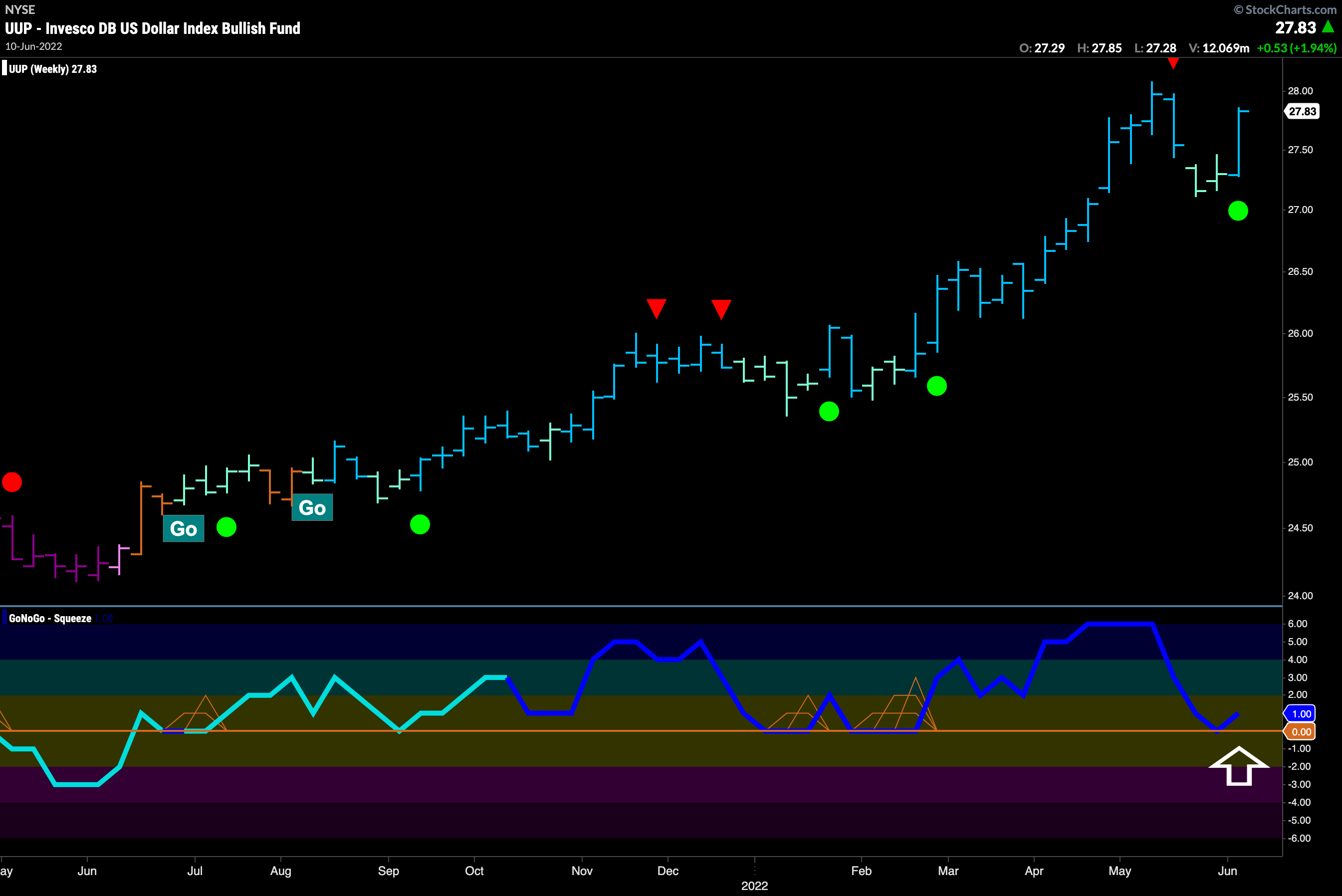

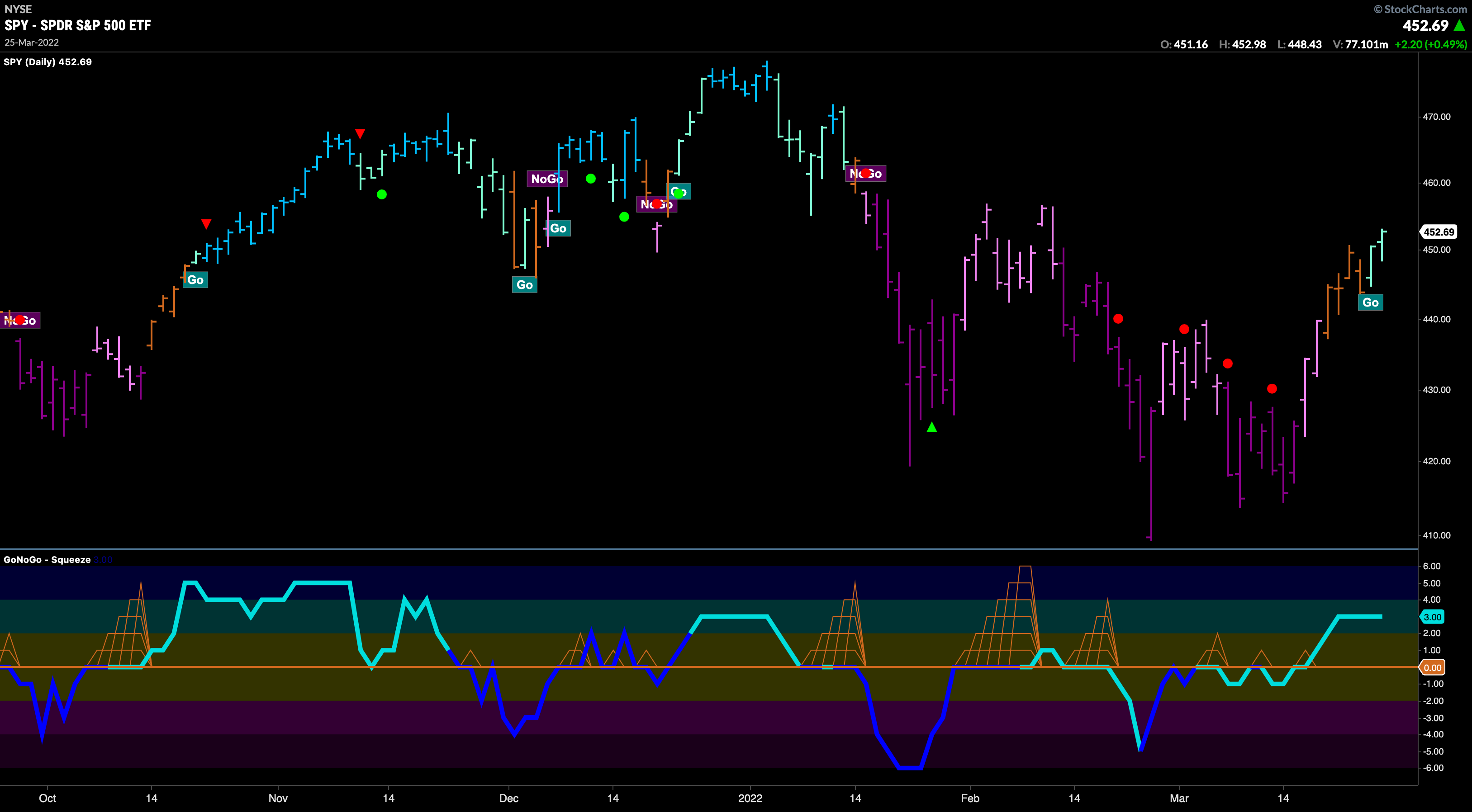

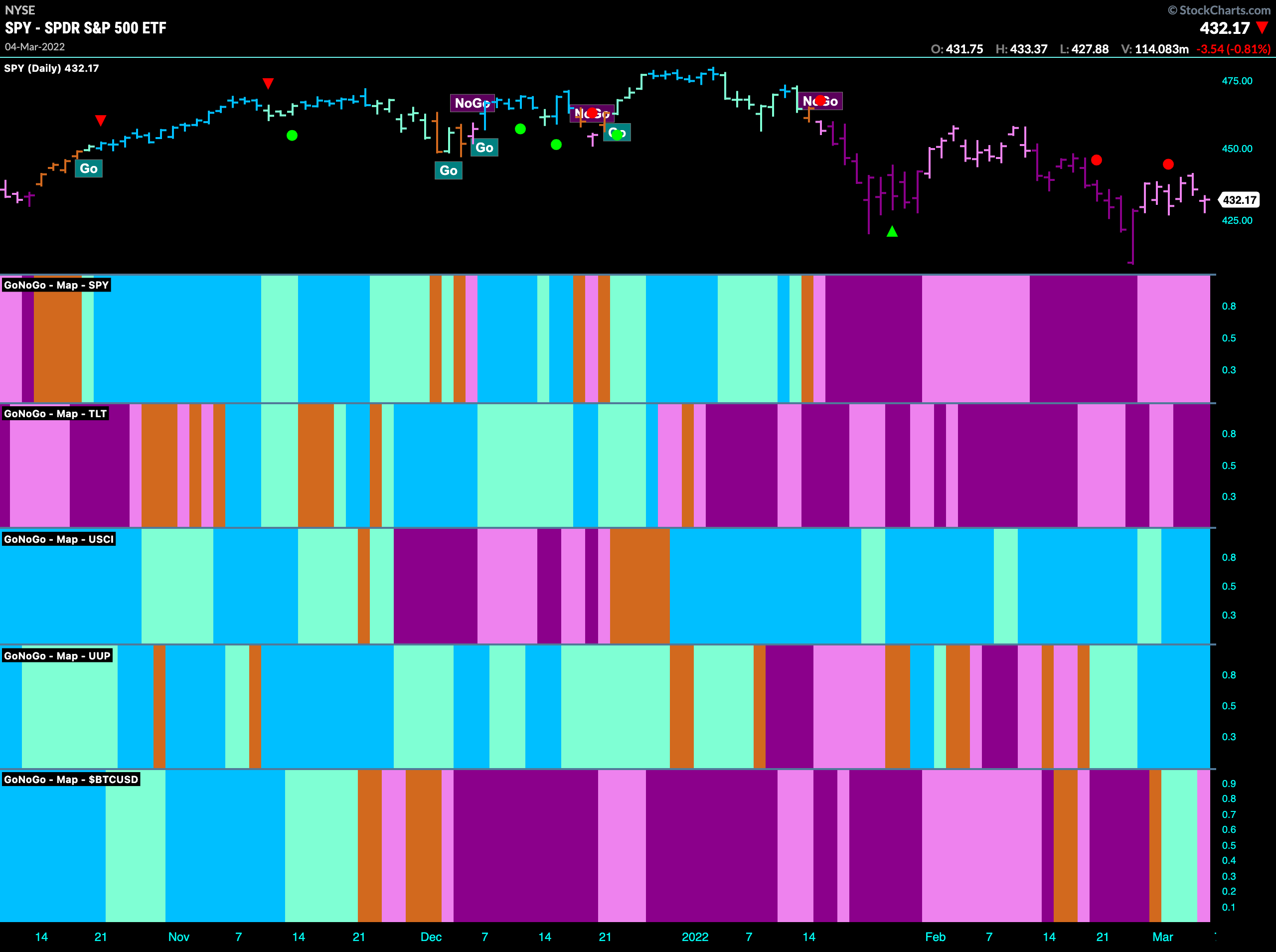

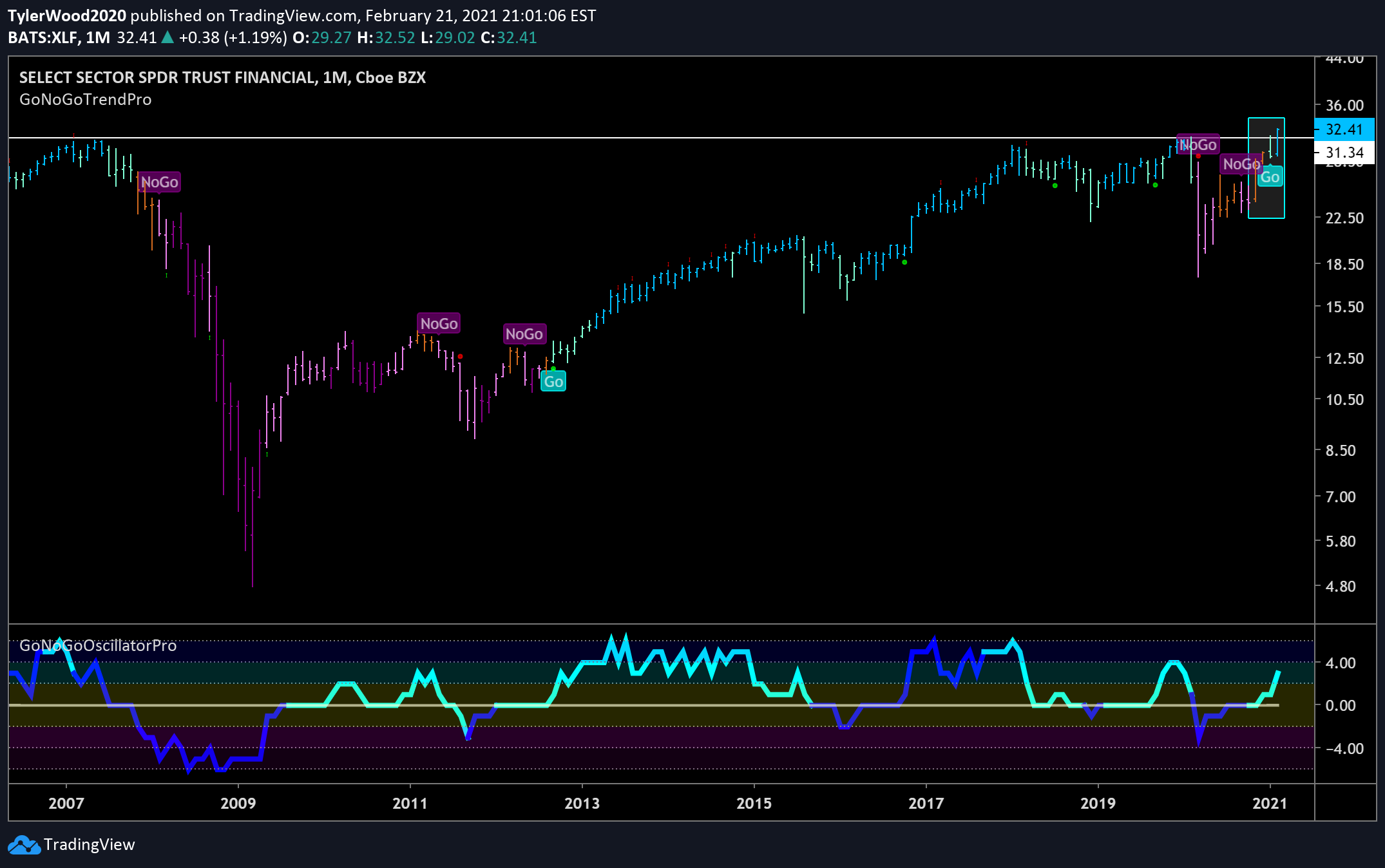

