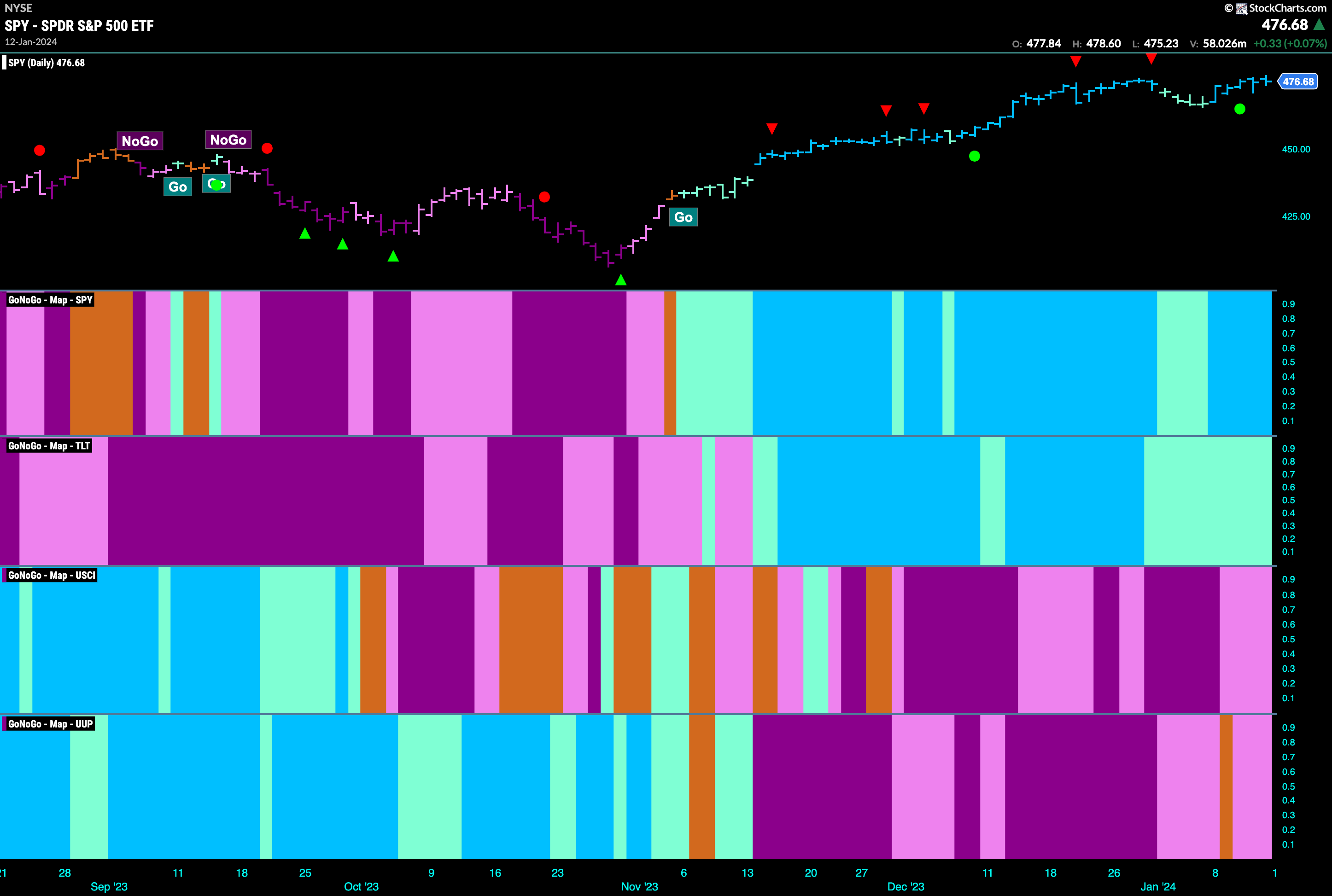

Good morning and welcome to this week’s Flight Path. Equities surged back to challenge all time highs this past week and GoNoGo Trend painted strong blue “Go” bars. Treasury bond prices remained in a “Go” trend but we saw continued weakness with a string of paler aqua bars. Commodities and the dollar were able to hang on to “NoGo” trends but both assets showed weakness as the indicator paints weaker pink bars instead of the strong purple of a strong down move.

