Key Observation: this is a Bull Market

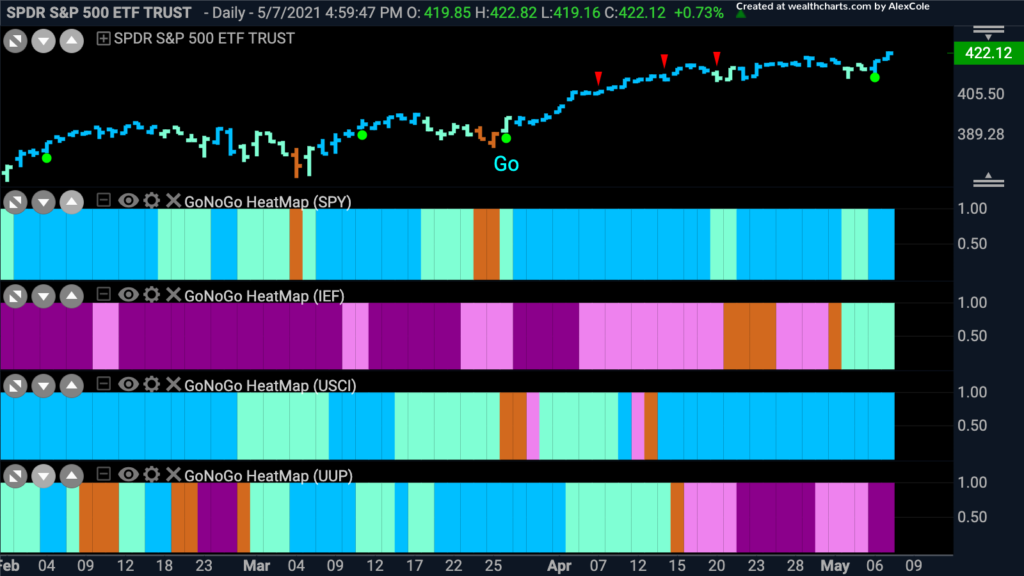

The primary long-term trend for equities is still intact. The Dow posted another record-setting gain +2.7%, and even the S&P 500 finished the week at all-time highs, despite further consolidation and rotation into cyclical stocks at the start of the week. In the second year of a bull market, it is common to see prices digesting such monumental gains. Globally, the number of indices, sectors, and securities approaching key levels puts many charts at critical inflection points and suggests investors will need to work through choppy trades for longer. From the GoNoGo Heat Map below, we can compare major asset classes and understand that risk assets are still outperforming – Equities and Commodities strongest:

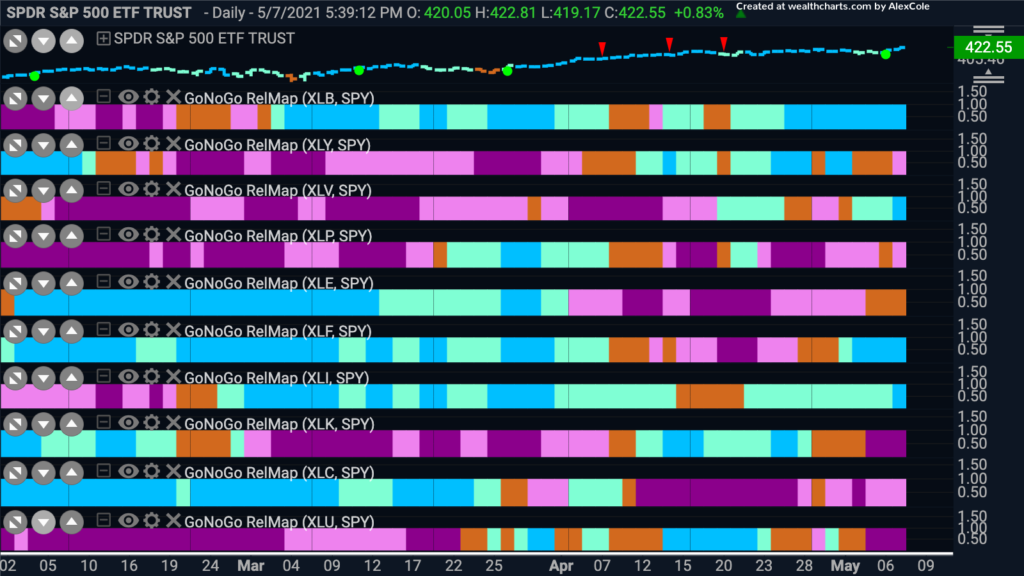

Leaders and Laggards

Cyclical sectors led the indices higher including energy (+8.9%), materials (+5.9%), financials (+4.2%), and industrials (+3.6%) reflect the thematic shift towards the reopening of the physical economy despite lackluster numbers from key economic reports this week including monthly deceleration from ISM Manufacturing Index and non-farm payrolls which both increased far less than consensus estimates.

The tattered trends of growth equities – tech stocks in particular – joined the broad equity rally into the close, but the Nasdaq Composite still finished the week down -1.5% after intraweek lows of -3.8%.

A quick word on the US Dollar…

Following the remarkably strong “NoGo” trend for the US Dollar index last year, 2021 has largely been a story of countertrend rally or mean reversion. As $DXY was plodding higher, it challenged some of the prominent trends of 2020. This week those correlation questions were silenced by the sharpest decline in the dollar index in 6-months. GoNoGo Charts show a fully confirmed resumption of the “NoGo” trend and a test of the January lows is a logical next target. Further weakness from the US Dollar could restore tailwinds for risk assets across the board including, Stocks, Commodities, and even Cryptocurrencies.

Flip Through Your Weekly GoNoGo Launch Conditions Chart Pack Here:GoNoGo LC 050821