Feb 21, 2022

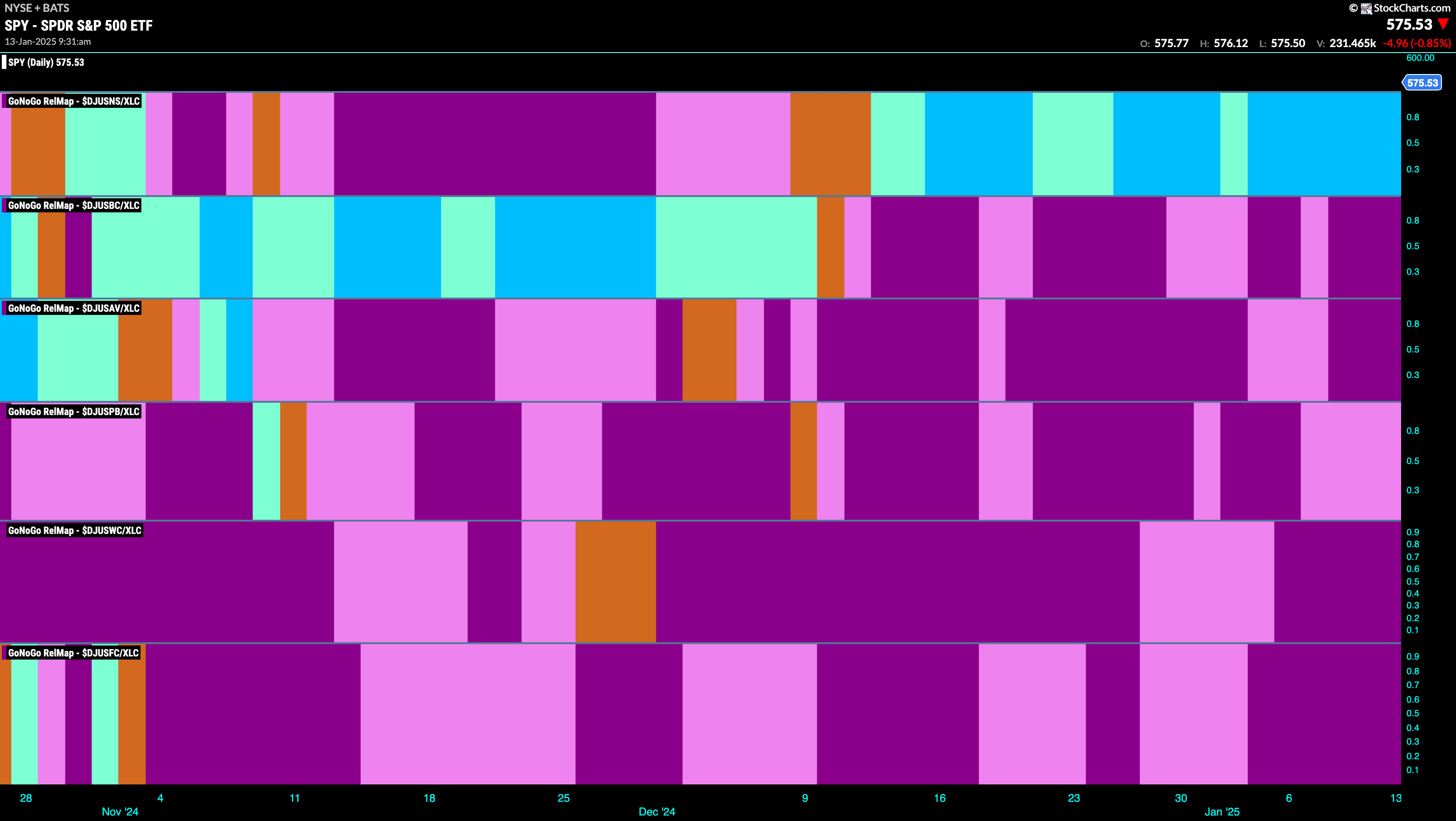

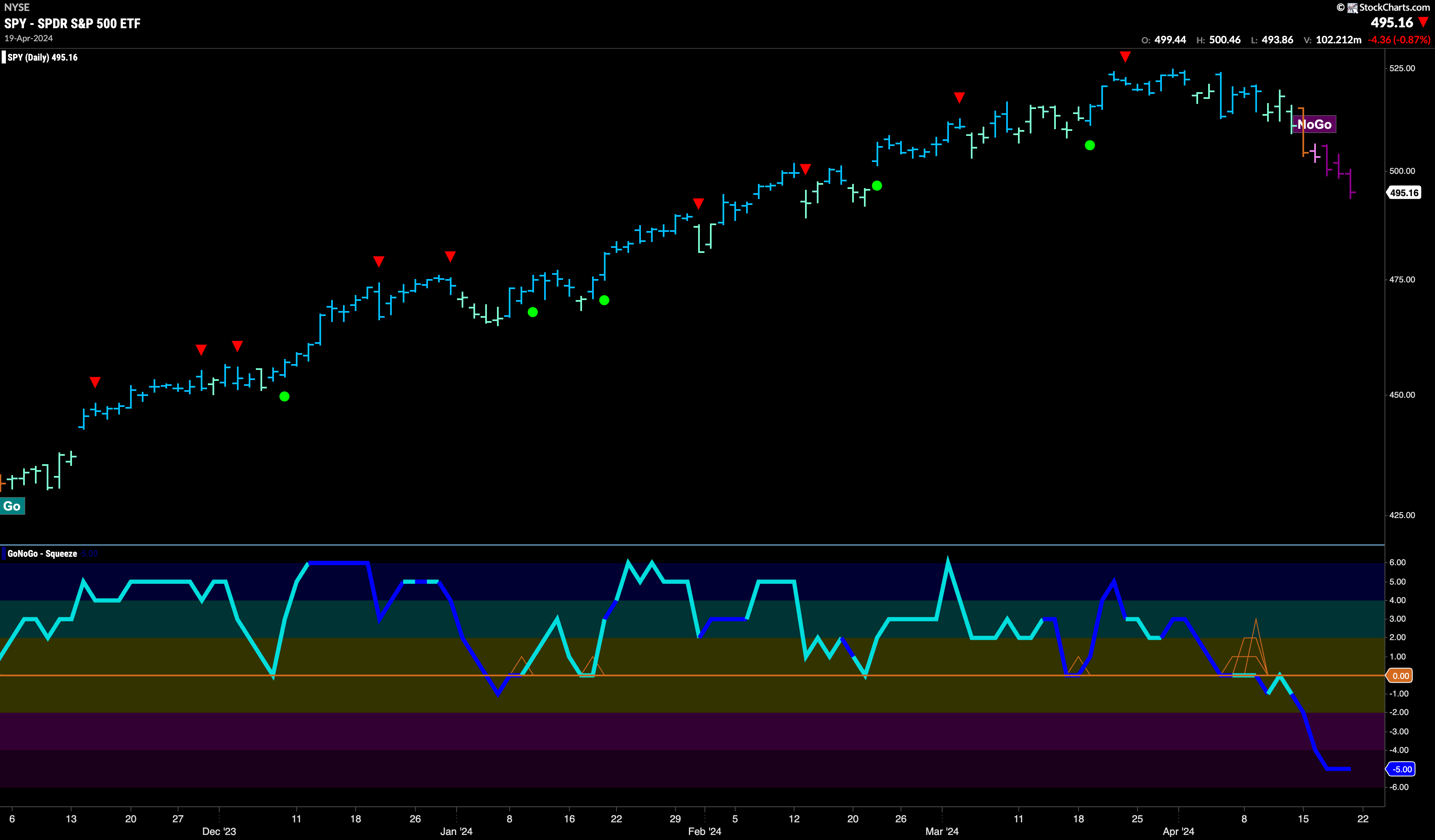

Fish Where the Fish Are

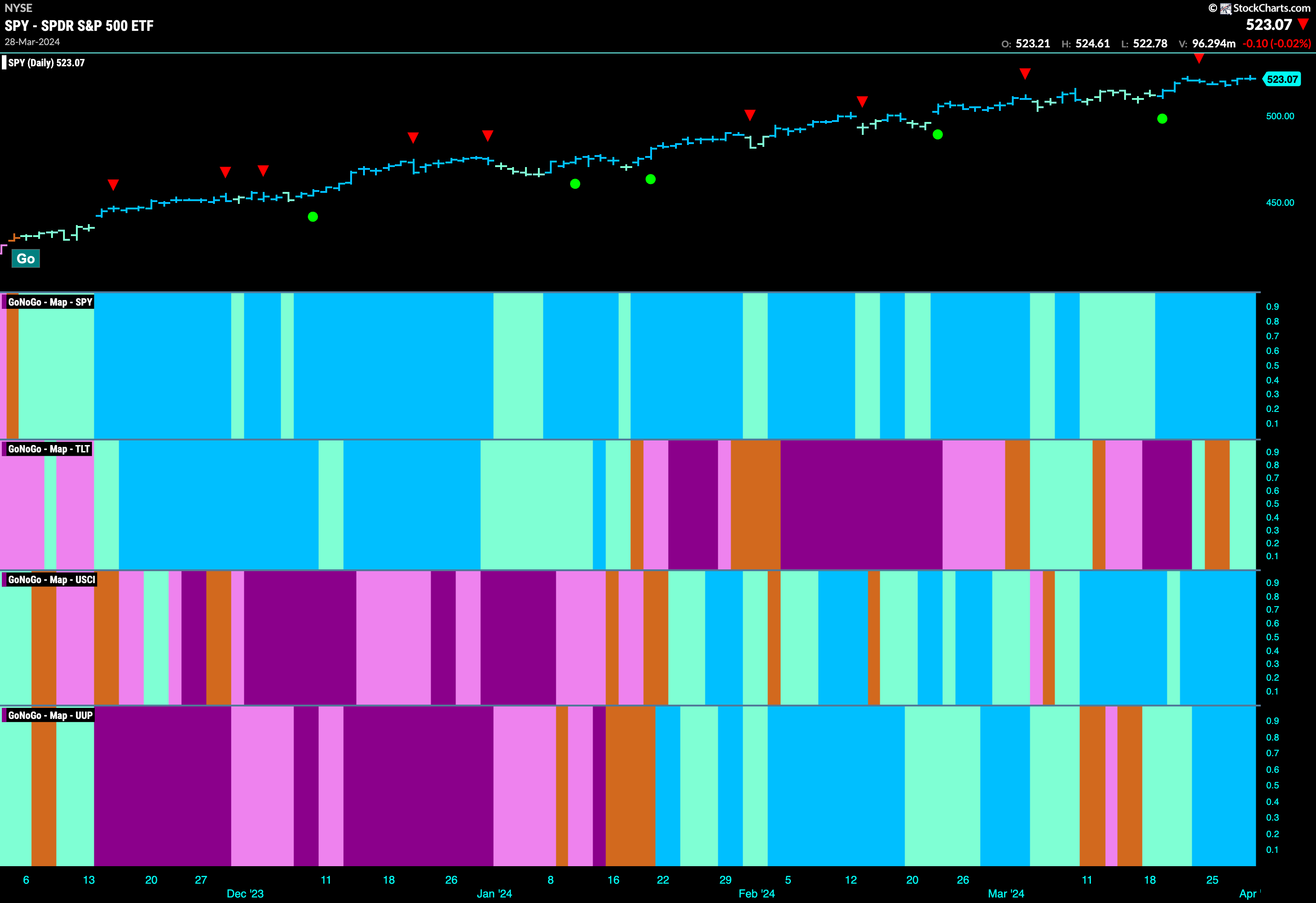