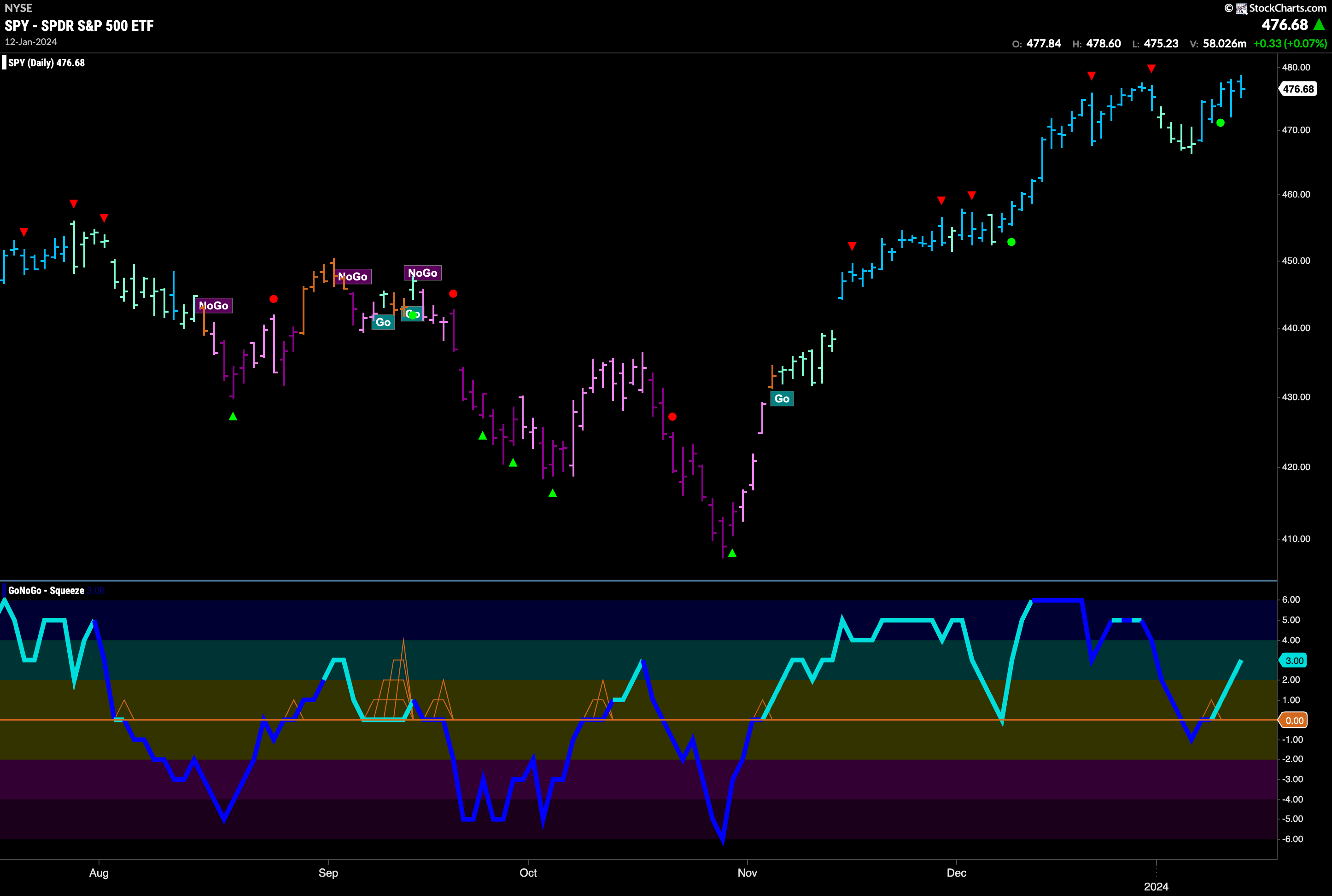

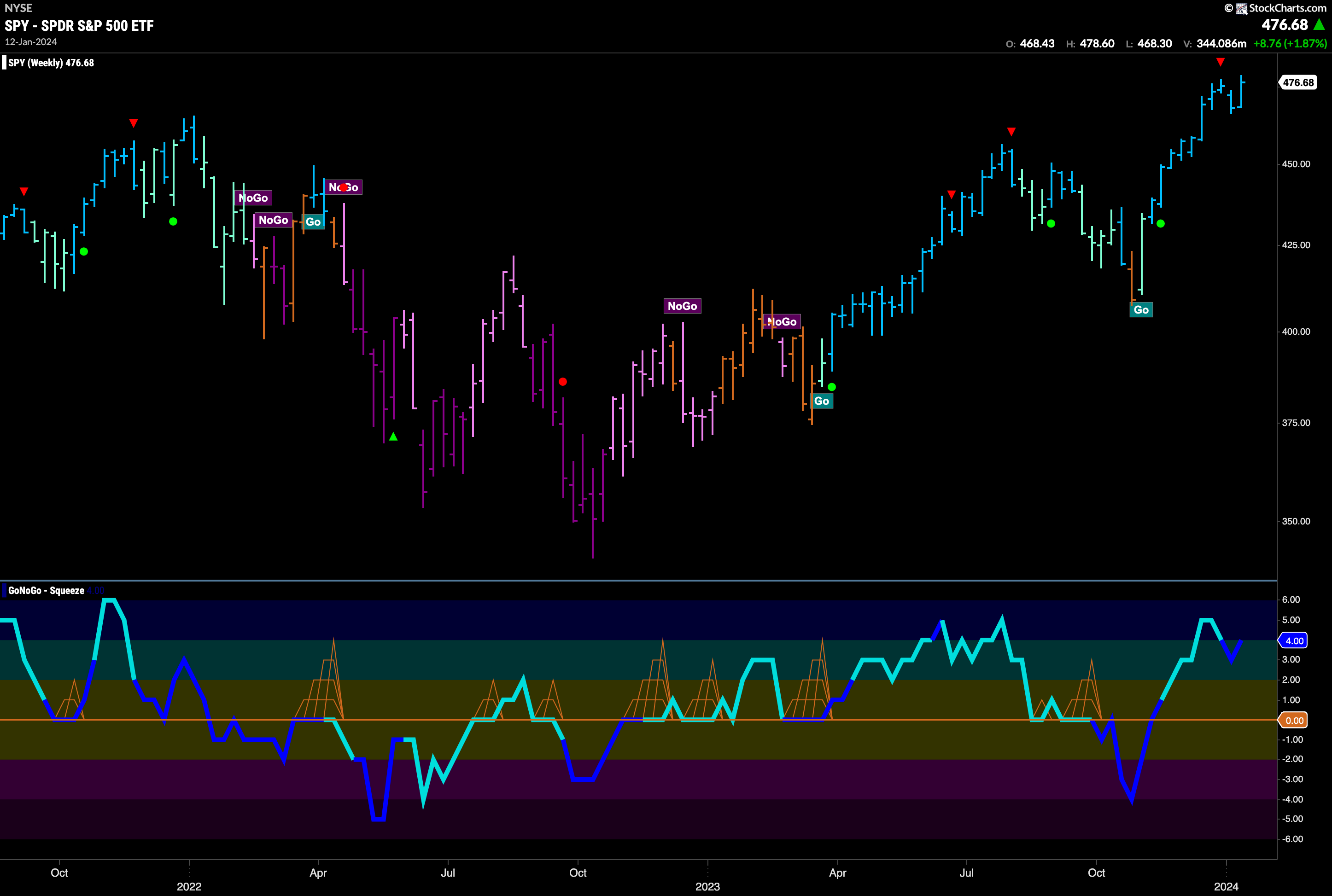

Equities Rally Back to Test Highs

This week saw a strong response to last week’s correction. We saw strong blue “Go” bars the whole week as price climbed back to challenge the all time highs from a couple of weeks ago. GoNoGo Oscillator sharply reversed course after spending a bar below zero and moved quickly back into positive territory this past week. This tells us that momentum is once again surging in the direction of the underlying “Go” trend and therefore we can expect price to make an attempt to consolidate at or above these levels.

The weekly chart shows just how strong the response was. We closed at a new weekly high on a closing basis. This was a quick turnaround after the Go Countertrend Correction Icon (red arrow) we saw only two weeks ago. GoNoGo Oscillator came out of overbought territory but has already turned back up and volume is heavy. We will look to see if price can move higher and clearly set a new high in the next few weeks.

