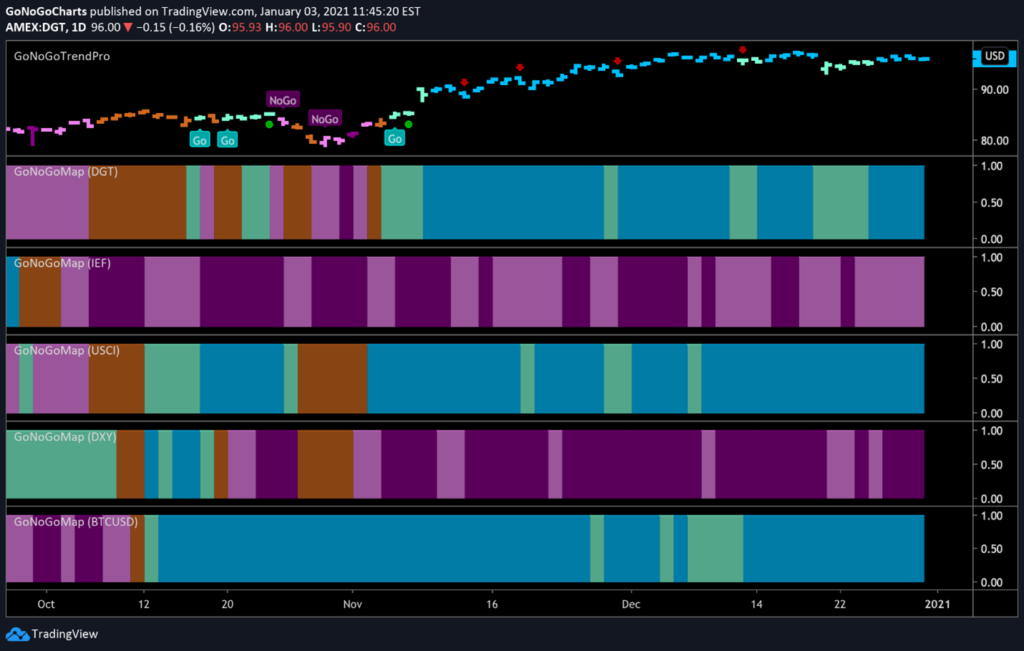

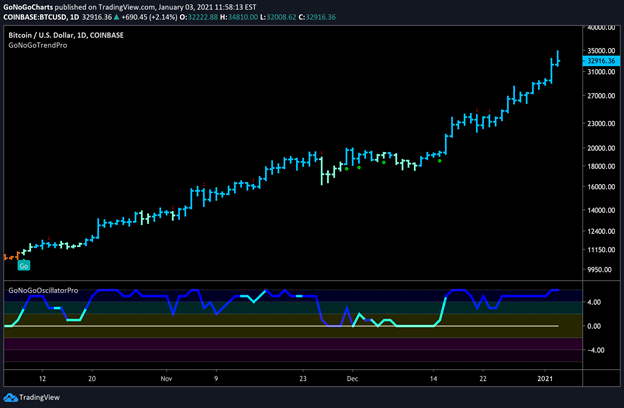

| The GoNoGo Heat Map® above shows us the daily trend performance of five asset classes: Equities, Bonds, Commodities, Currencies, and Digital Assets from the US perspective. The takeaway remains the same as it has been for several weeks: Equities, commodities, and the cryptocurrency markets are now in established “Go” trends.