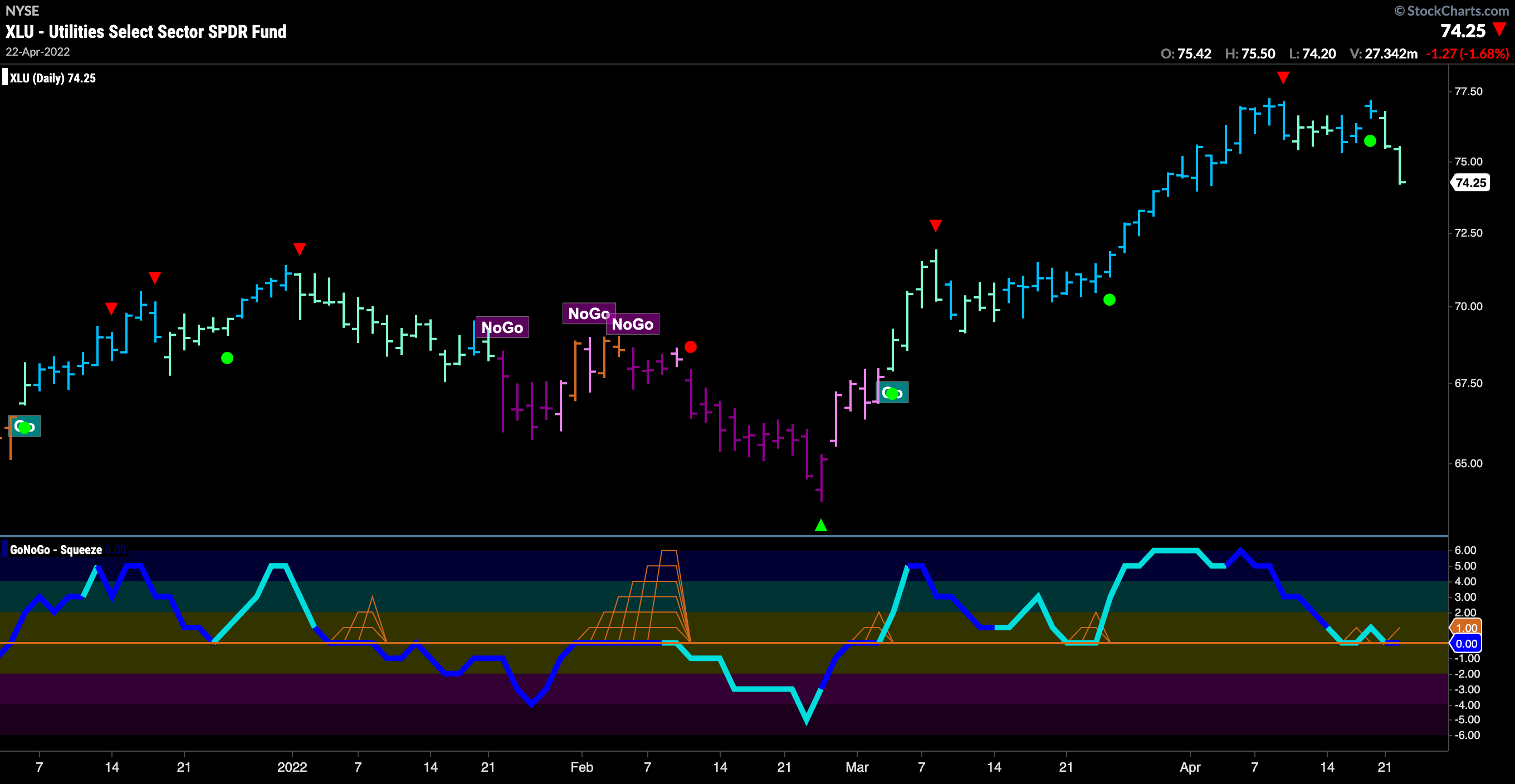

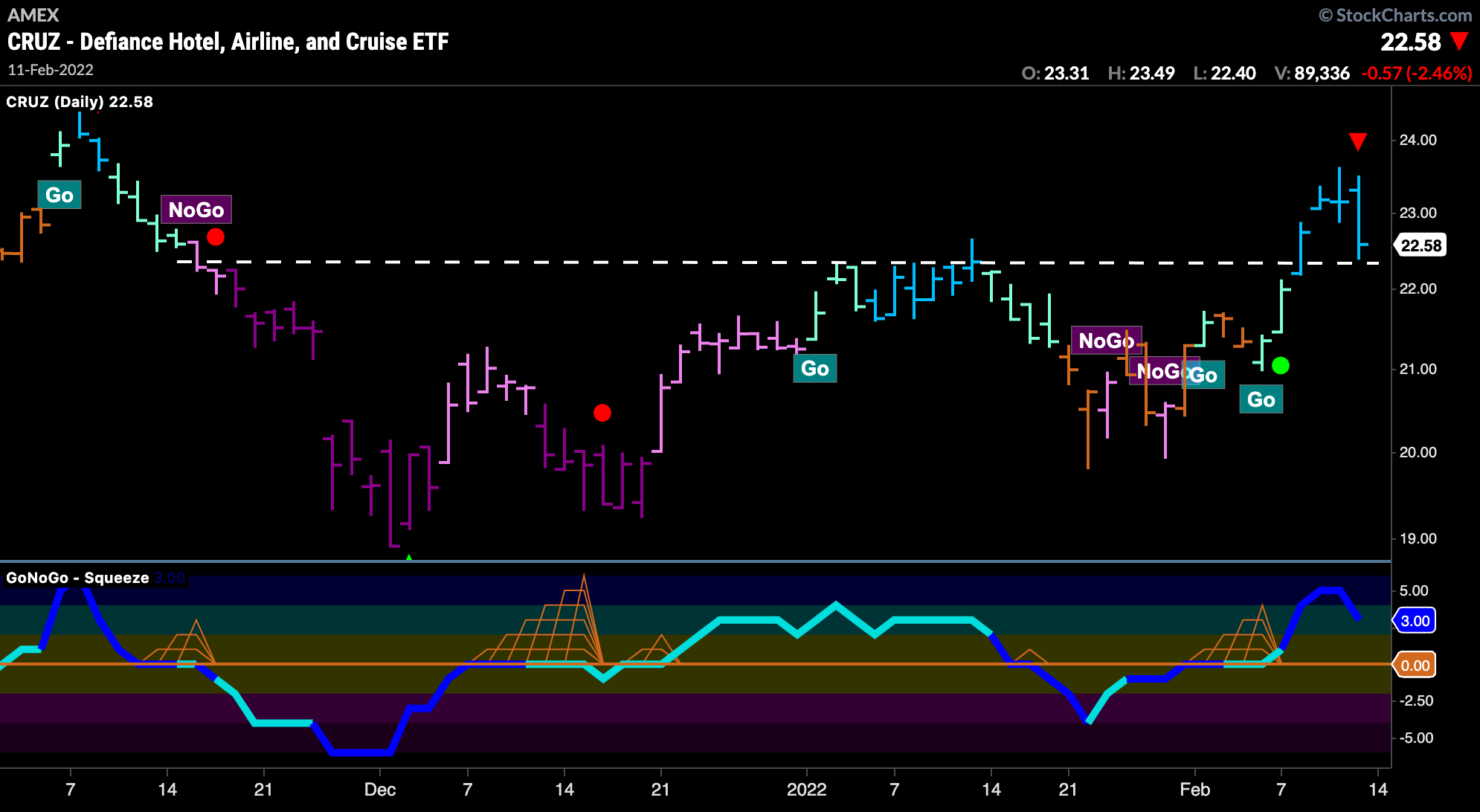

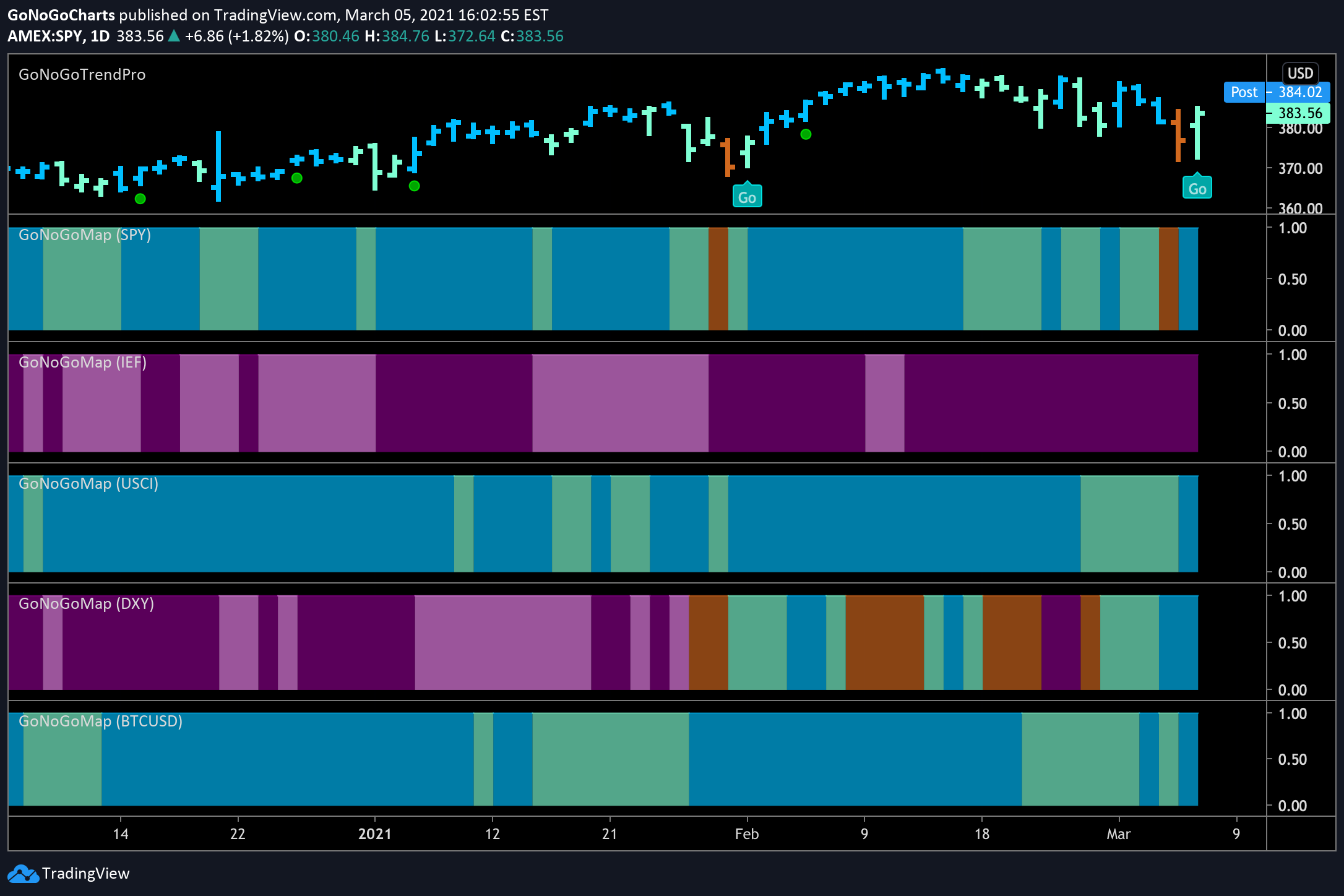

Jan 31, 2022