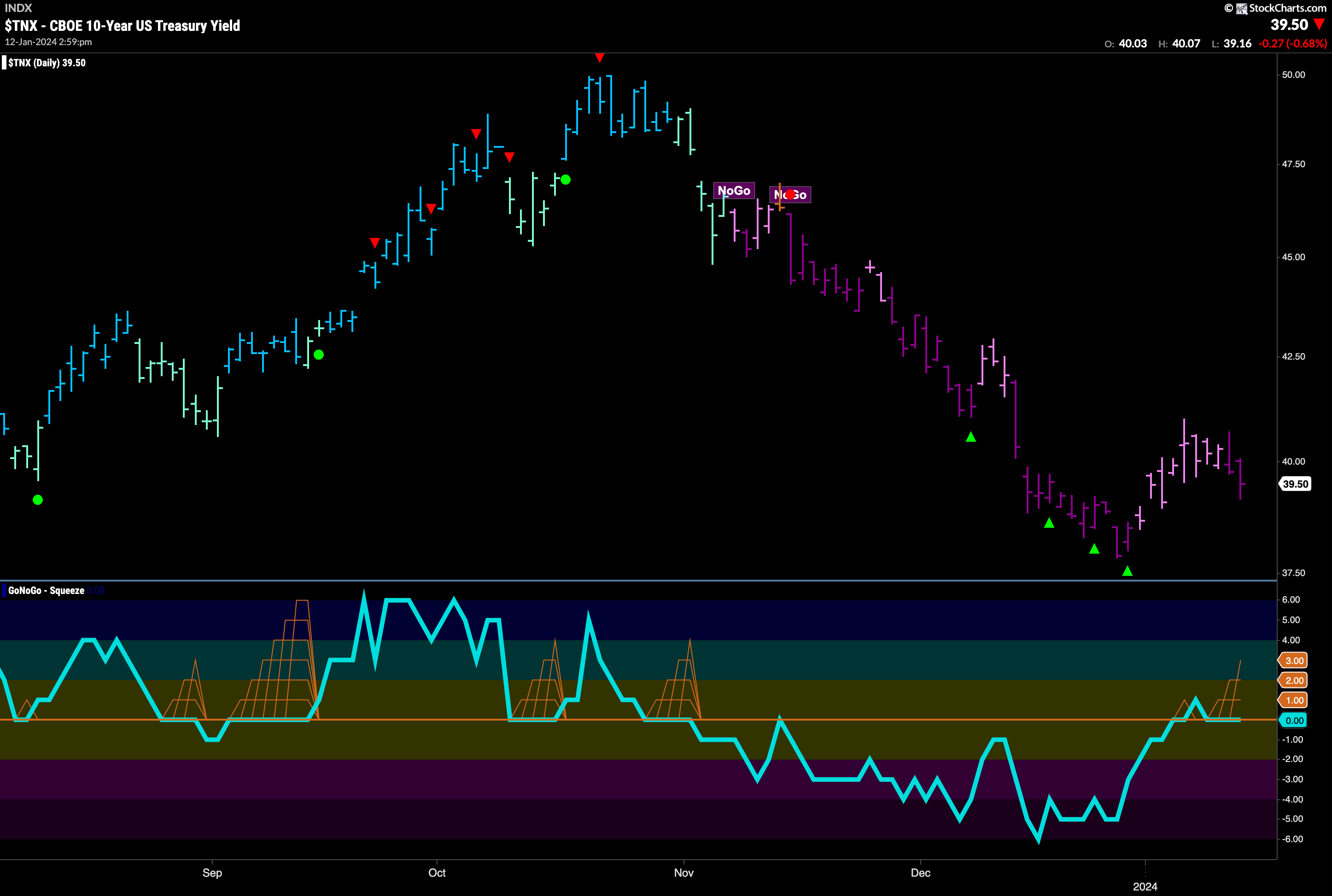

Treasury Rates Rally Short-lived

The “NoGo” trend continued this past week and the rally that we saw last week didn’t last as GoNoGo Trend paints stronger purple bars as the week came to a close. What looks like a new lower high appears to be in and GoNoGo Oscillator was so far unable to stay in positive territory. As the oscillator rides the zero line, we see the beginnings of a GoNoGo Squeeze building and we will watch to see if it reverts back into negative territory. If it does, we will look for price to make an attempt at new lows.

The larger timeframe chart shows that GoNoGo Trend has finally been able to identify a new “NoGo” trend. After 4 bars of “Go Fish”, we see a first pink “NoGo” bar. GoNoGo Oscillator is confirming what we see in price as it is in negative territory but not oversold at a value of -3. Momentum is now inline with the new “NoGo” trend and we will see if it moves lower from here.

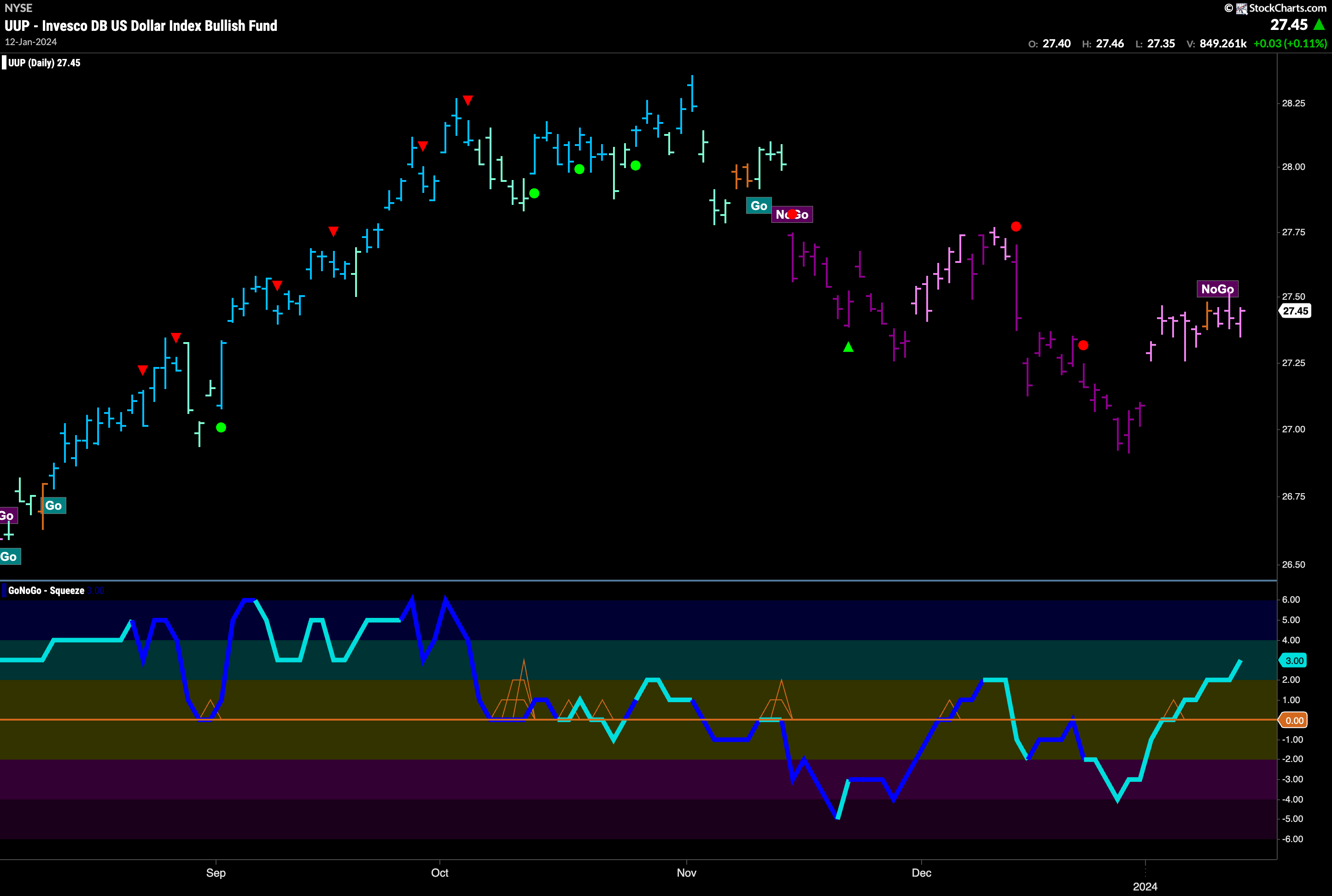

Dollar Stays in “NoGo” for Now

Looking at the daily chart below we see that the “NoGo” trend has returned after one “Go Fish” bar. The trend is not strong as GoNoGo Trend paints weaker pink bars but it is back to “NoGo” bars for the greenback. Will this be a new lower high? So far we don’t see any conviction yet in a move higher and any move lower from here would put in a new lower high. However, GoNoGo Oscillator is in positive territory at a value of 3 so that tells us that momentum is out of step with the “NoGo” trend and could potentially signal some upward pressure.