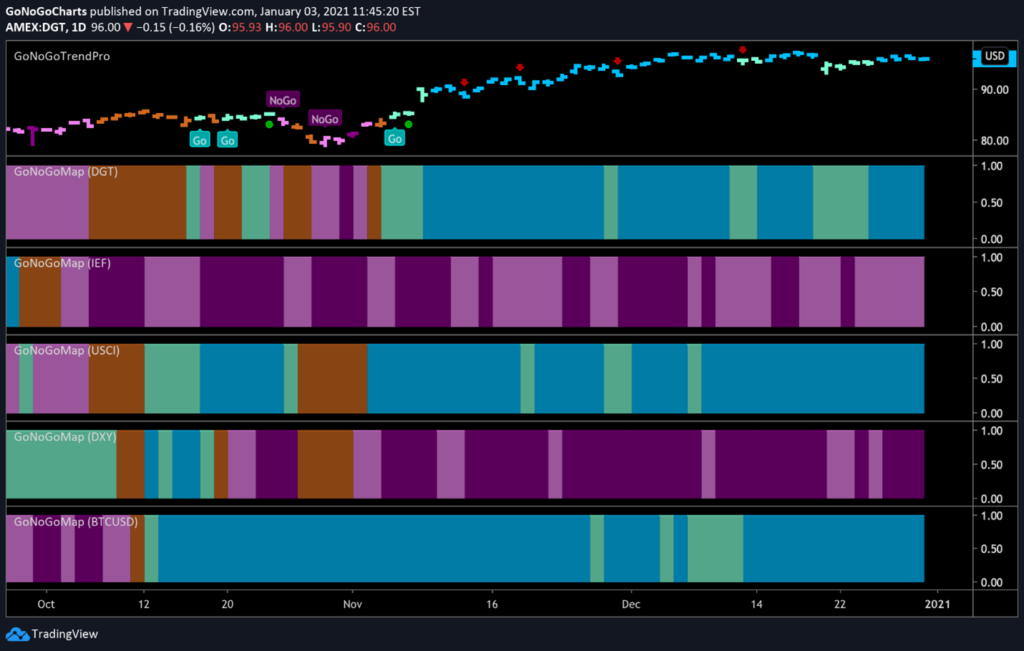

Panel 1 – Global stocks continue in the “Go” trend now in place for several weeks. $DGT tracks an equal-weighted index of 150 of the world’s most prominent companies as selected by Dow Jones.