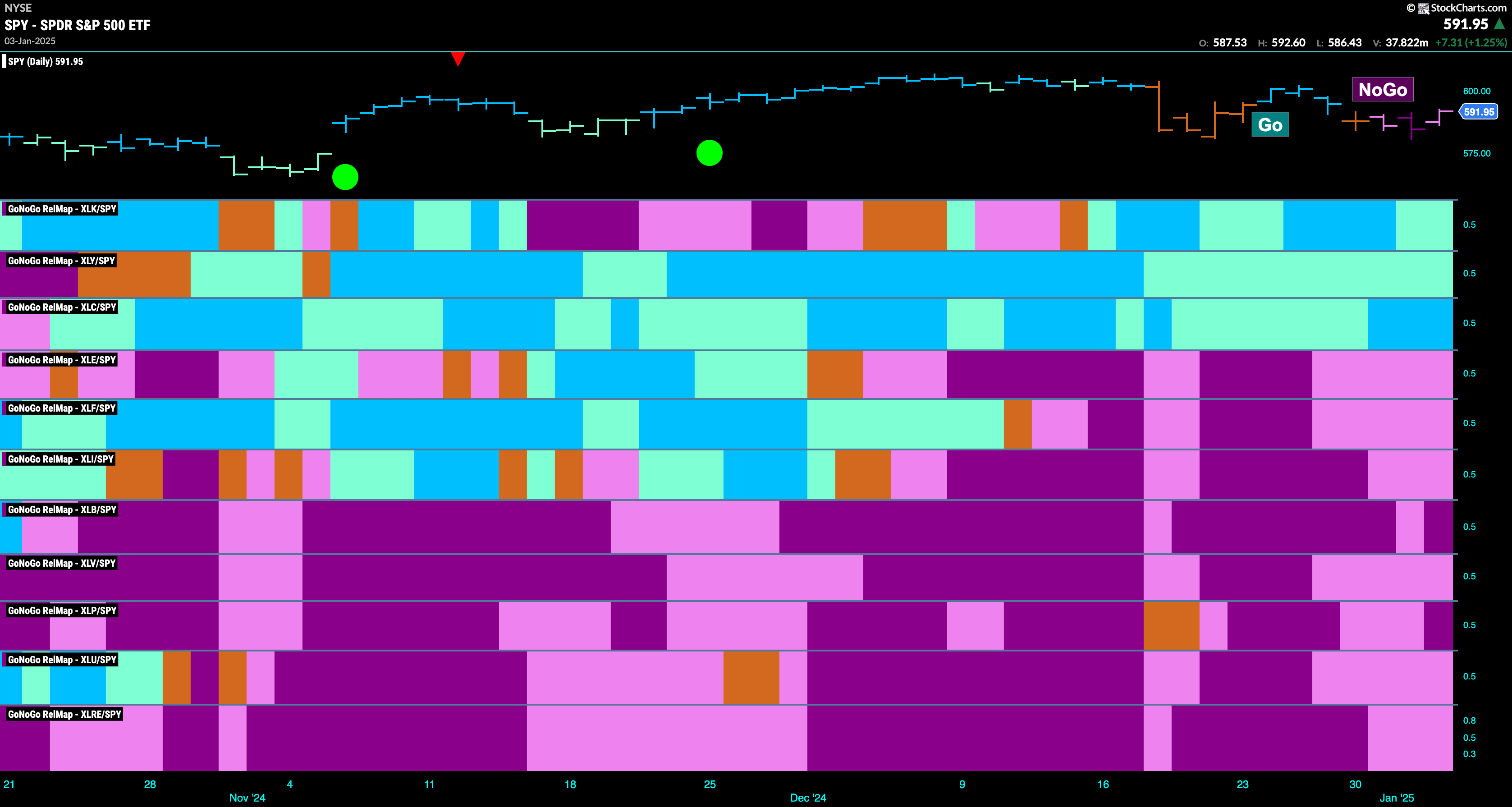

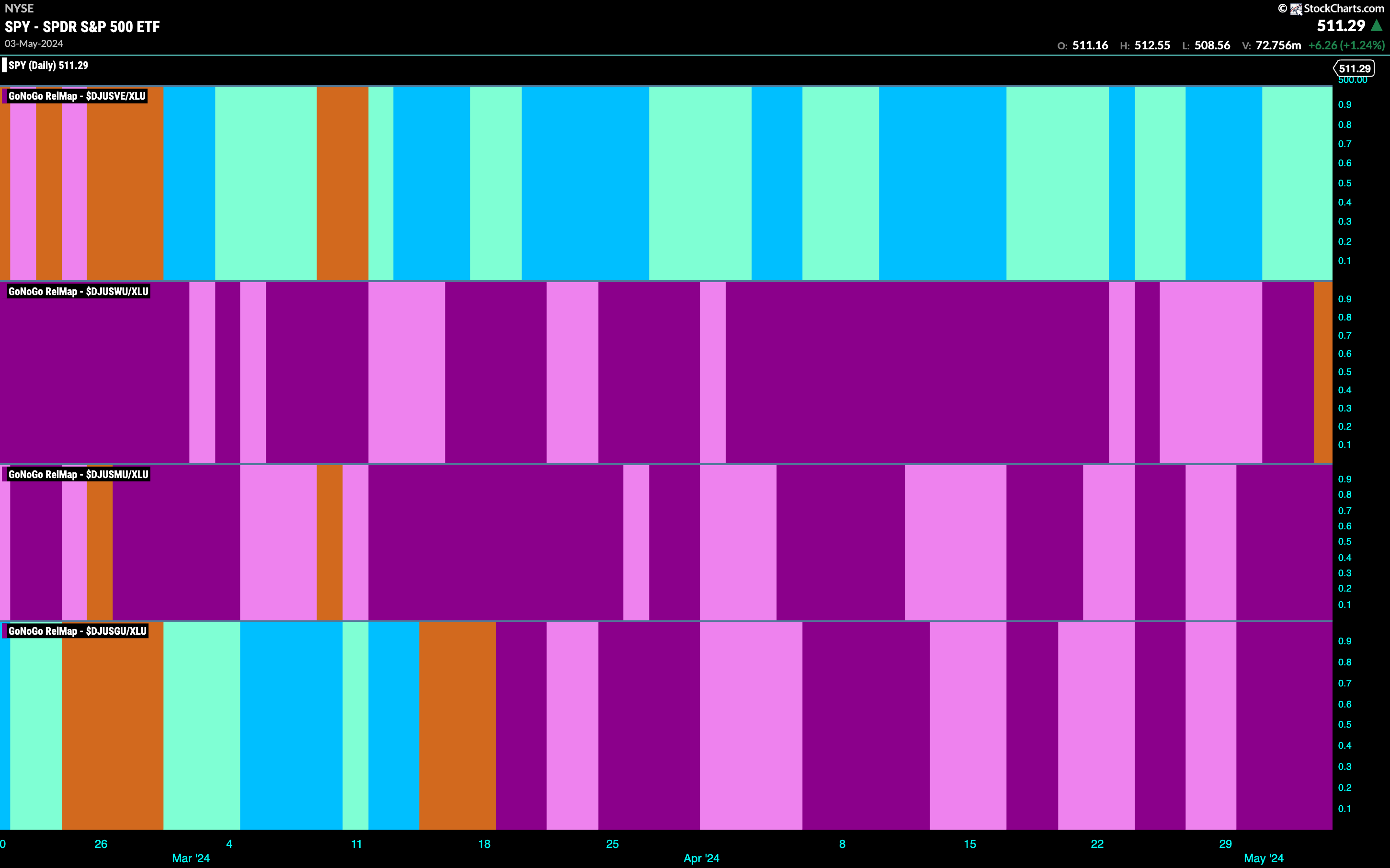

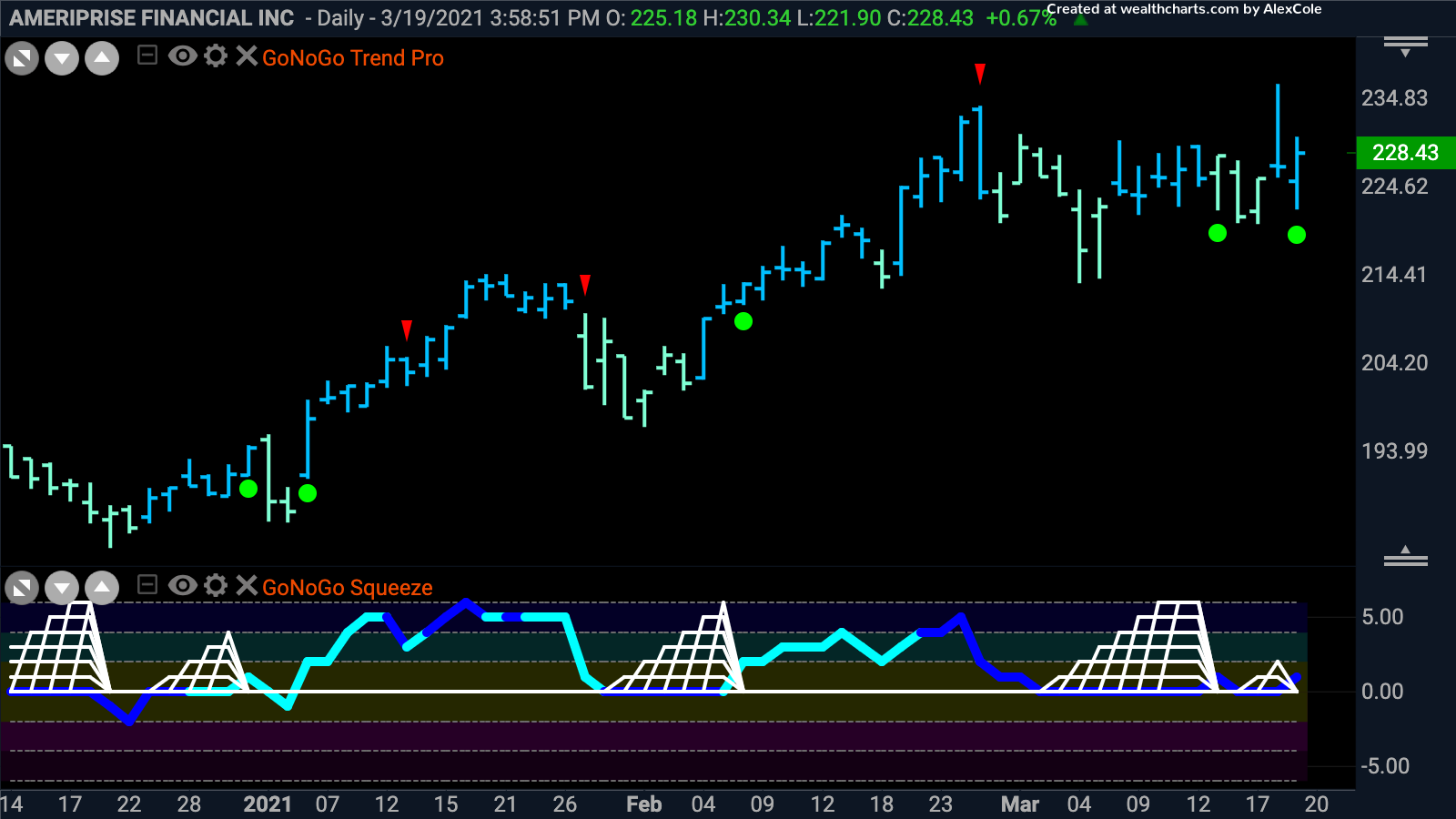

Flight to Quality