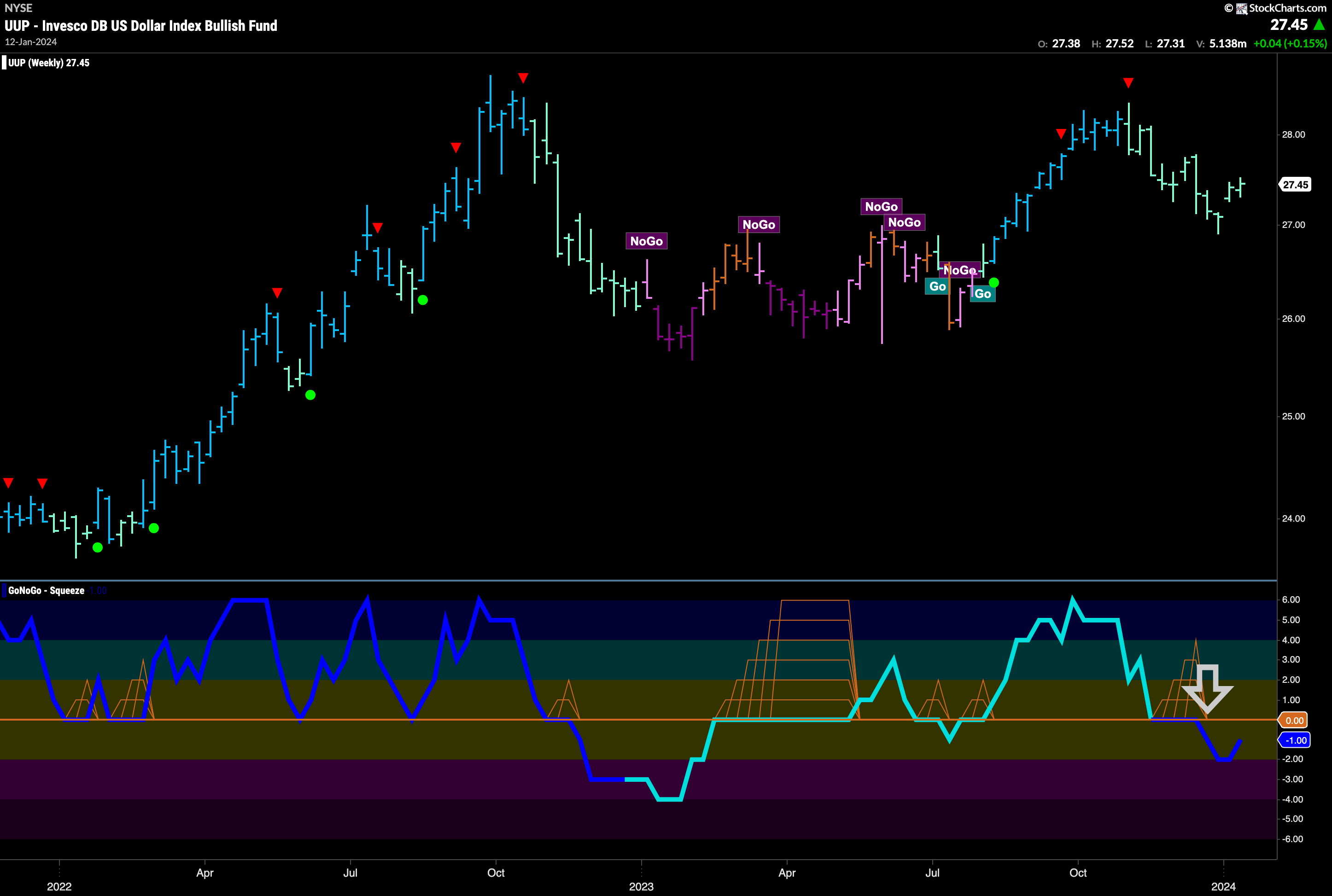

The weekly chart below shows that the “Go” trend on the longer time frame remains tenuously in place. We see another weak aqua “Go” bar this week and although price is climbing slightly from the low a few bars ago we see that GoNoGo Oscillator is in negative territory on heavy volume. This comes after breaking out of a small GoNoGo Squeeze.

Oil Feeling the Squeeze

Oil prices continue to try to rally but didn’t get very far once again this week. Price is painting weaker pink “NoGo” bars as price hovers around this new higher low that we saw last week. We must pay attention to the lower panel. GoNoGo Oscillator has been riding the zero line for an extended period of time and that has caused the climbing grid of GoNoGo Squeeze to rise to its Max. This extended GoNoGo Squeeze tells us that there is a tug of war at these levels between buyers and sellers and we will need to watch for the break of the Squeeze in order to understand price’s next direction.

