Happy Juneteenth, and welcome to your weekly installment of GoNoGo Launch Conditions. We hope you can take a moment away from the heaviness of the week to review global market trends and a longer-term perspective.

We find it is more productive to look at what is happening than what narrators are telling us might be possible down the road. Flip through your GoNoGo LC Chart Pack 061821 below for a sense of what is really happening:

Market Action

The S&P 500 started the week at record highs, but fell nearly 2% as investors abruptly exited positions in cyclical/value stocks – the DJIA dropped -3.5%. We saw the Nasdaq Composite fare much better, as growth-oriented shares led markets on a relative basis, drifting lower by just -0.3%. And the Russell 2000 sunk -4.2% as large caps outperformed small caps this week.

See the daily GoNoGo Trend® chart of the $SPY which shows the precipitous selling in the back half of the week. The index concluded in a neutral amber bar. GoNoGo Oscillator® plummeted through the zero line ending the week negative:

Market Sentiment

The narrative machine was working overtime this week. Did you catch the headline?

“The Fed began hinting at the fact that they were thinking about considering discussing the potential raising rates at some point in time that might be a bit sooner than the later time that they were already planning.”

To be clear, the central bank made no changes to the fed funds rate or the pace of asset purchases, just as expected. What changed was the median forecast for the path of interest rates. Consensus is now for two rate hikes by the end of 2023 – the prior indication was leaving rates unchanged through 2023.

St. Louis Fed President Bullard acknowledged the rising inflation pressures in the economy, insisted that the FOMC should not be involved in mortgage-backed Securities, and was one of the seven members who expected a rate hike in 2022.

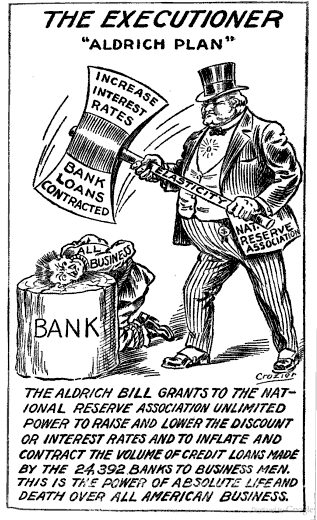

This satirical cartoon from 1907 seems to capture the sentiment of markets this week with respect to any move by the central bank to curb the enthusiasm of this bull-market:

We would also offer that the substantial shift towards a planned economy since the great financial crisis has created interdependencies that may now restrict the autonomy of central bankers to enact policy as they see fit. These thoughts are well summarized by Mohamed El-Erian:

“Having been forced into being the only game in town, they

(Central banks) now find that their destiny is no longer entirely

or even mostly theirs to control. The legacy of their exceptional

period of hyper policy experimentation is now in the hands of

governments and their political bosses (p. 265).”

― Mohamed El-Erian, The Only Game in Town

What Actually Matters?

The 2yr yield rose 11 basis points to 1.27% and the 10yr fell slightly to 1.45%, thus flattening the yield curve and tightening the spread which creates lending revenues for banks. From a sector perspective, a flattening yield curve hits the financials hardest. The $XLF fell -6.2% this week.

Bolstering the view that inflation rates, and growth rates, are peaking as the immediate effects from reopening the economy wear off materials (-6.3%), energy (-5.2%), and industrials (-3.8%) sectors dropped sharply this week.

As prices rise with stronger demand for treasuries with longer maturities, yields fall inversely. See the GoNoGo chart below of the $TLT – 20 yr treasury notes ETF. Strongest “Go” trend conditions on blue bars following a resurgence of momentum as GoNoGo Oscillator hits overbought extremes:

As written in GoNoGo Research’s Flight Path this Monday, the falling rate environment provides strong tailwinds for growth-style equities. Most explicit in the weight of this week’s evidence, the information technology sector alone managed to eke out a positive finish(+0.1%).

Stay tuned this coming Monday for an in-depth look at the strongest trend conditions in individual securities. For now, just know that in the long run the market is a weighing machine, not a voting machine. Best to stay on the right side of the trend.