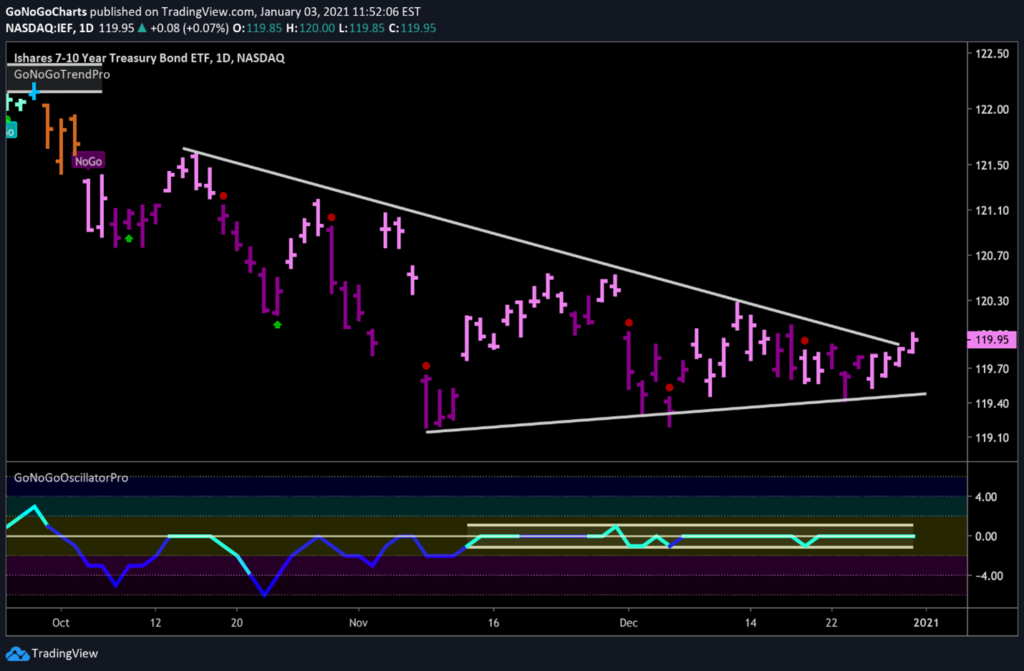

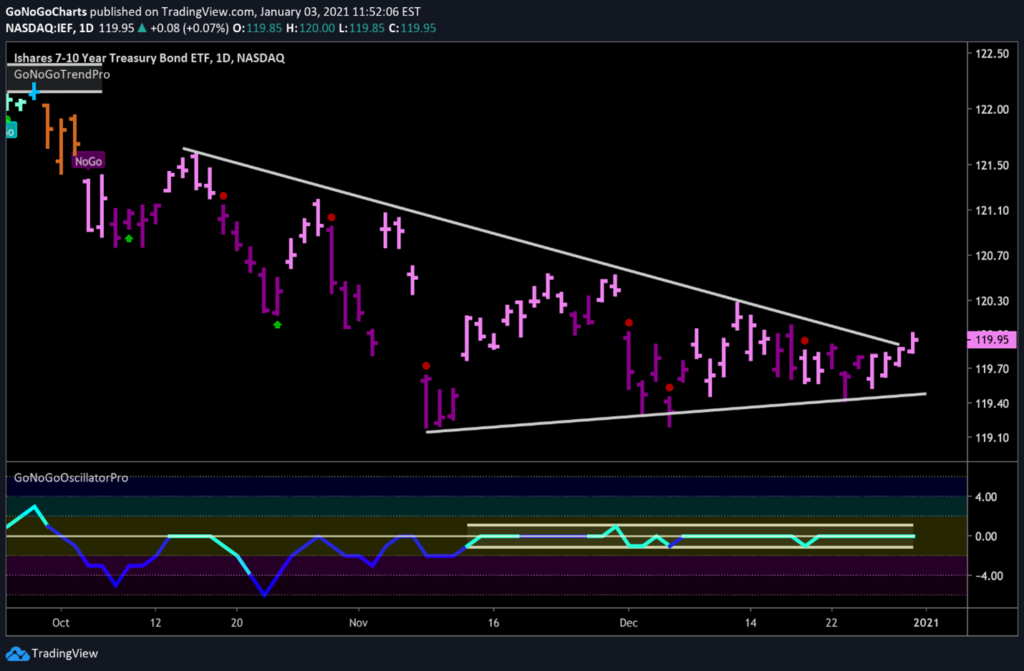

Panel 2 – Government bonds, continue to paint “NoGo” bars, although they show weaker directional trend strength on pink bands. $IEF tracks a market-value-weighted index of debt issued by the US Treasury with 7-10 years to maturity remaining.