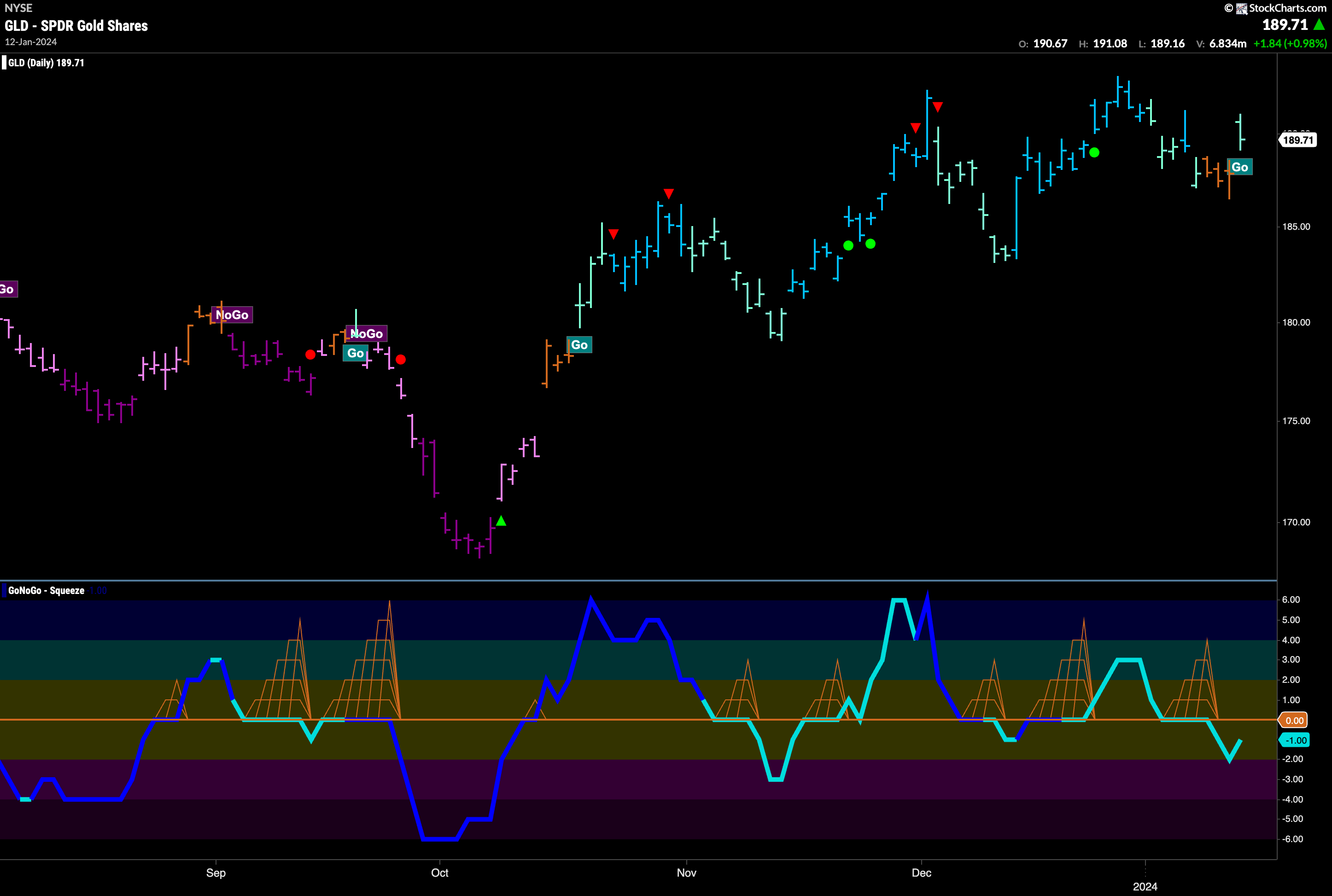

Gold Stumbles but Doesn’t Fall

GoNoGo Trend shows that this week saw some uncertainty creep in as the precious metal painted 3 amber “Go Fish” bars in a row. Concurrently, GoNoGo Oscillator fell into negative territory after breaking out of a small GoNoGo Squeeze. However, it quickly reversed course and is heading back to the zero line as price paints a fresh aqua “Go” bar. We will need to see the oscillator regain positive territory to have confidence in the new “Go” but if it does, we can look for price to set a new high.

The monthly chart continues to be bullish. As we mentioned last week, the month is not over yet but we are on course to set another monthly close above the horizontal channel we have drawn on the chart. GoNoGo Oscillator remains supported by zero and in fact is moving further into positive territory. The evidence is perhaps building for a bigger move higher.

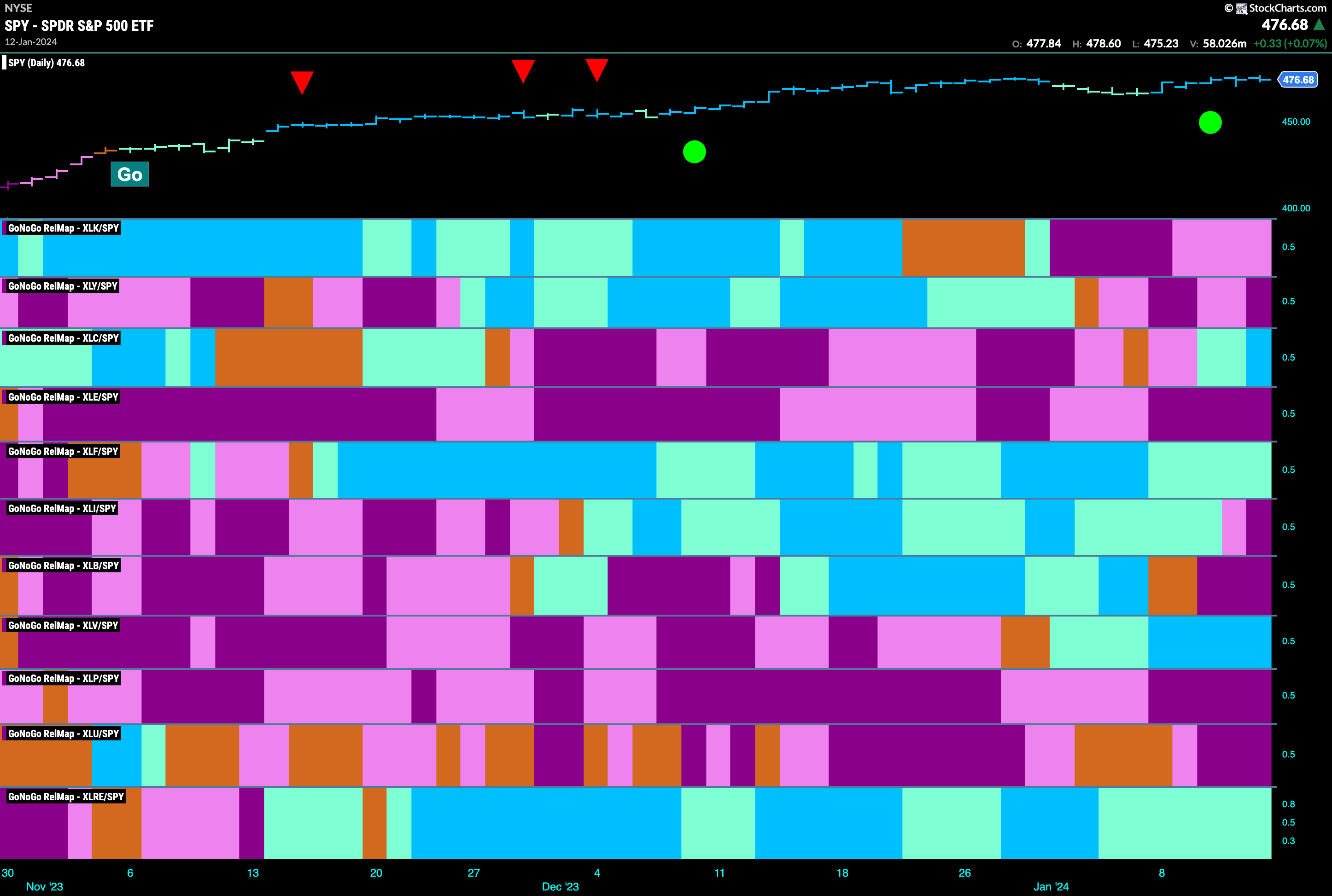

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. Looking at this map, we can quickly see where the relative outperformance is coming from as well as which sectors are lagging on a relative basis. 4 sectors are outperforming the base index this week. $XLC, $XLF, $XLV and $XLRE, are painting “Go” bars.

