqua bar. GoNoGo Oscillator shows heavy trading as it is dark blue and it is in negative territory but close to zero at a value of -1. If the oscillator stays in negative territory then we would question the health of this long term “Go” trend.

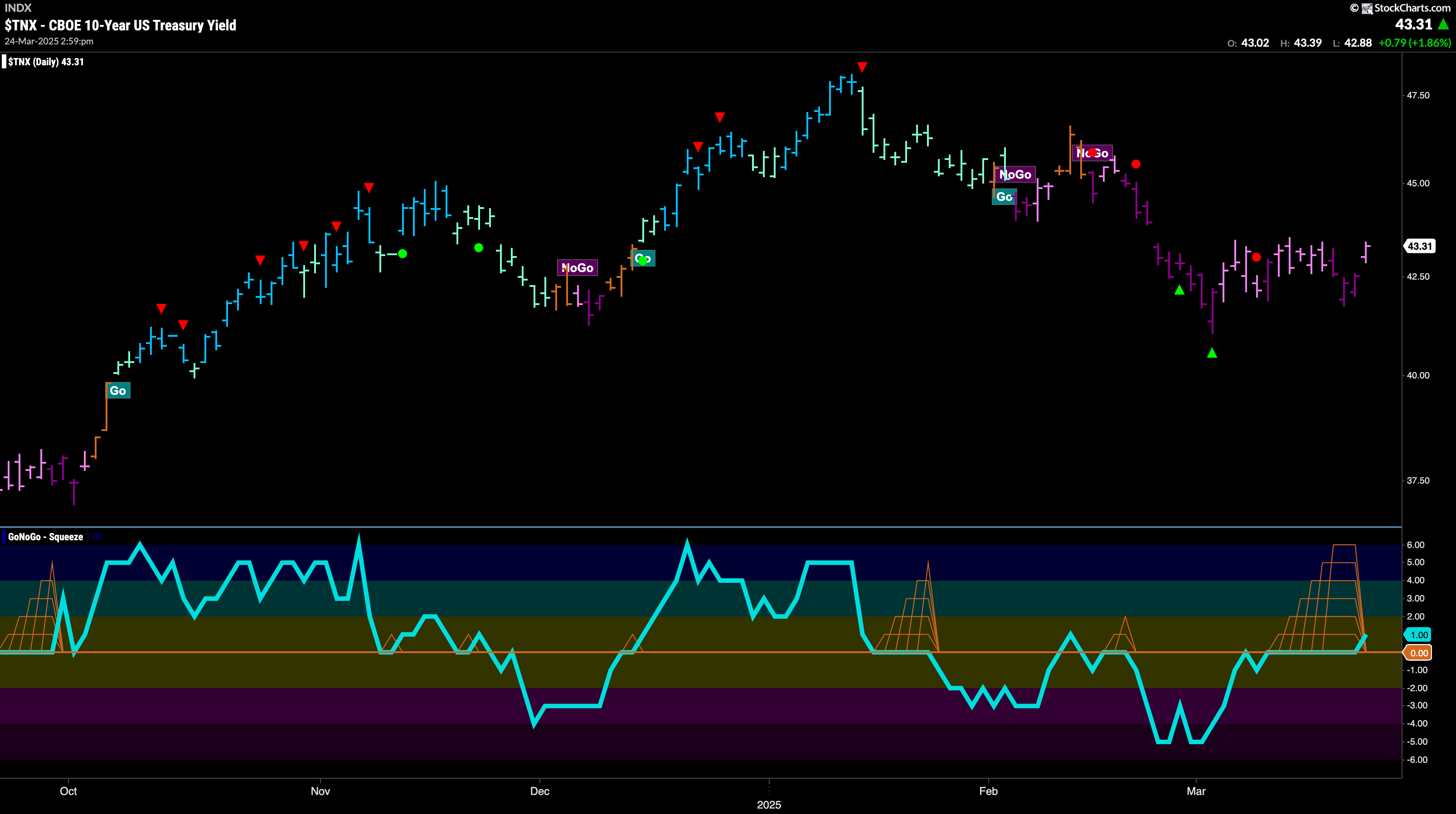

Treasury Rates Meander Sideways

GoNoGo Trend shows that the “NoGo” trend is still in effect as it paints a pink bar. However, rates are testing resistance and looking to perhaps set a new high. GoNoGo Oscillator shows that momentum is breaking out of a Max GoNoGo Squeeze into positive territory. This tells us that momentum is out of step with the “NoGo” trend and so we will watch closely to see if the “NoGo” trend is in trouble.