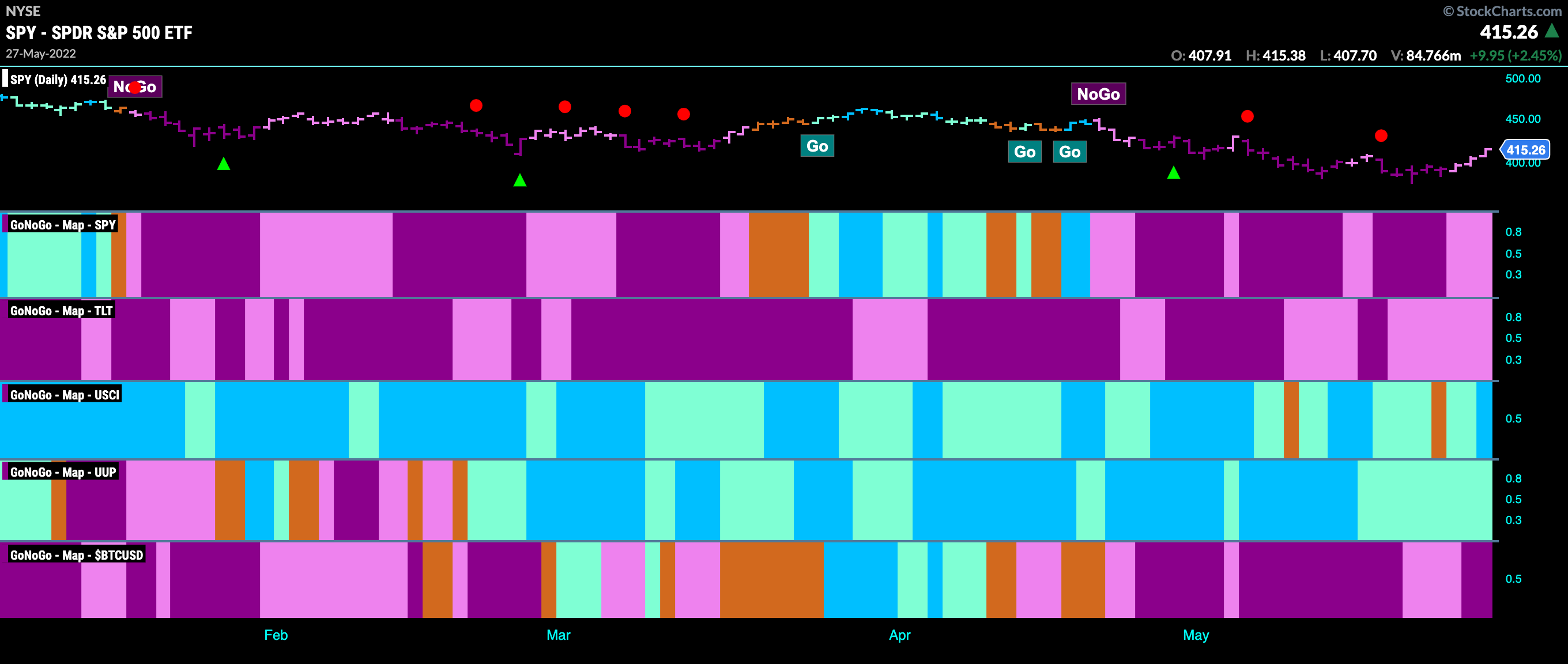

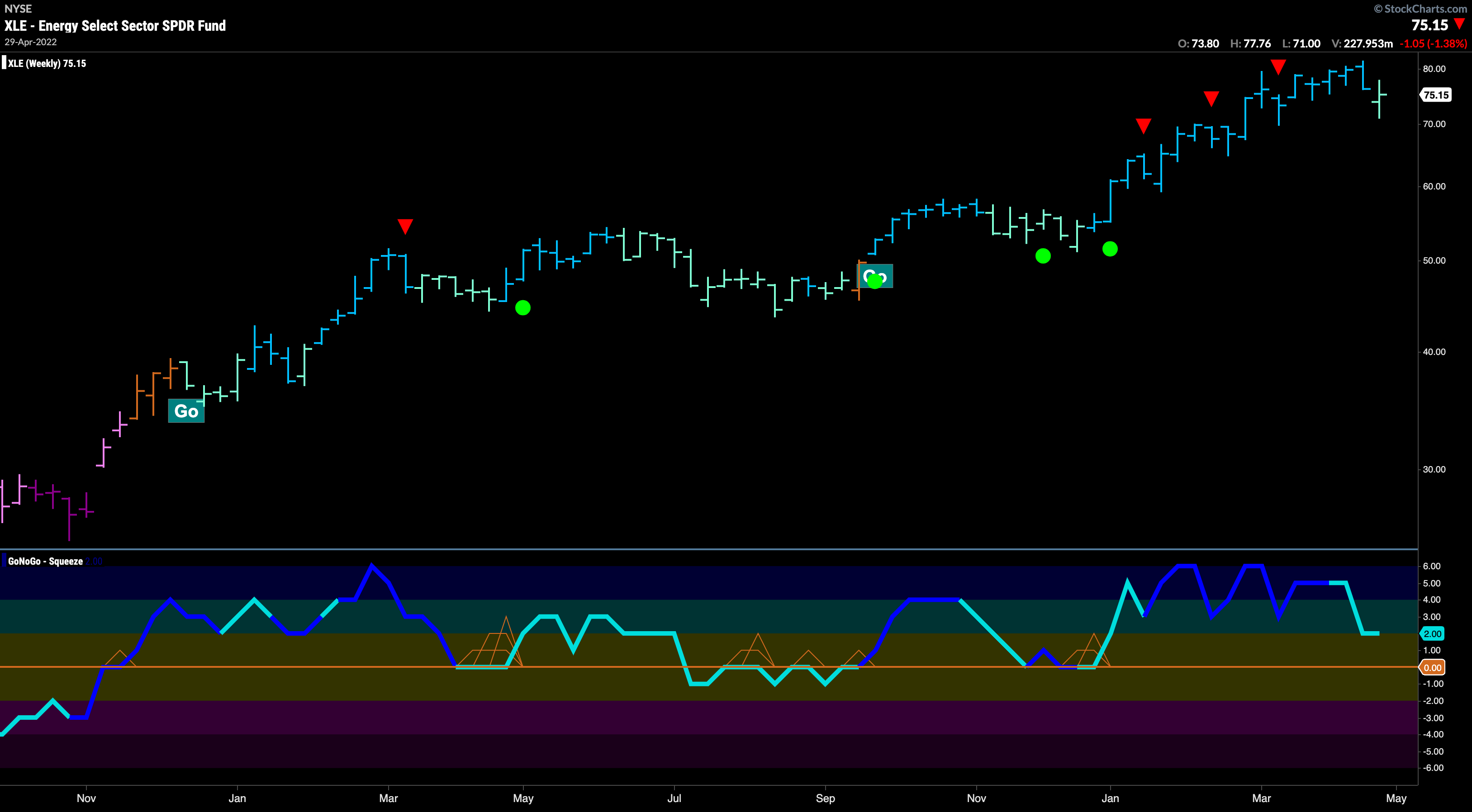

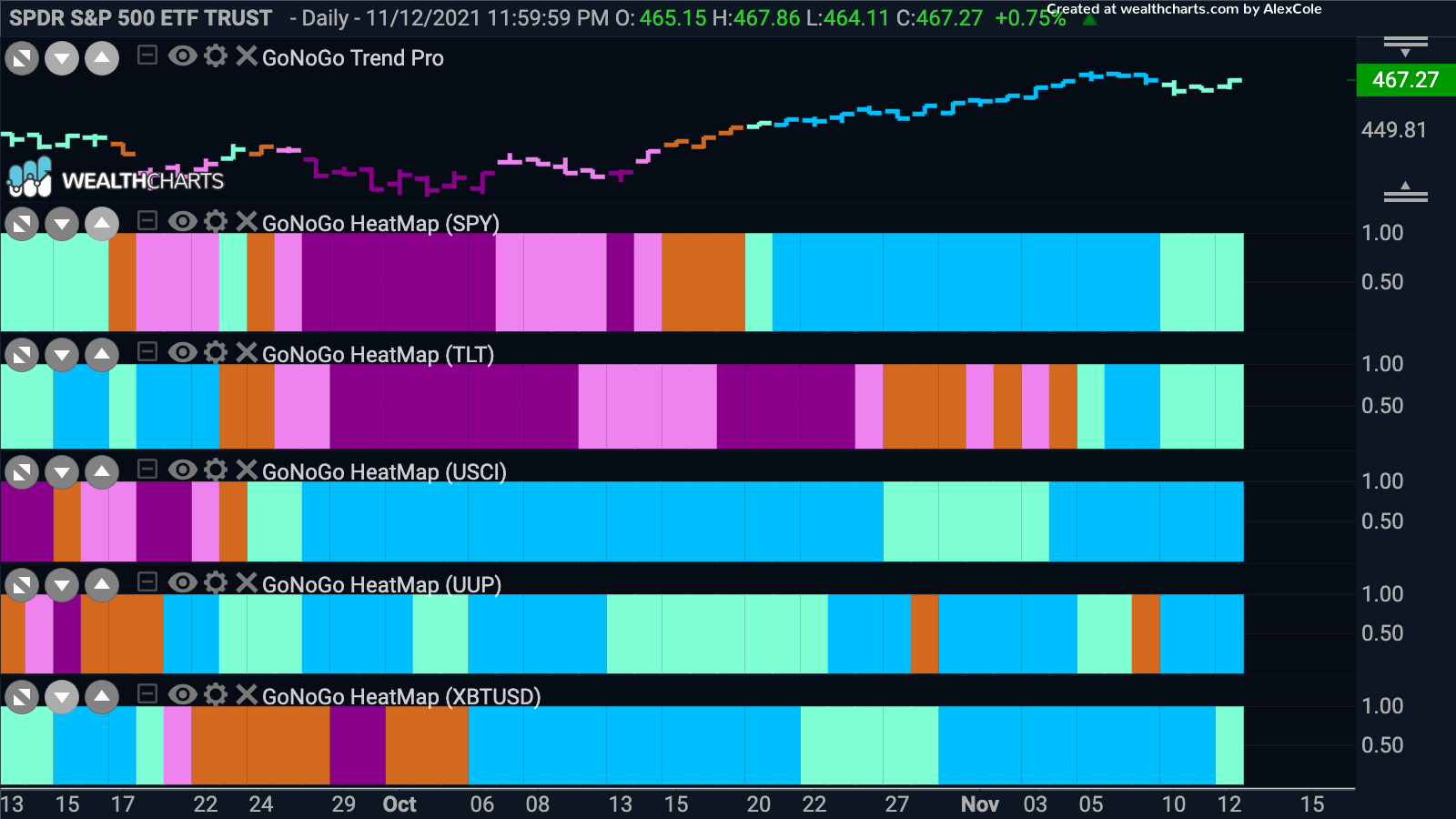

Oct 25, 2021

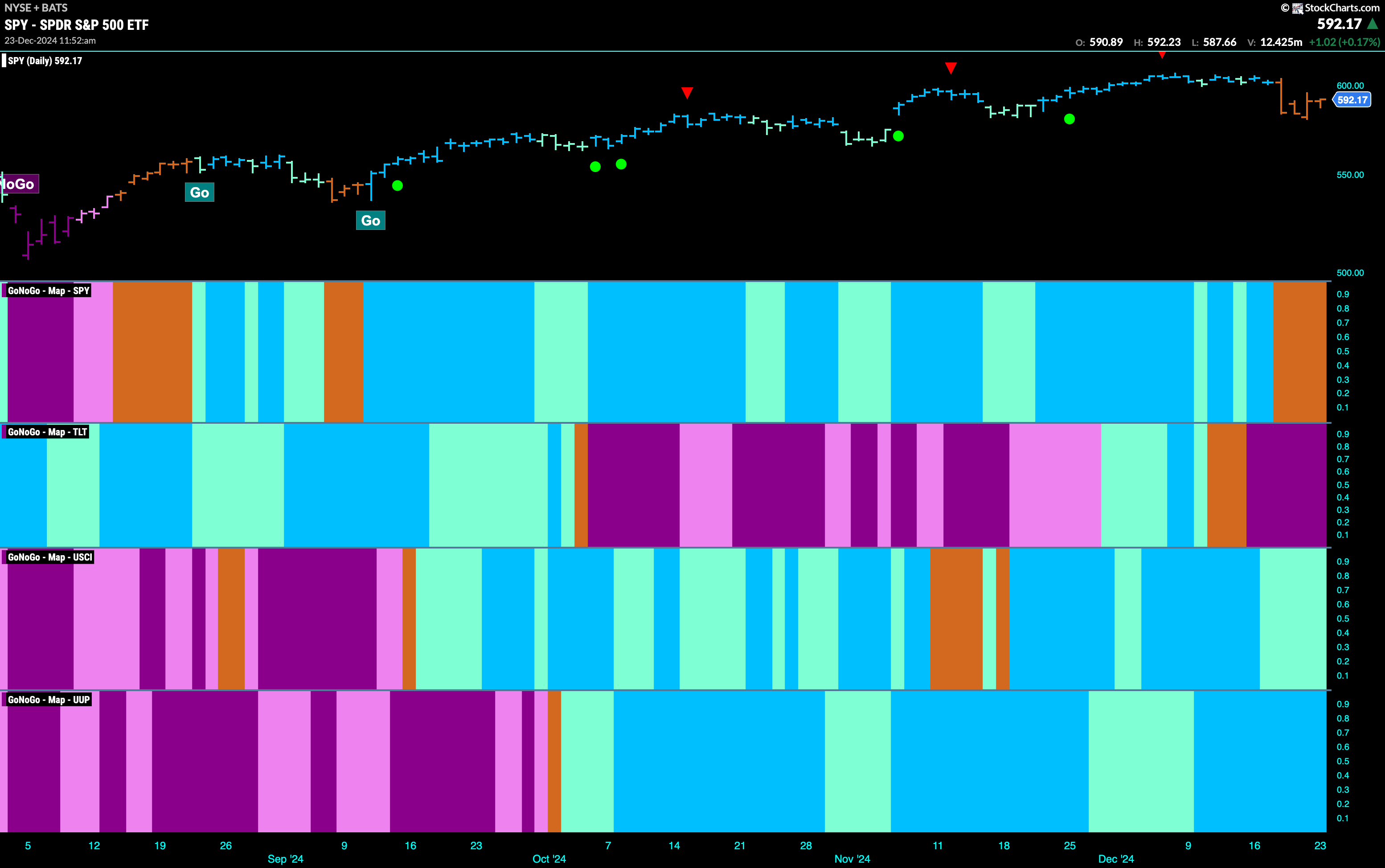