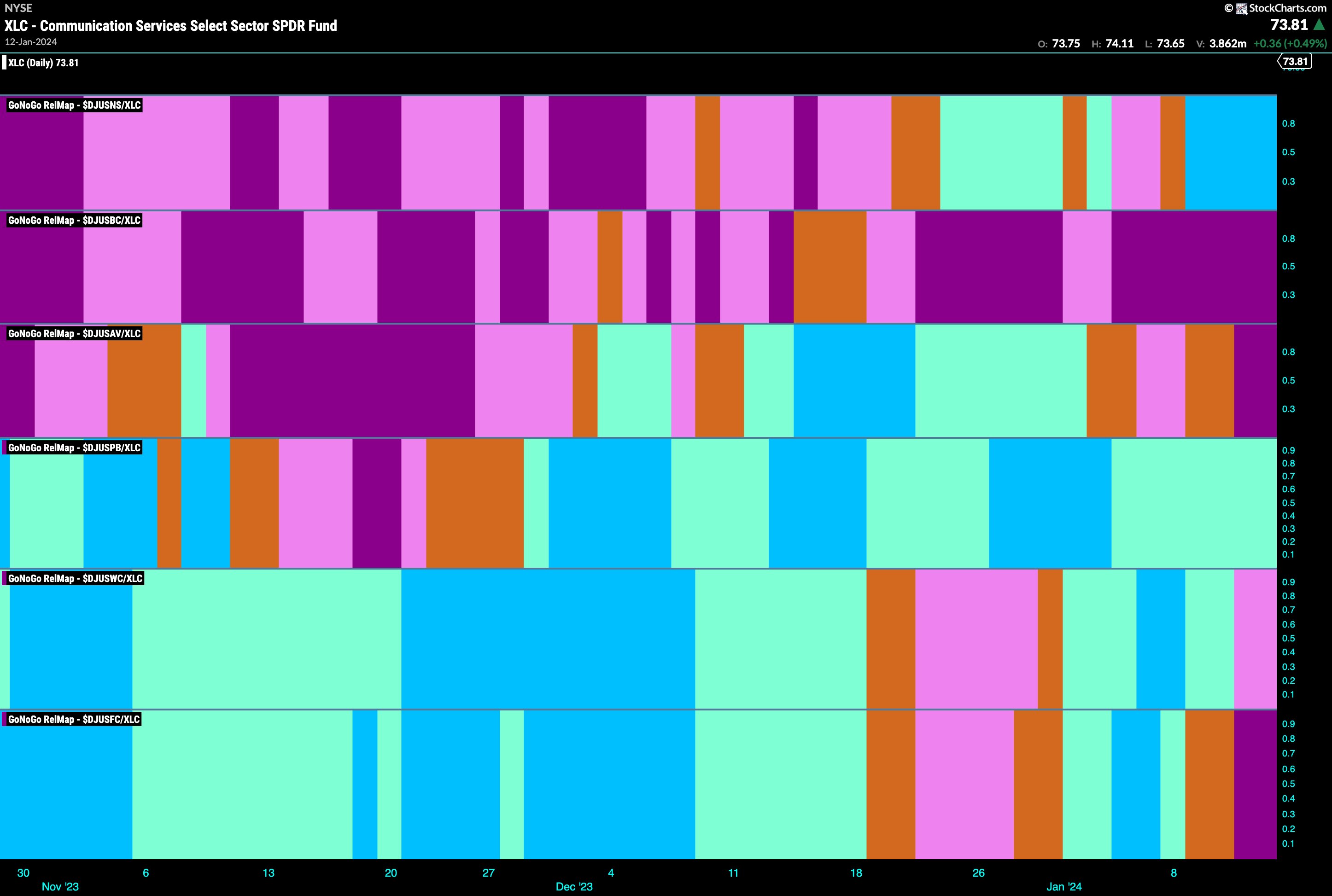

Communications Sub-Group RelMap

The GoNoGo Sector RelMap above shows that the communications has started to outperform the larger index on a relative basis. Indeed, the last bar of the week saw a strong blue “Go” bar as the relative trend takes off. Below, we see the individual groups of the sector relative to the sector. We apply the GoNoGo Trend to those ratios and see that the internet index (top panel) is showing recent strength on a relative basis.