“NoGo” Weakening as Dollar Climbs

The “NoGo” trend is weakening as price climbs off the lows. We see consecutive pink bars following a failure to make lower lows. This was after we saw two NoGo Countertrend Correction Icons (green arrows) indicating that price may struggle to go lower in the short term. With GoNoGo Oscillator rising to test the zero line from below, we will watch closely to see if momentum gets turned away by the zero line or if it breaks into positive territory.

$USO Continues to Climb as “NoGo” Weakens

The “NoGo” trend continued to weaken this week and price crept higher after the NoGo Countertrend Correction. As it gets closer to potential resistance from prior lows, we see that GoNoGo Oscillator has broken out of a GoNoGo Squeeze into positive territory. This tells us that momentum is out of step with the “NoGo” trend and may help push price higher.

Gold Sets Another Higher High

We saw the “Go” trend surge to new highs last week again and on strong blue “Go” bars. Finally, momentum has waned and we see a Go Countertrend Correction Icon (red arrow) indicating that price may struggle to go higher in the short term. GoNoGo Oscillator is falling toward the zero line from above and we will watch to see if it finds support when it gets there.

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 9 sectors are in relative “Go” trends. $XLC, $XLE, $XLF, $XLI, $XLB, $XLV, $XLP, $XLU, and $XLRE are painting relative “Go” bars.

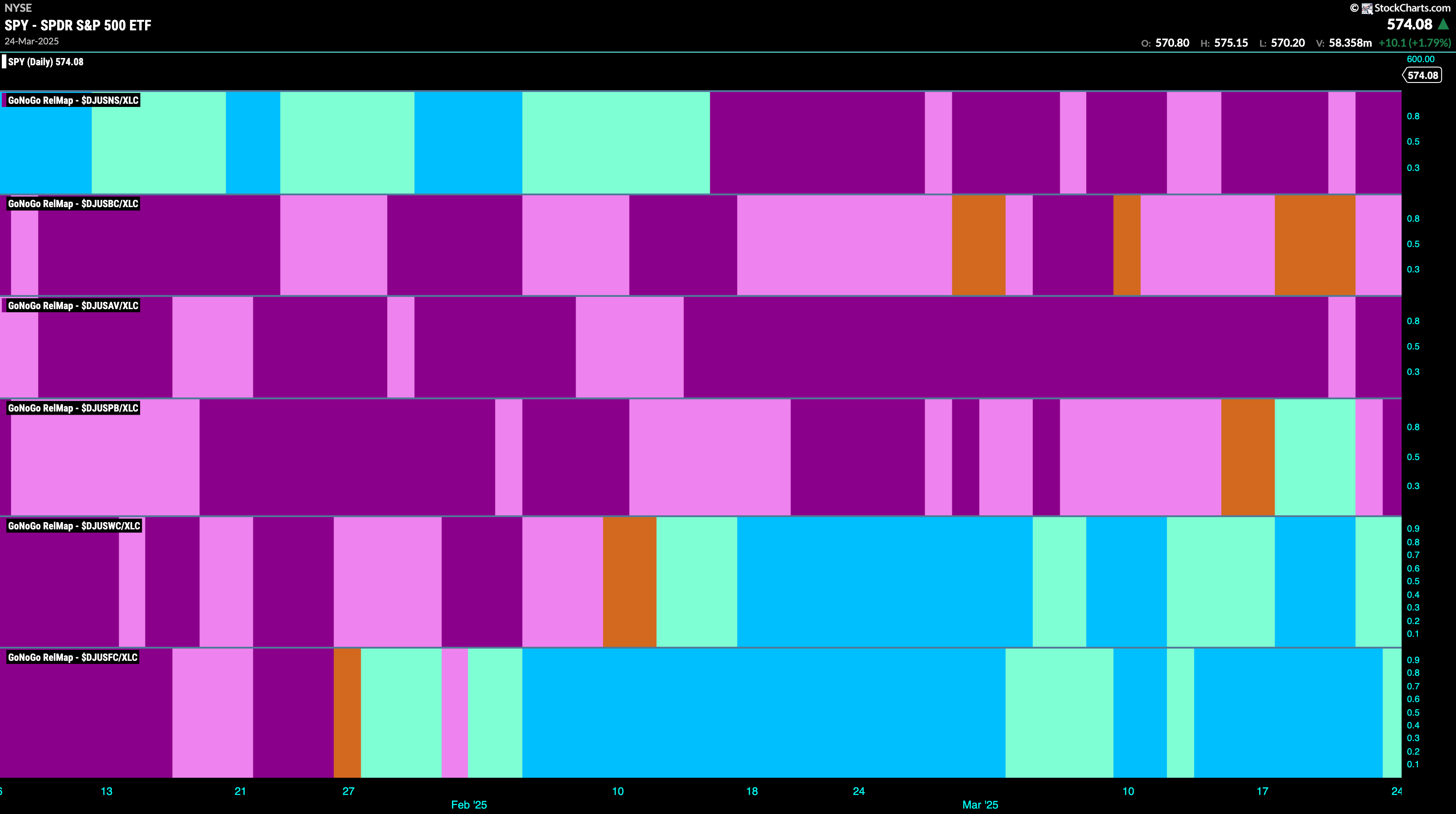

Communications Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the communications sector this week. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLC. We saw in the above GoNoGo Sector RelMap that $XLC is strong relatively speaking as it paints bright blue relative “Go” bars to the S&P 500. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. In the lowest panel, fixed communications has been in a “Go” trend for some time.