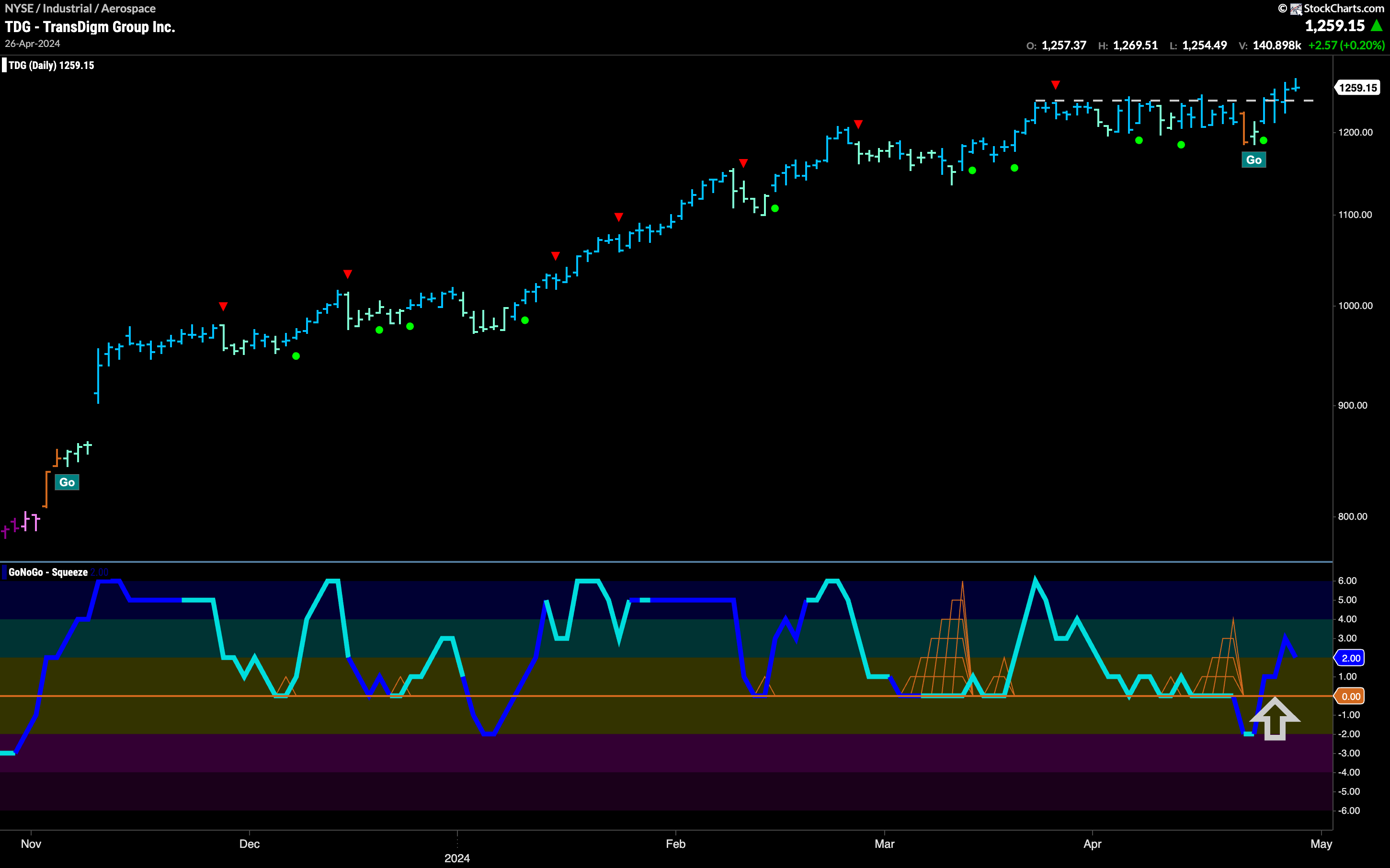

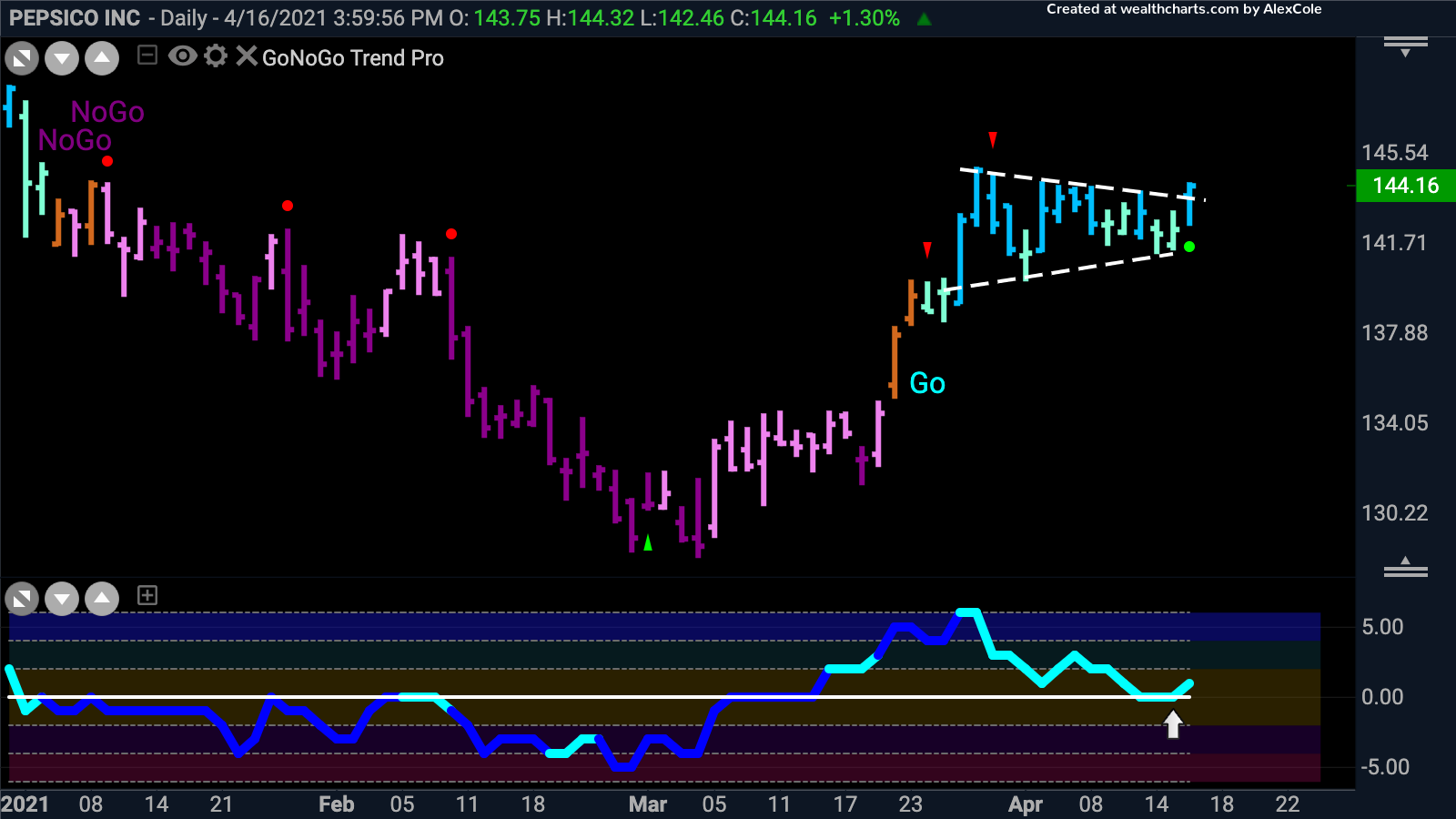

Trading Bonds for Equities

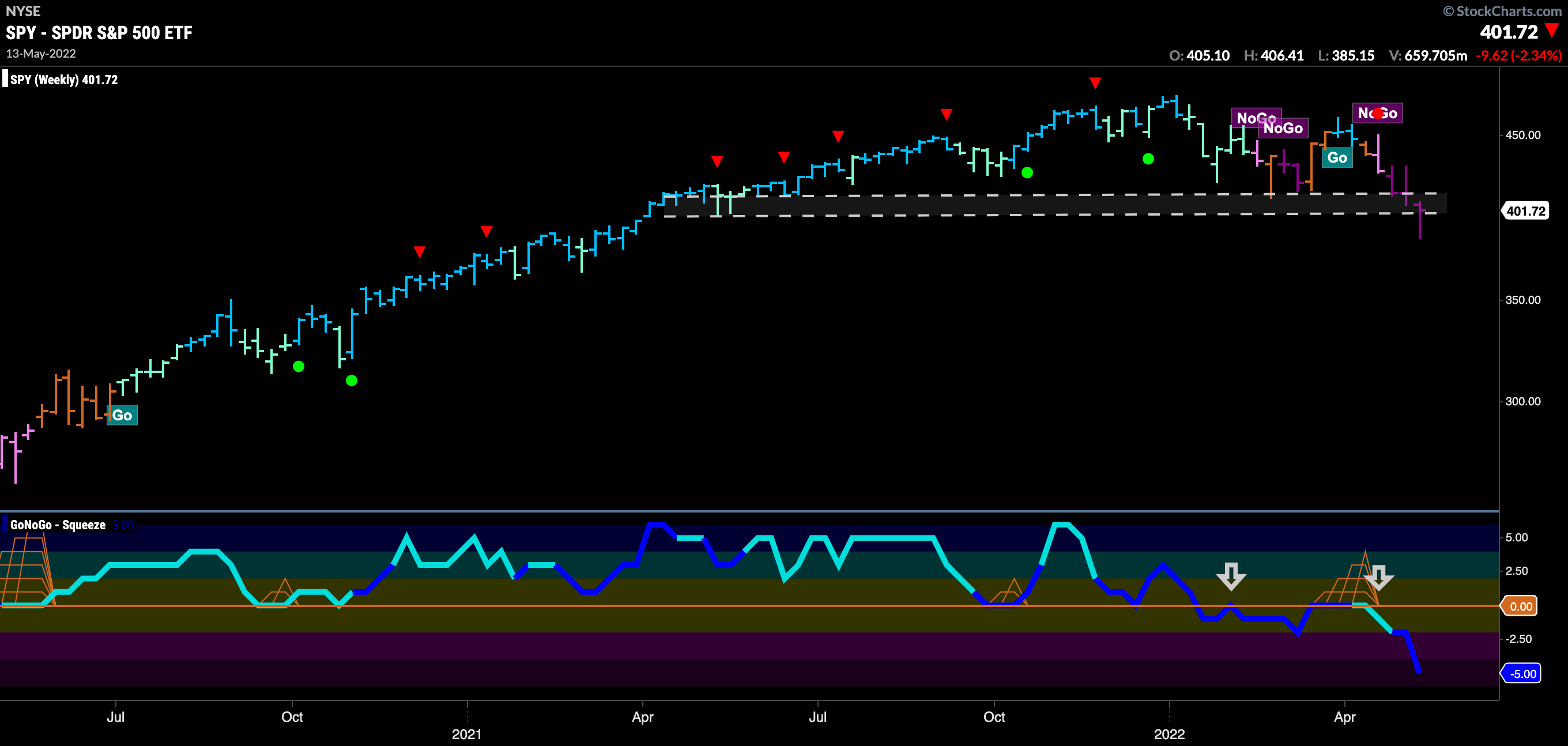

