"Never bet against America." - Warren Buffett, Annual Shareholder Letter

The tension between growth hopes and inflation fears was evident in the market’s choppy trading Thursday and Friday. However, while the headlines warned of market “Turmoil” and the equity “sell-off,” the S&P was less than 3.5% off of Monday’s closing high by the time we reached Thursday’s closing low – a 5% move between intraday highs and lows. The S&P 500 posted an 0.8% gain for the week. Welcome to your weekly dose of rational perspective on the markets.

Click below to open your GoNoGo Launch Conditions Chart Pack 3-05

Notably, we saw a rotation amongst investor positioning toward the industrial economy attributed in part to continued optimism about the rollout of coronavirus vaccines. The J&J single-dose vaccine began distribution on Monday and President Biden revised his timeline by two months stating that every American adult should have access to Covid vaccines by the end of May.

The Dow Jones Industrial Average outperformed with a 1.8% gain, while the Nasdaq Composite (-2.1%) and Russell 2000 (-0.4%) continued to fade from recent leadership. Higher interest rates challenged the tolerance of investors toward extended valuation metrics for growth companies, particularly in the technology space.

Consistent with the theme of reopening the industrial economy, the energy sector ($XLE) climbed 10.1%, buoyed by higher oil prices which closed the week at $66.09 per barrel, a 7.6% gain for the week.