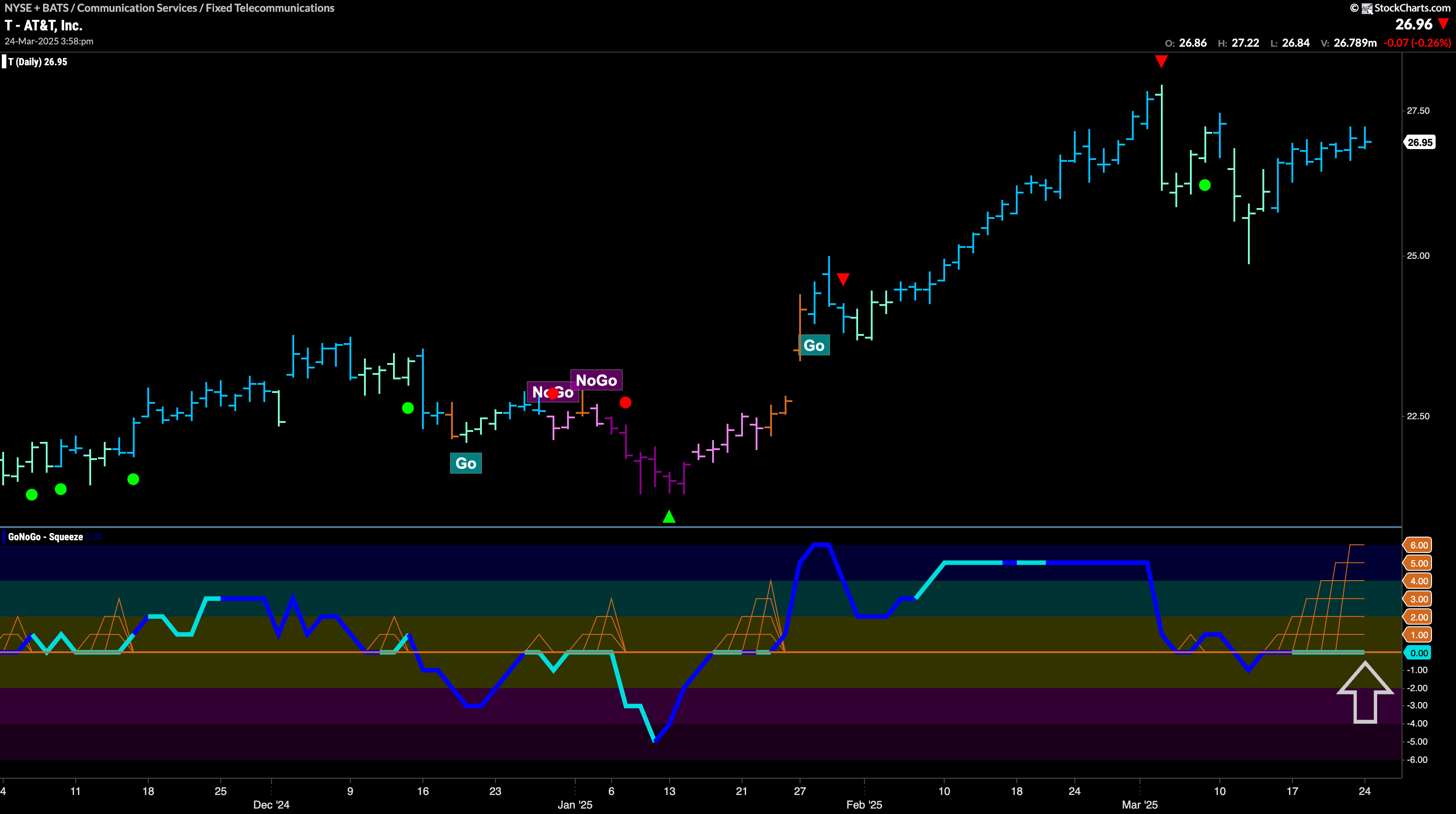

$T Looks to Set up For New High

GoNoGo Trend shows that the trend is strong for $T and we see price rising from a recent low. GoNoGo Oscillator fell to test the zero line from above and we see a Max GoNoGo Squeeze. This represents the virtual tug of war between buyers and sellers at these levels. We will watch to see in which direction the oscillator breaks out of the GoNoGo Squeeze. If it regains positive territory then that might give price the push it needs to make an attack on prior highs.