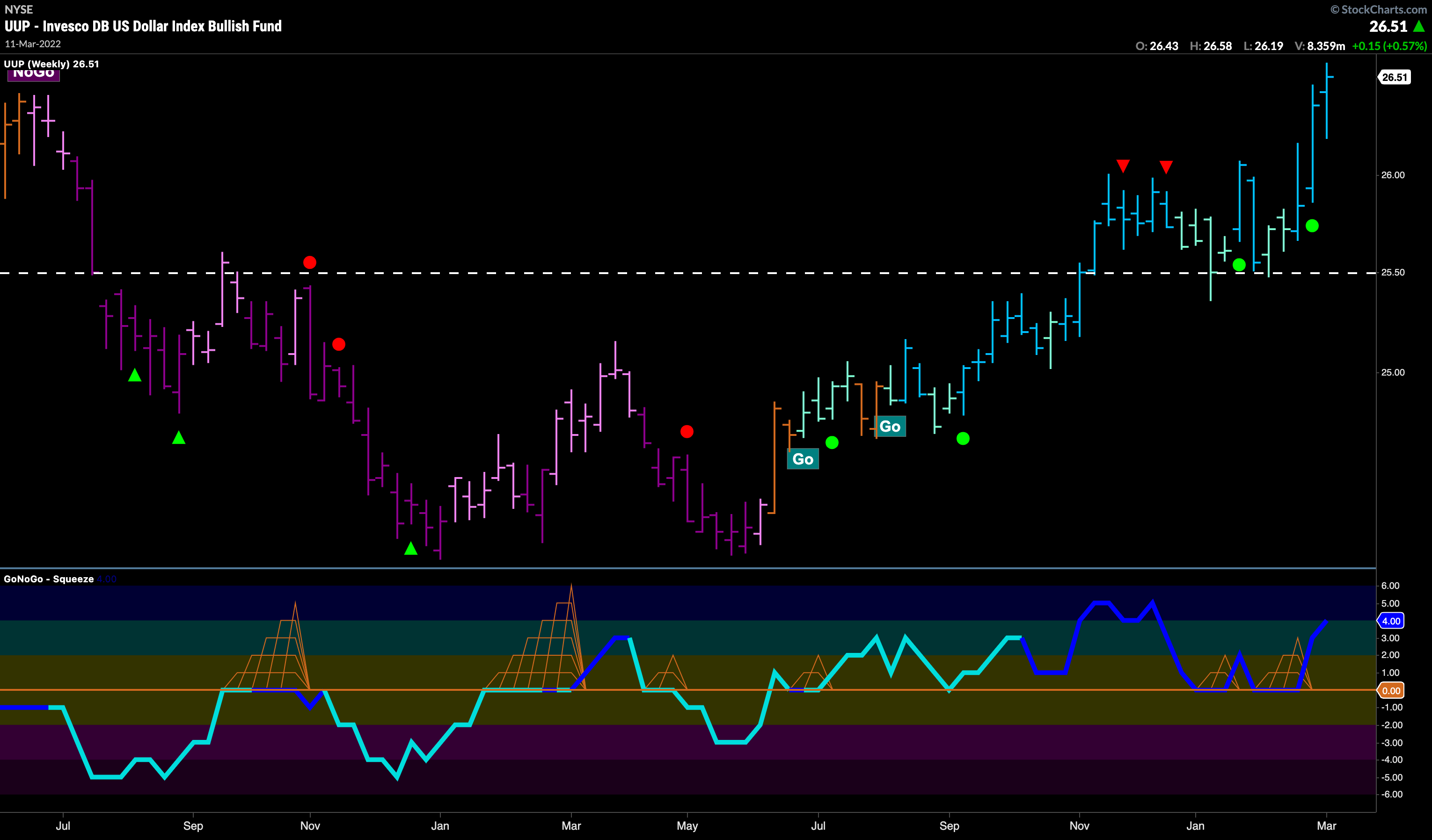

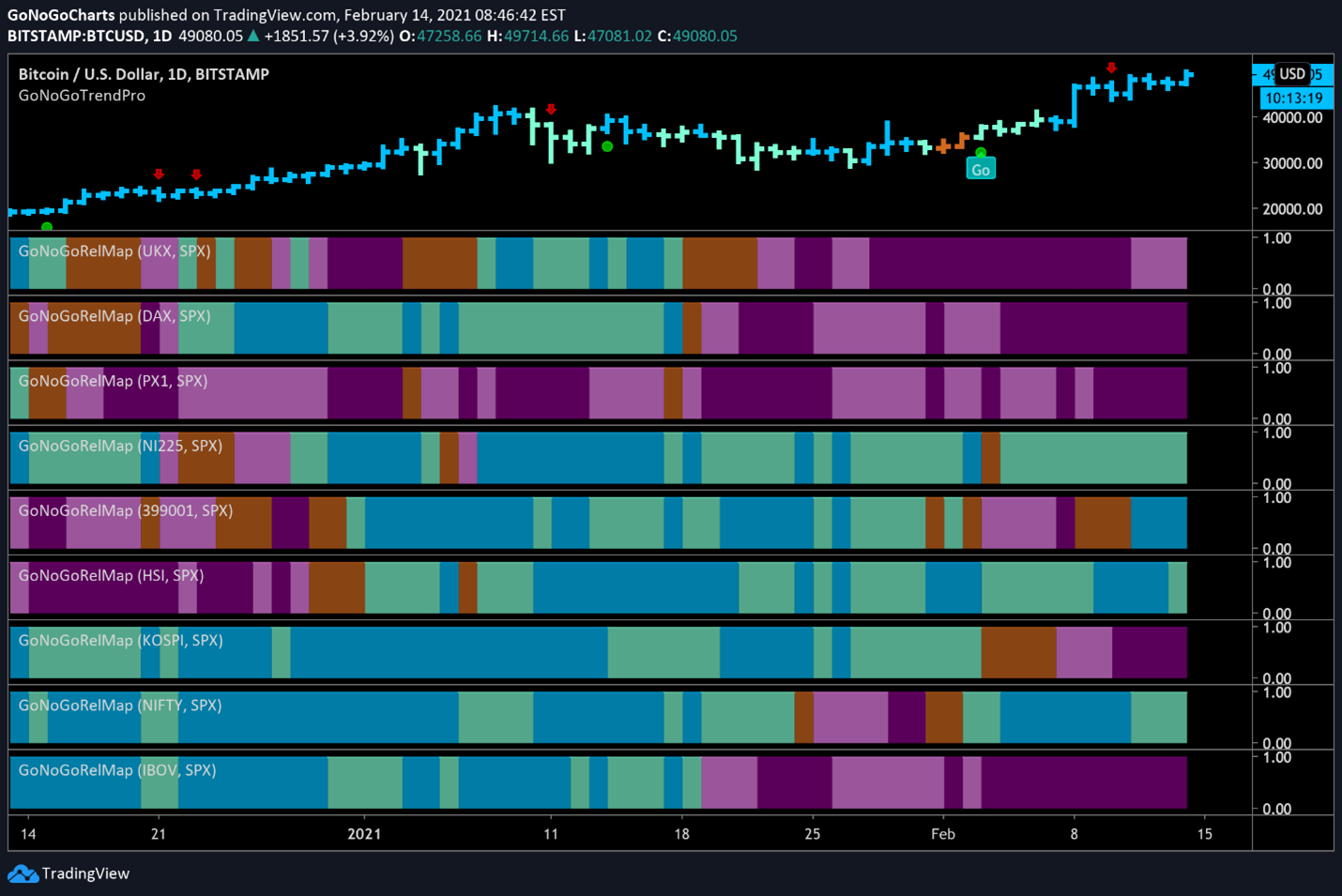

Aug 23, 2021

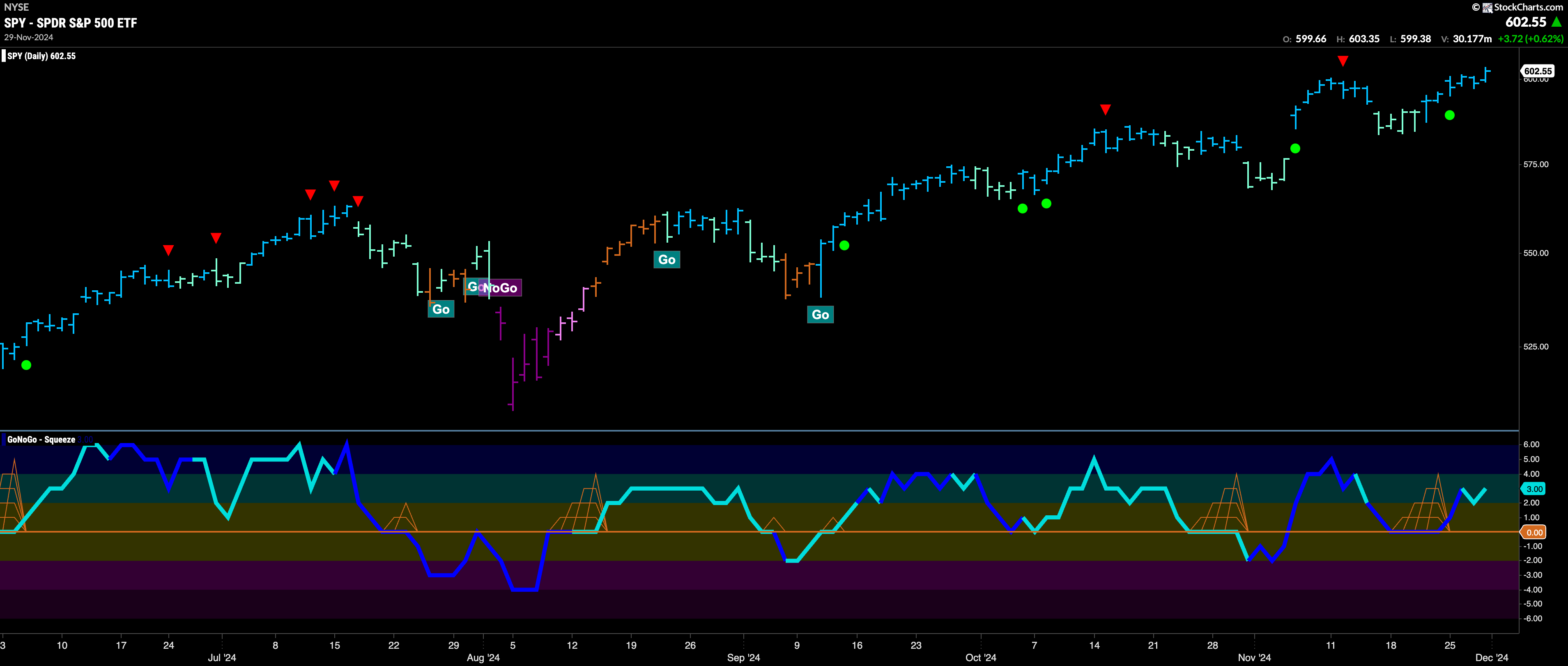