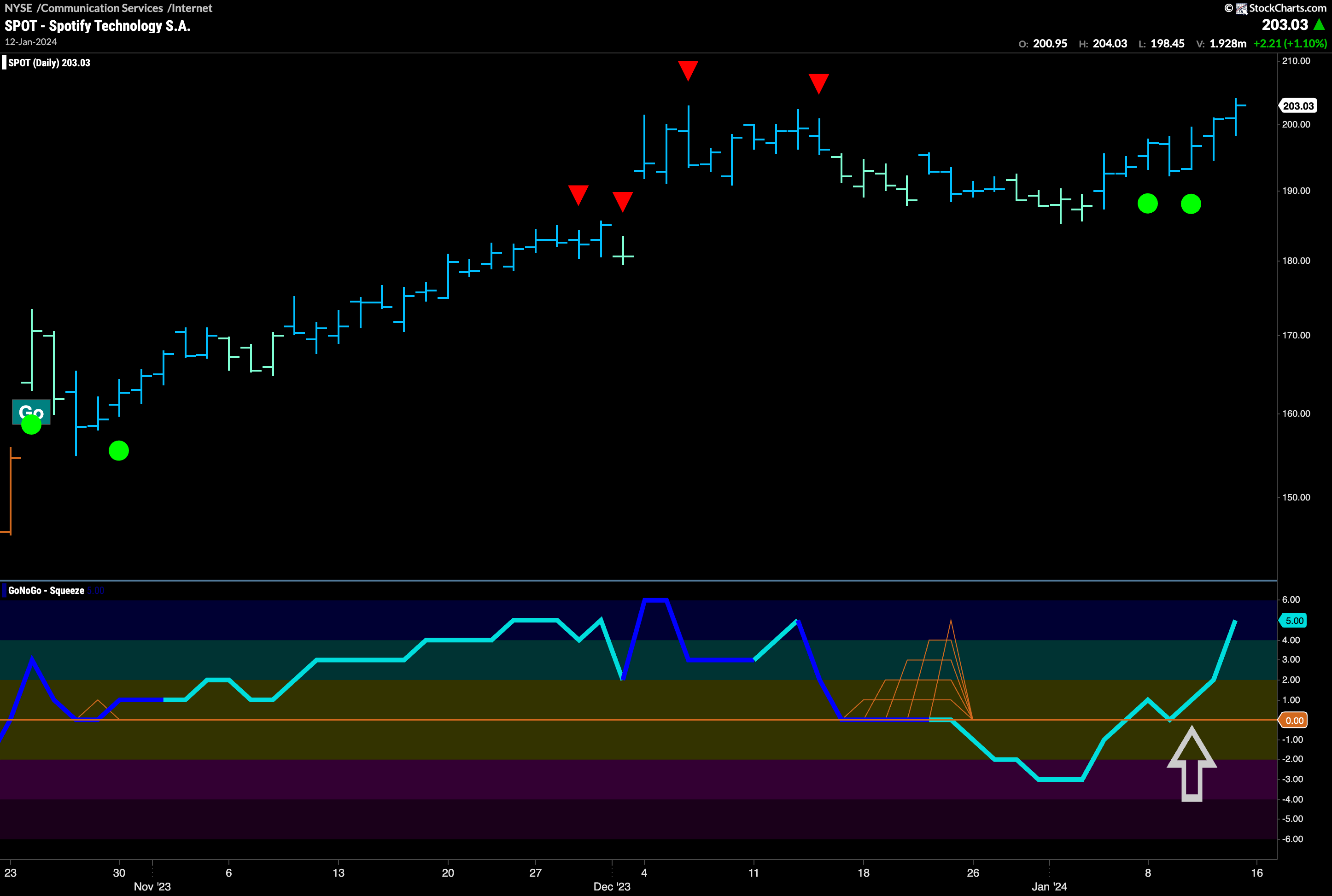

$SPOT-ing Signs of Trend Continuation

Spotify technologies is in the internet index and so is helping drive the outperformance of the group and the sector. The daily chart below shows a strong bullish “Go” trend. GoNoGo Trend is painting a string of strong blue “Go” bars. Several weeks ago we saw Go Countertrend Correction Icons (red arrows) at the last high and this told us that in the short term price may struggle to go higher. That was indeed the case as price moved mostly sideways and agains the trend and the indicator painted several weaker aqua “Go” bars. During this time GoNoGo Oscillator was even pushed into negative territory which told us the countertrend correction was strong. Most recently, with GoNoGo Trend painting strong blue bars once again, GoNoGo Oscillator has regained positive territory and already retested that level. This triggers Go Trend Continuation Icons (green circles) on the price chart and we will look for price to move higher and set a new high.

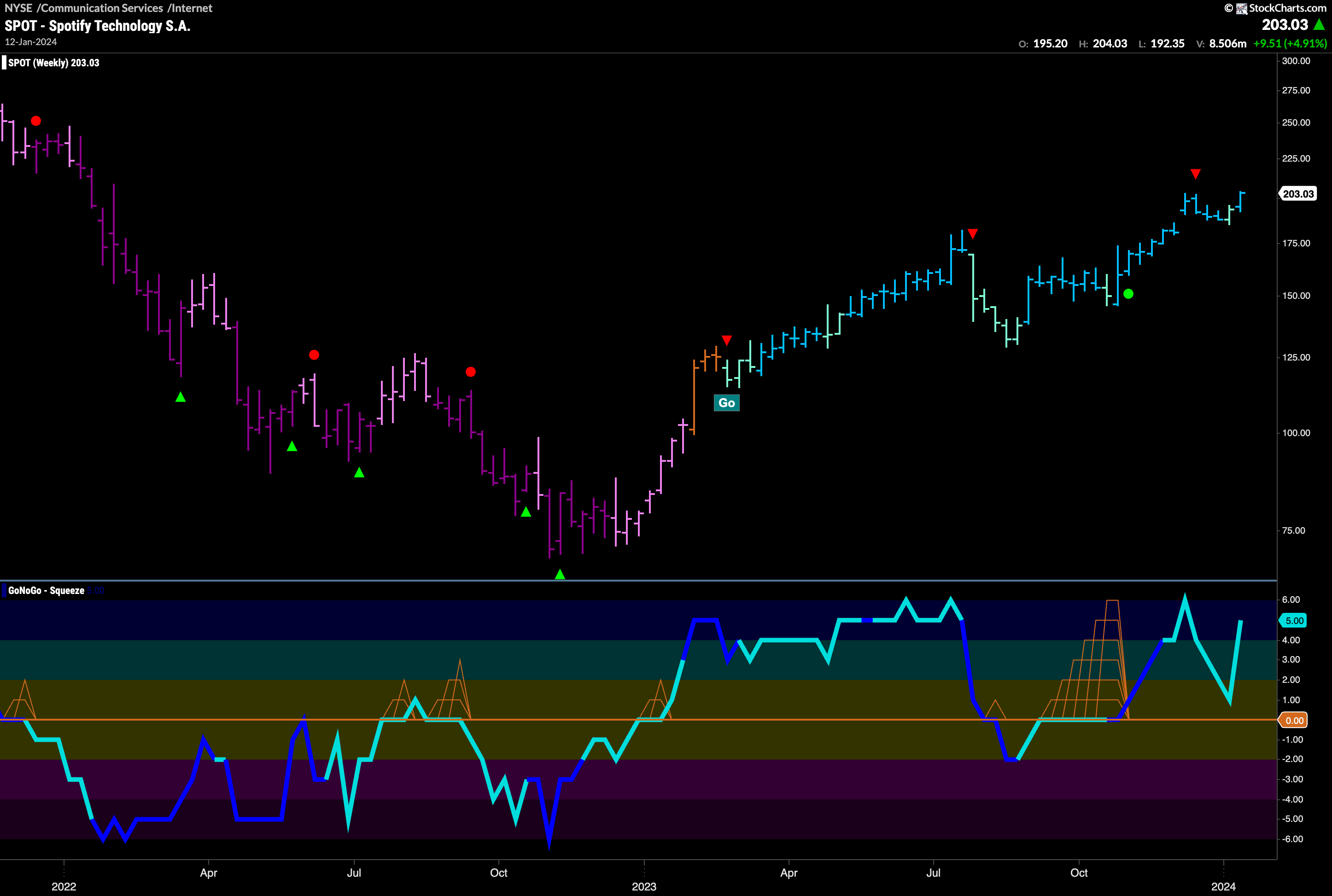

The longer time frame chart shows that there is room to run for $SPOT. Unlink the larger equity index ($SPY), price is not at all time highs. There is plenty of room for this current “Go” trend to continue before facing resistance from prior highs. With a fresh strong “Go” bar painted last week and GoNoGo Oscillator rising in positive territory we can look for more gains in price.