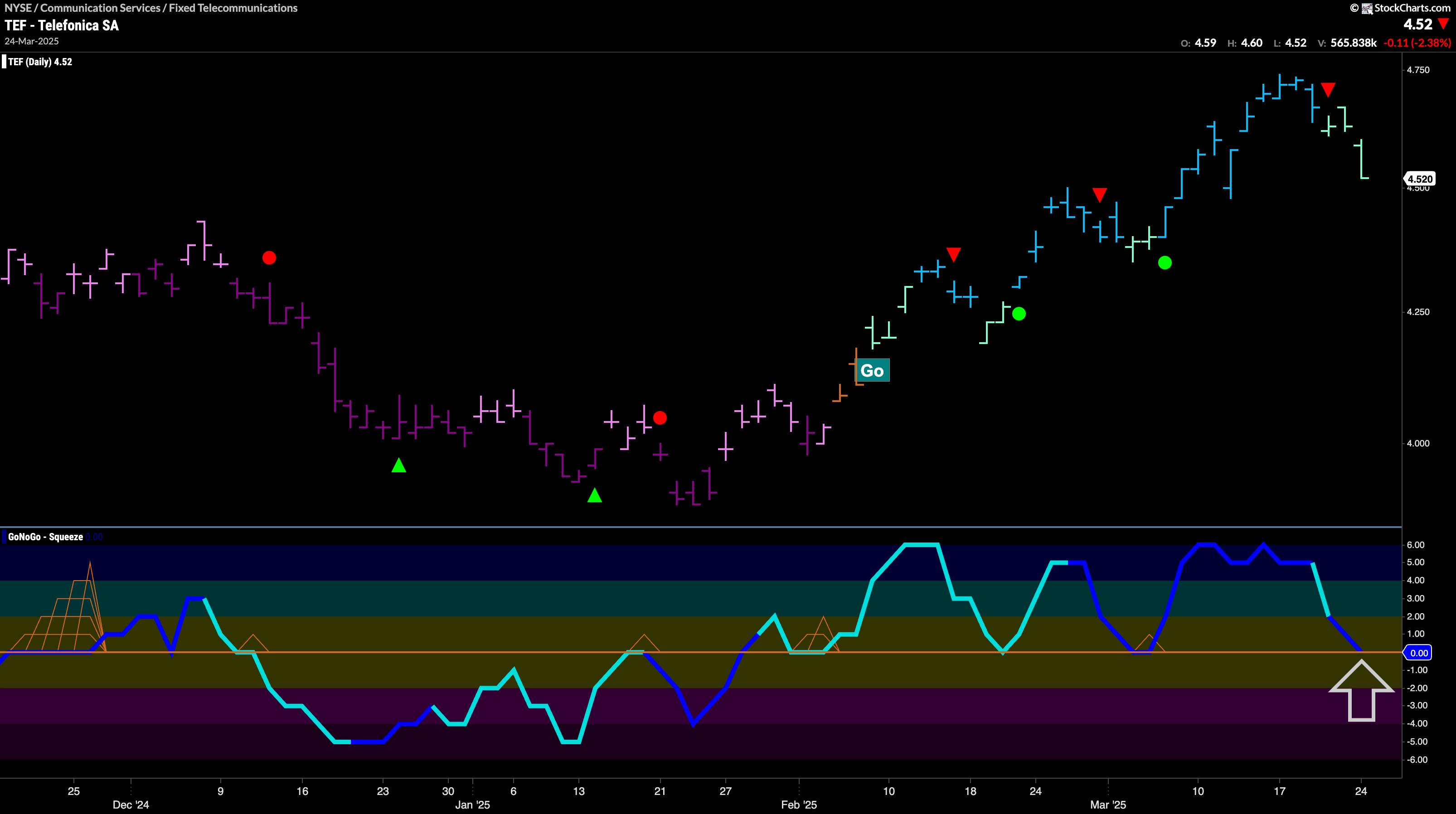

$TEF Looks For Support in “Go” Trend

$TEF has been in a “Go” trend since early February and we have seen a series of higher highs and higher lows. During this time, GoNoGo Oscillator repeatedly found support at the zero line giving signs of trend continuation each time. Now, as price falls from its recent high, GoNoGo Oscillator is testing the zero line one more time. We will look to see if it bounces back into positive territory again. If it does, then we will expect an attempt at another higher high.