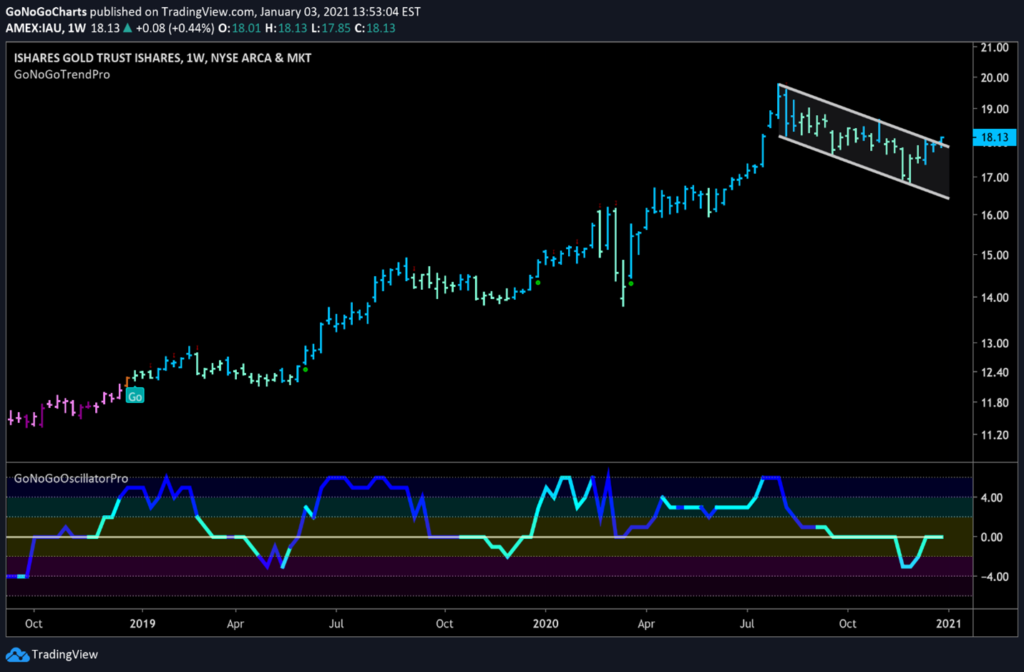

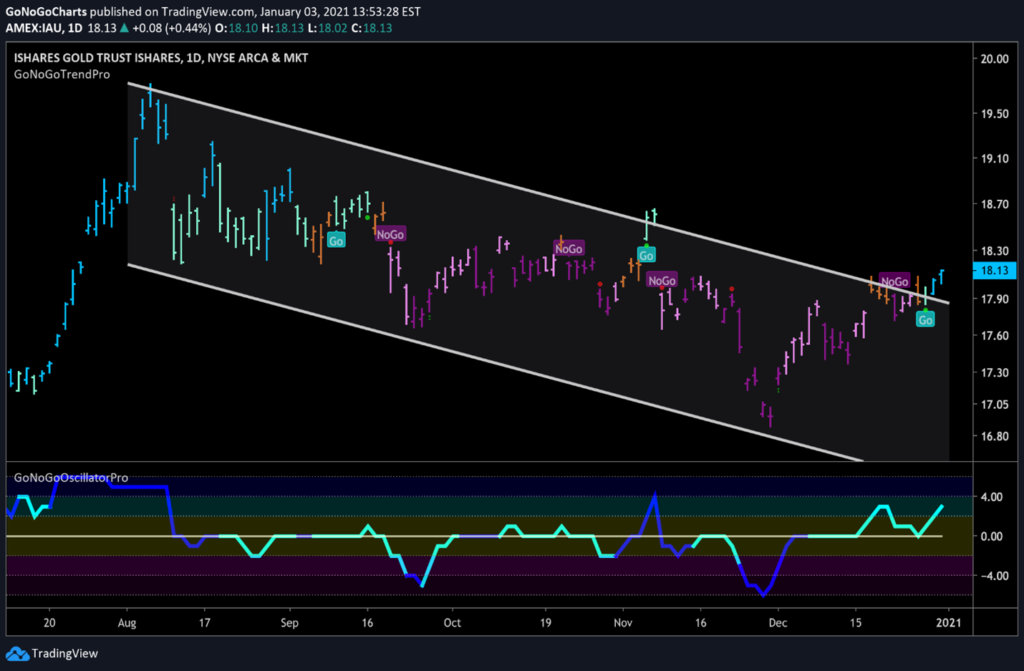

Panel 3 – Commodities are a “Go” continuing to paint strong blue bars. $USCI tracks an equal-weighted index of 14 commodity futures contracts and holds at least one precious metal, industrial metal, energy, livestock, soft, and grain commodity.

Panel 4 – The US Dollar is now again in a persistent “NoGo” trend. $DXY is an index of the value of the United States Dollar relative to a basket of foreign currencies.

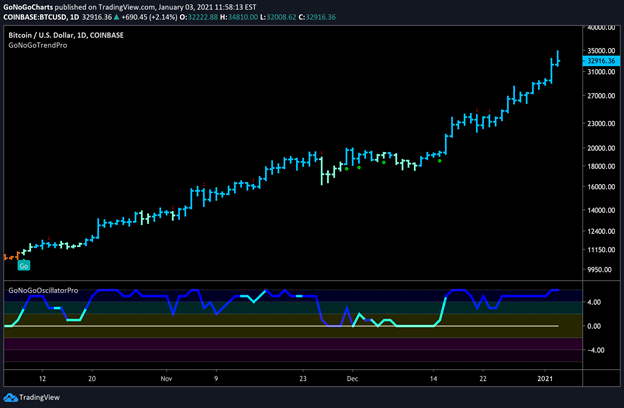

Panel 5 – Bitcoin continues in a “Go” trend and we saw continued strength this week as price climbed daily to new all-time highs. |