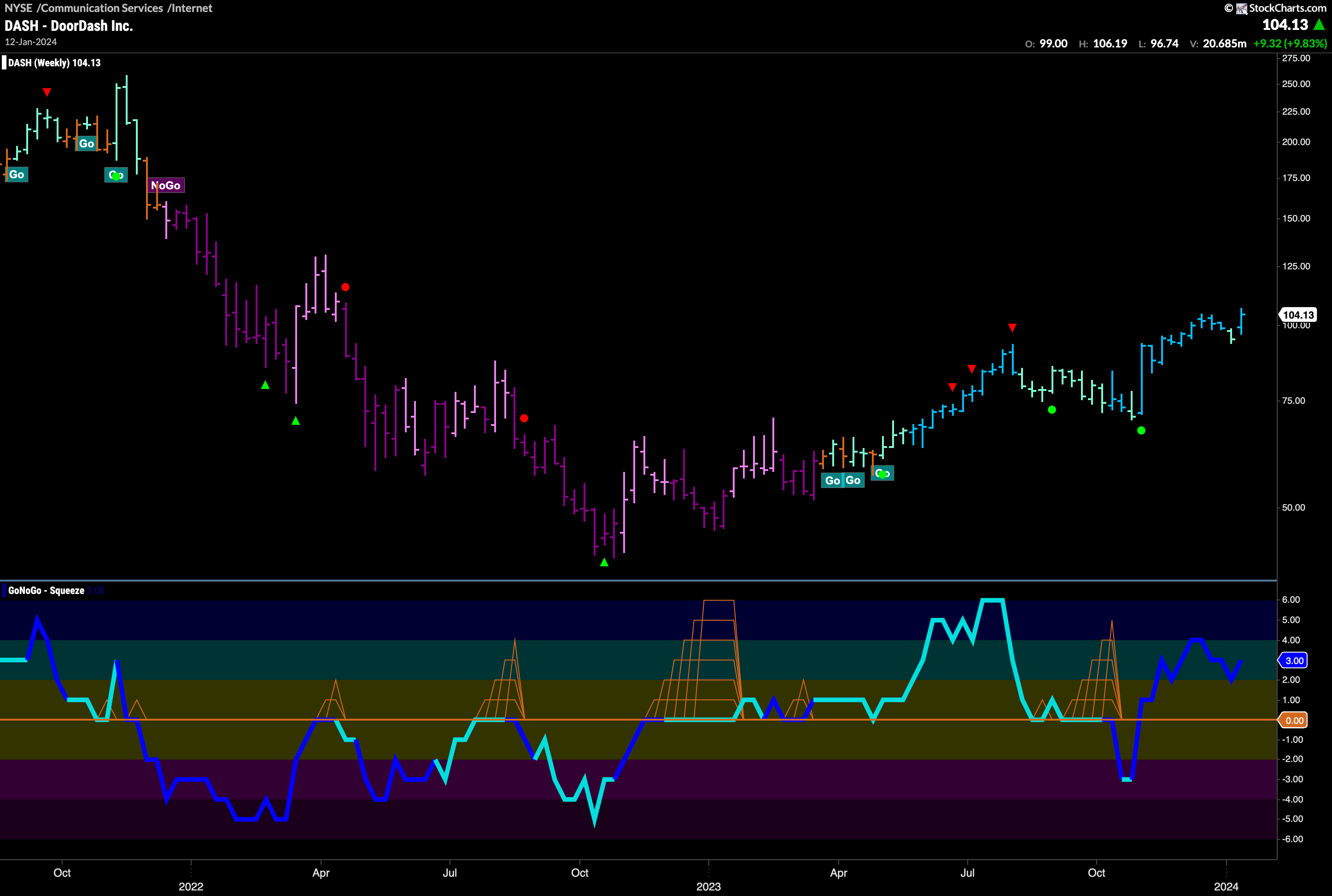

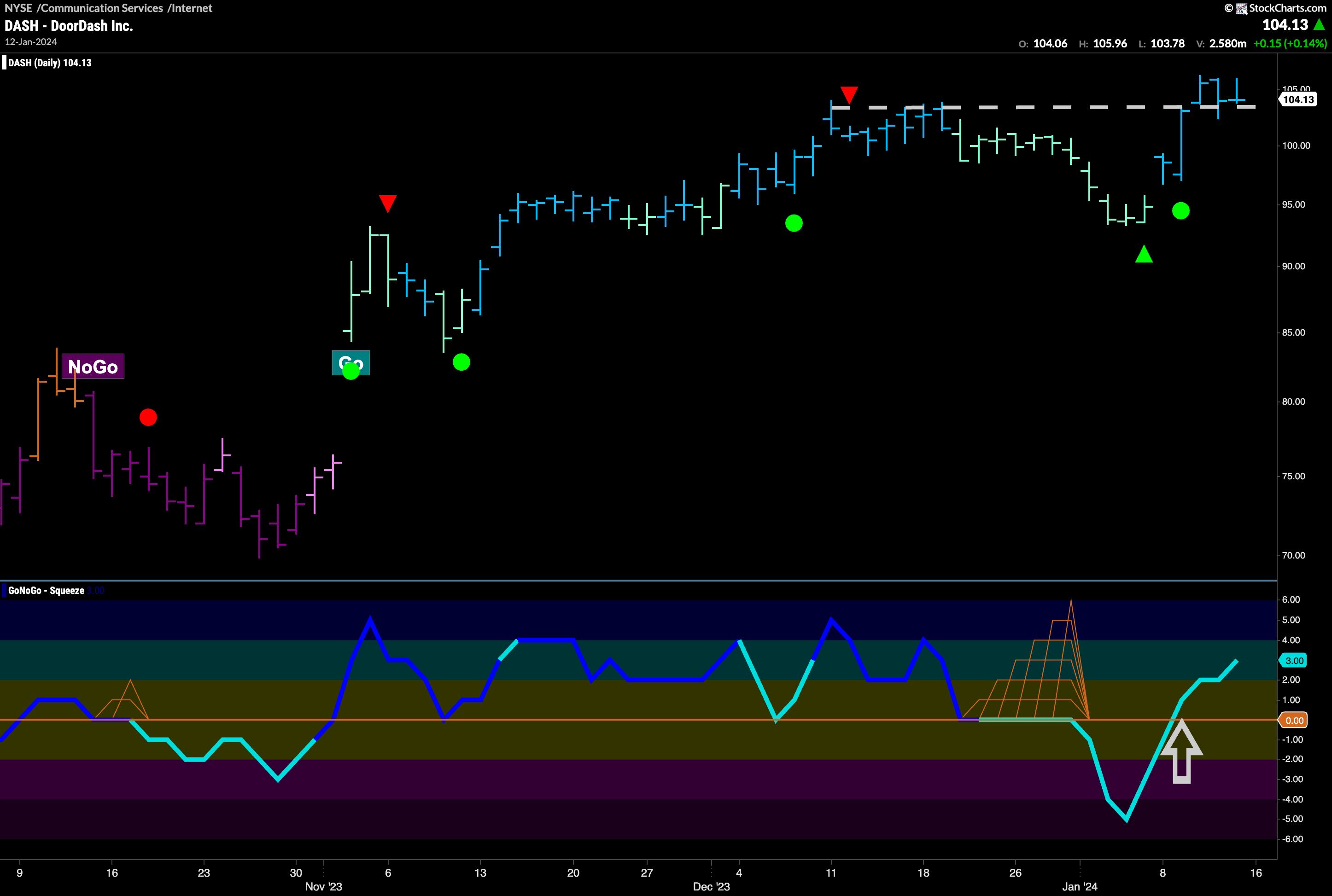

$DASH-ing to New Highs?

Another company in the internet index is DoorDash. This also looks strong as we can see from the chart below. GoNoGo Trend paints strong blue “Go” bars as price consolidates at new highs on the daily chart. Like $SPOT, after a deep correction that pushed GoNoGo Oscillator into negative territory we see that it has surged back above zero and this has given a Go Trend Continuation Icon (green circle).

The longer time frame chart tells a similar story in that there is much room to run here for price. As this “Go” trend progresses we can see that we are no where near prior highs. GoNoGo Trend is painting a strong blue “Go” bar and GoNoGo Oscillator is in positive territory but not overbought at a value of 3 and volume is heavy. This tells us that there is strong market participation.