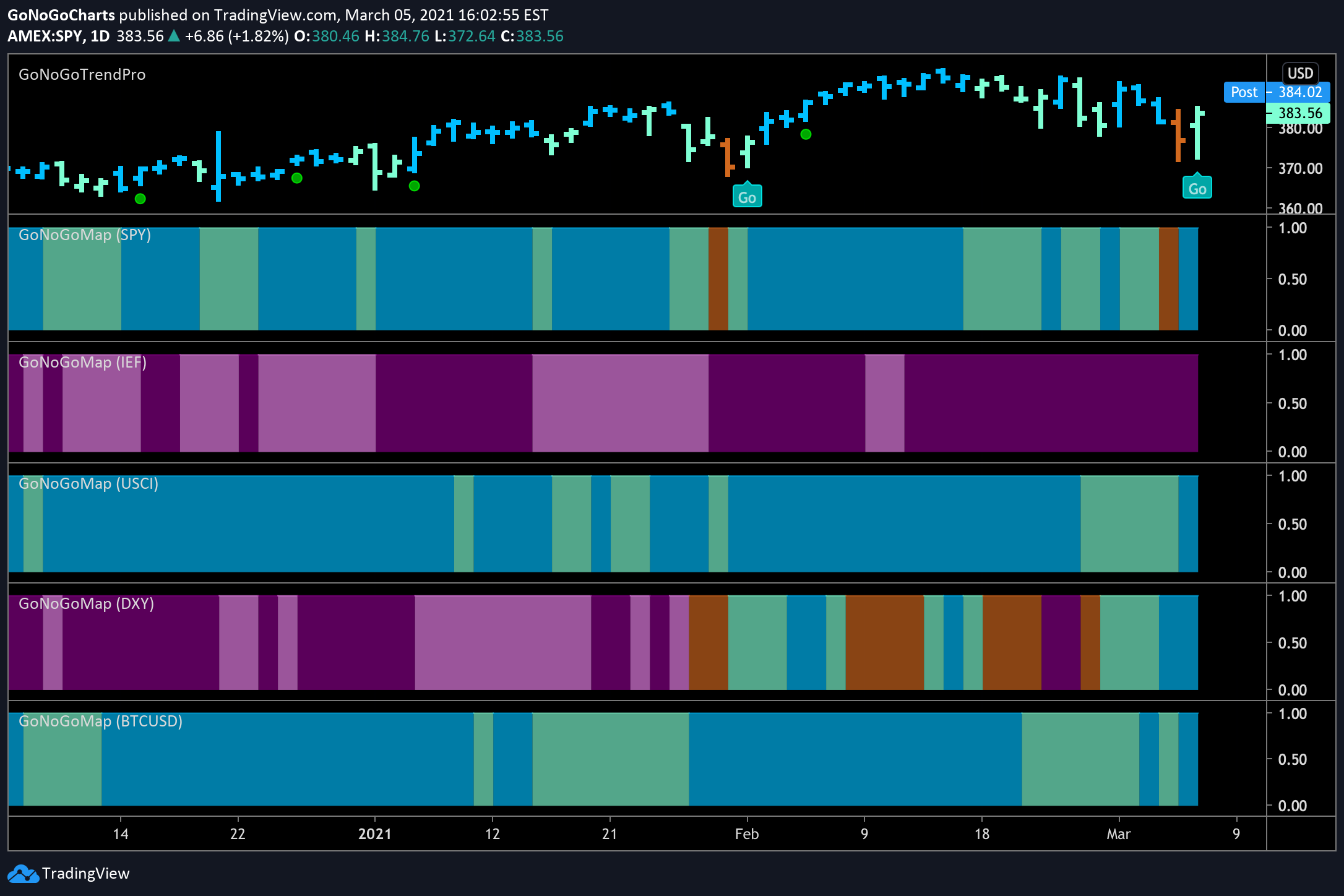

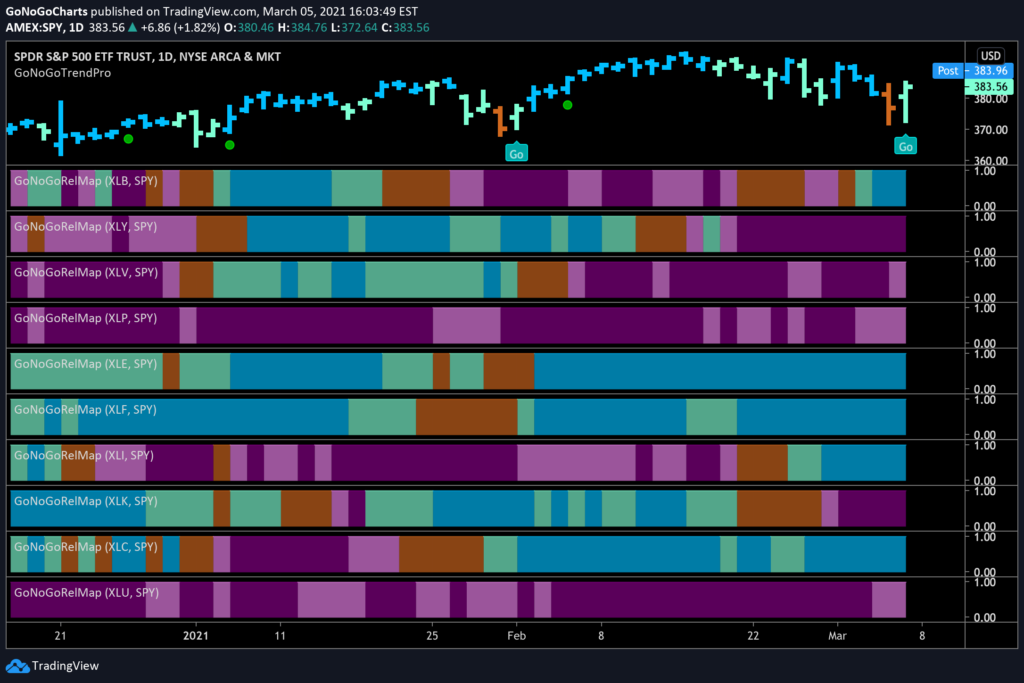

See the GoNoGo RelMap below which offers a clean comparison of trends amongst the 10 equity sectors of the S&P. What is unique about this visualization is that it depicts the GoNoGo Trend conditions of the sectors’ relative performance against the index.

- Five sectors decisively outperformed the broad S&P 500 Index

- Energy ($XLE) & Financials ($XLF) continue strong outperformance

- Materials ($XLB) & Industrials ($XLI) joined leadership this week

- The Communications ($XLC) sector rounds out the outperforming sectors painting blue bands this week

- Technology ($XLK) fell out of neutral amber, to paint “NoGo” purple bands this week

Remember to flip through your GoNoGo Launch Conditions Chart Pack 3-05 this weekend to view the remaining 15 charts!