Welcome to your global, cross-asset chart pack review for the week ending June 25. Launch Conditions from GoNoGo Research is designed to help you pause for a moment during your weekend to review longer-term market trends. We hope you can better understand the conditions for launching your next trade ideas in the week ahead.

Click below to review your GoNoGo Launch Conditions ChartPack for the week ending June 25, 2021

Market Performance:

The S&P 500 (+2.7%) and Nasdaq Composite (+2.4%) set all-time intraday and closing record highs this week, offering greater evidence of the resiliency of this this bull market. And, after the routing of cyclical, small-cap, and value stocks the week prior, the Dow Jones Industrial Average (+3.4%) and Russell 2000 (+4.3%) delivered the strongest gains this week. See the daily GoNoGo Trend® of the S&P 500 ETF $SPY in the chart below. Equities bounced back from last week’s correction to post all time highs. GoNoGo Oscillator® burst back above zero into positive territory on heavy (dark blue) volume.

All sectors of the S&P 500 were up this week! Energy shares fared best within the S&P 500. The energy sector climbed 6.7% as oil prices reached their highest levels since October 2018. Crude oil futures finished the week at $73.30 per barrel on falling global inventories. Financials erased last week’s losses as well, gaining 5.3% after the spread of 10yr/2yr notes widened (1.54%/0.27%), and the yield curve steepened.

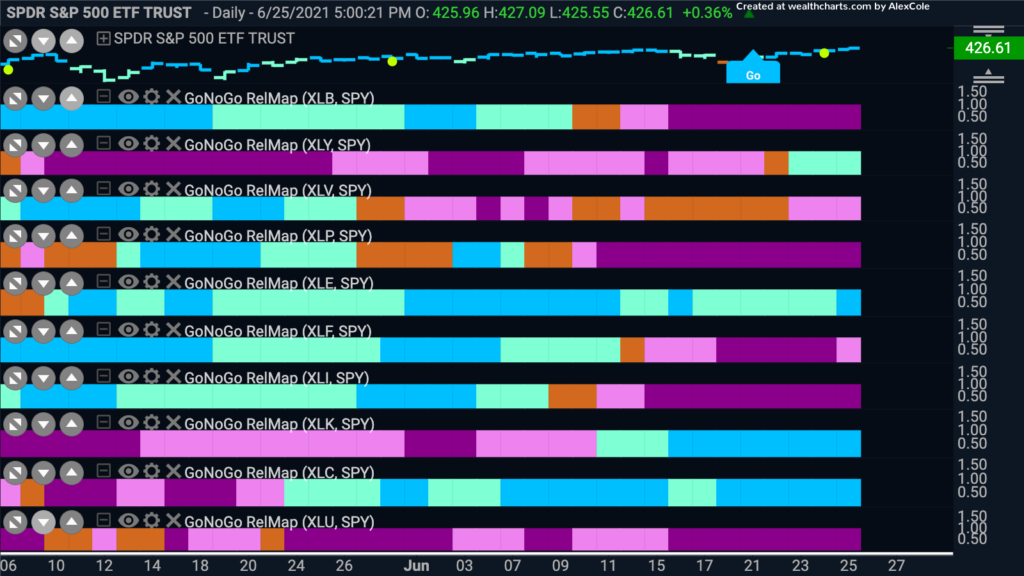

The absolute trend for all sectors was a “Go” this week, but if we consider these sectors on a relative basis against the broad index, we see four areas of leadership. Energy ($XLE), technology ($XLK) and communications ($XLC) are painting “Go” bars and the consumer discretionary sector ($XLY) has joined the leadership party this week. The GoNoGo Relmap below illustrates the rotation back to growth sectors (Energy shares providing the notable exception).

Fiscal policy decisions fueled the flames for cyclical stocks into the end of the week as President Joe Biden unveiled a $1.2 trillion “Bipartisan Infrastructure Framework” on Thursday. Economically sensitive securities got the biggest boost as the proposed agreement focuses spending on roads and bridges as well as water infrastructure and broadband, and comes with no new taxes because it is funded by other sources.

Key Takeaway

New highs and low volatility are not signs of exhaustion. Our fundamental colleagues agree. They have pointed out that economic activity continues to expand as Covid threats subside, credit spreads are low, household balance sheets are very strong, and share repurchases are ramping up. The weight of the evidence supports the case for a durable bull market.