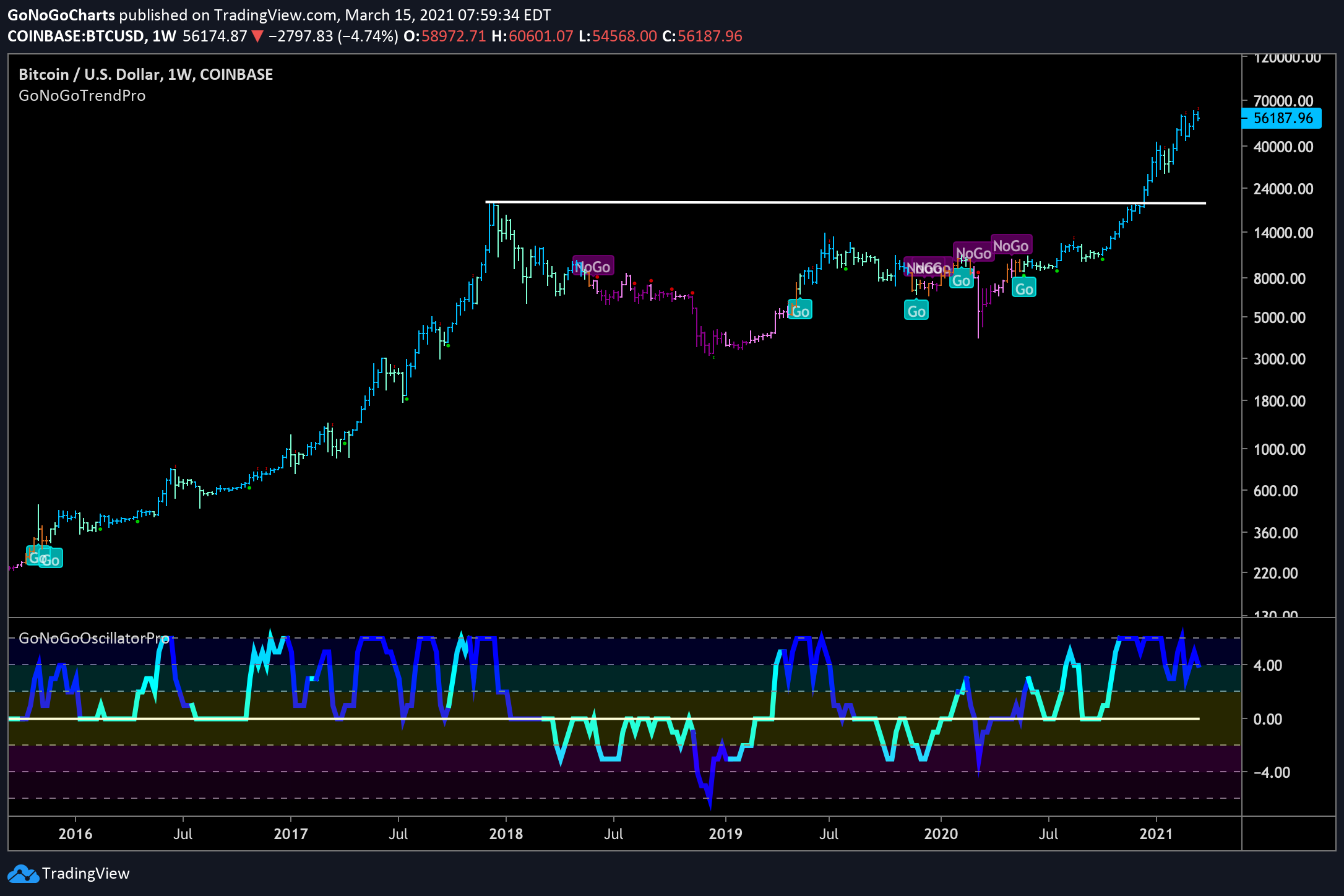

Bitcoin thrives, oil dives

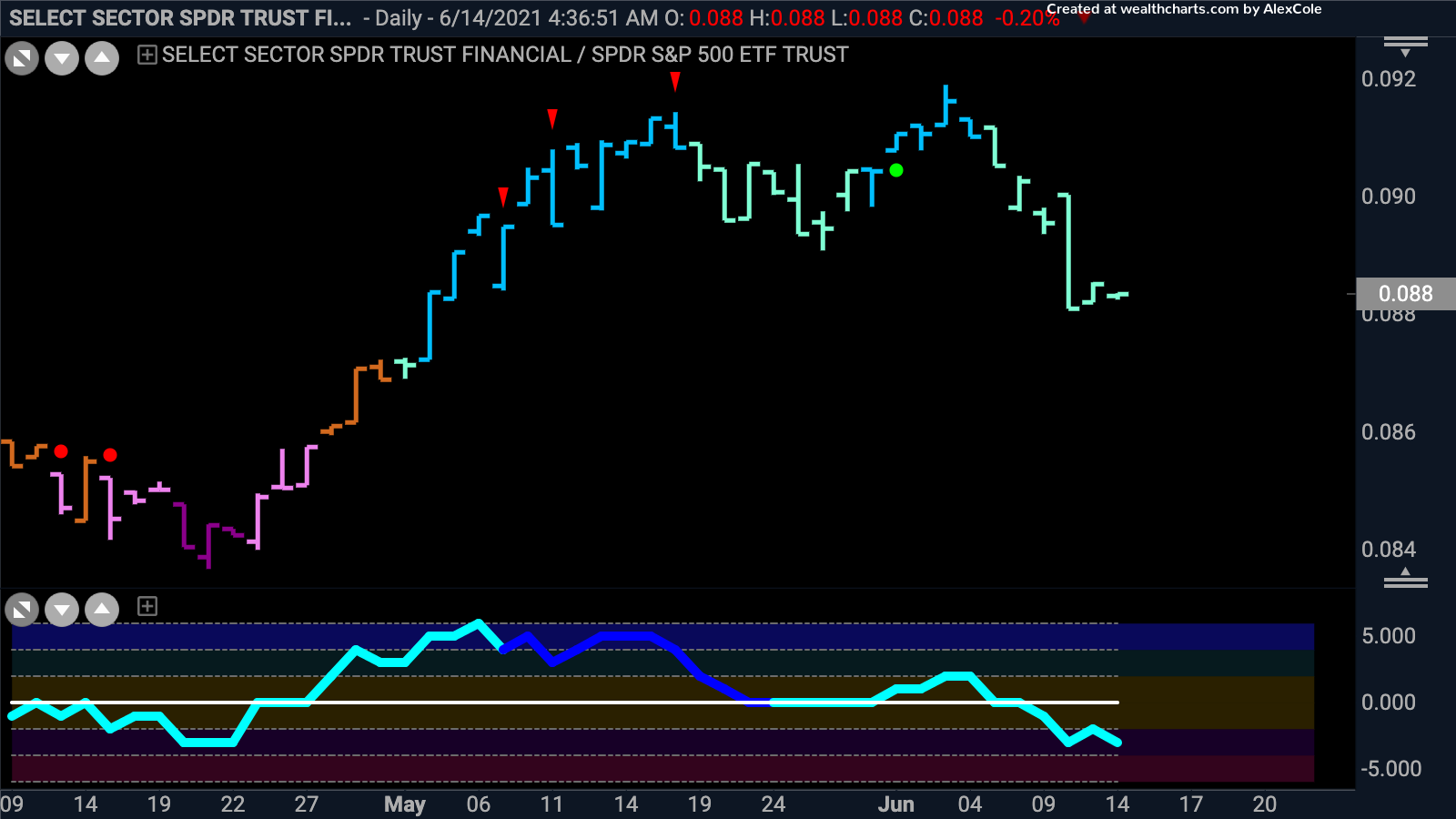

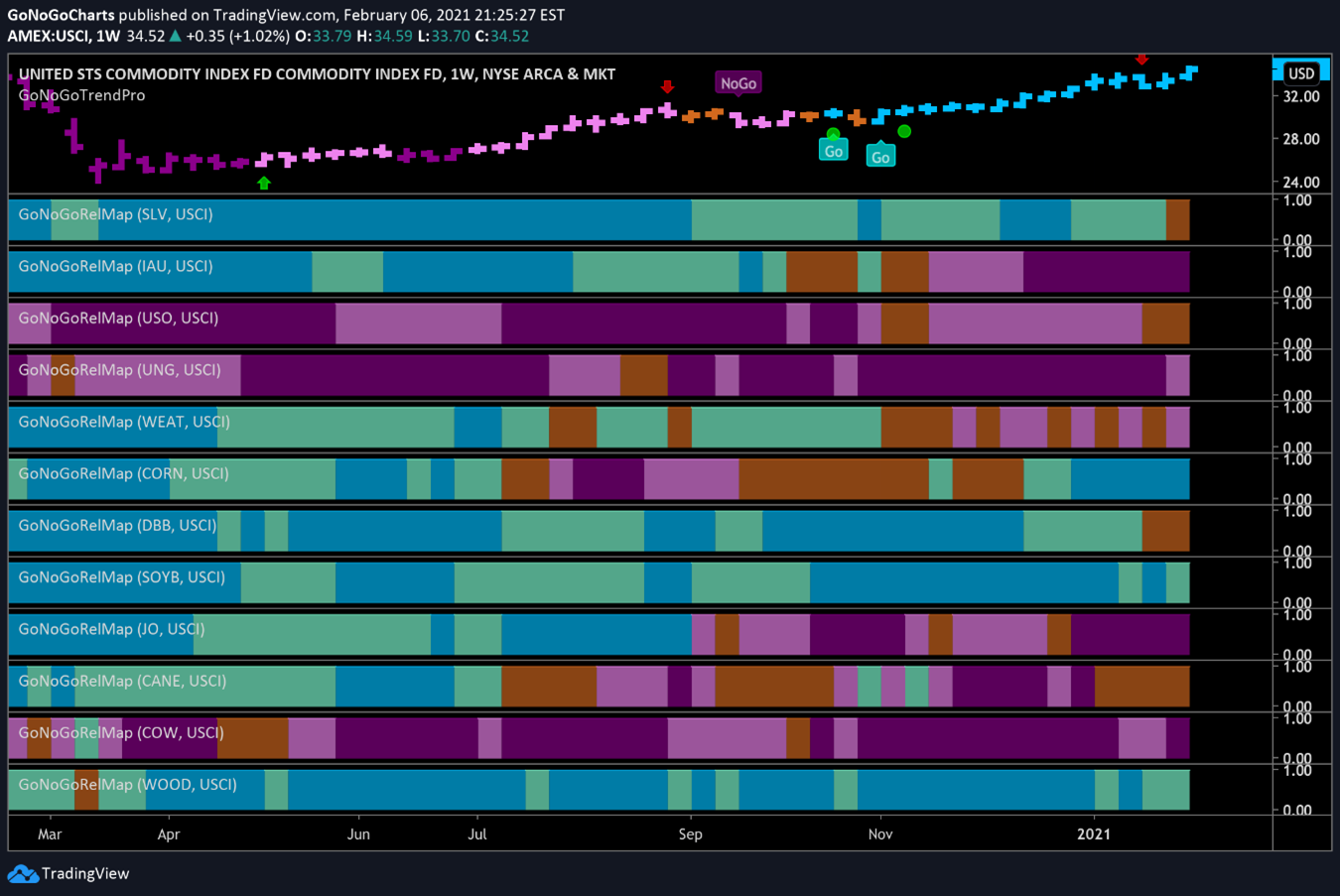

Jun 22, 2021

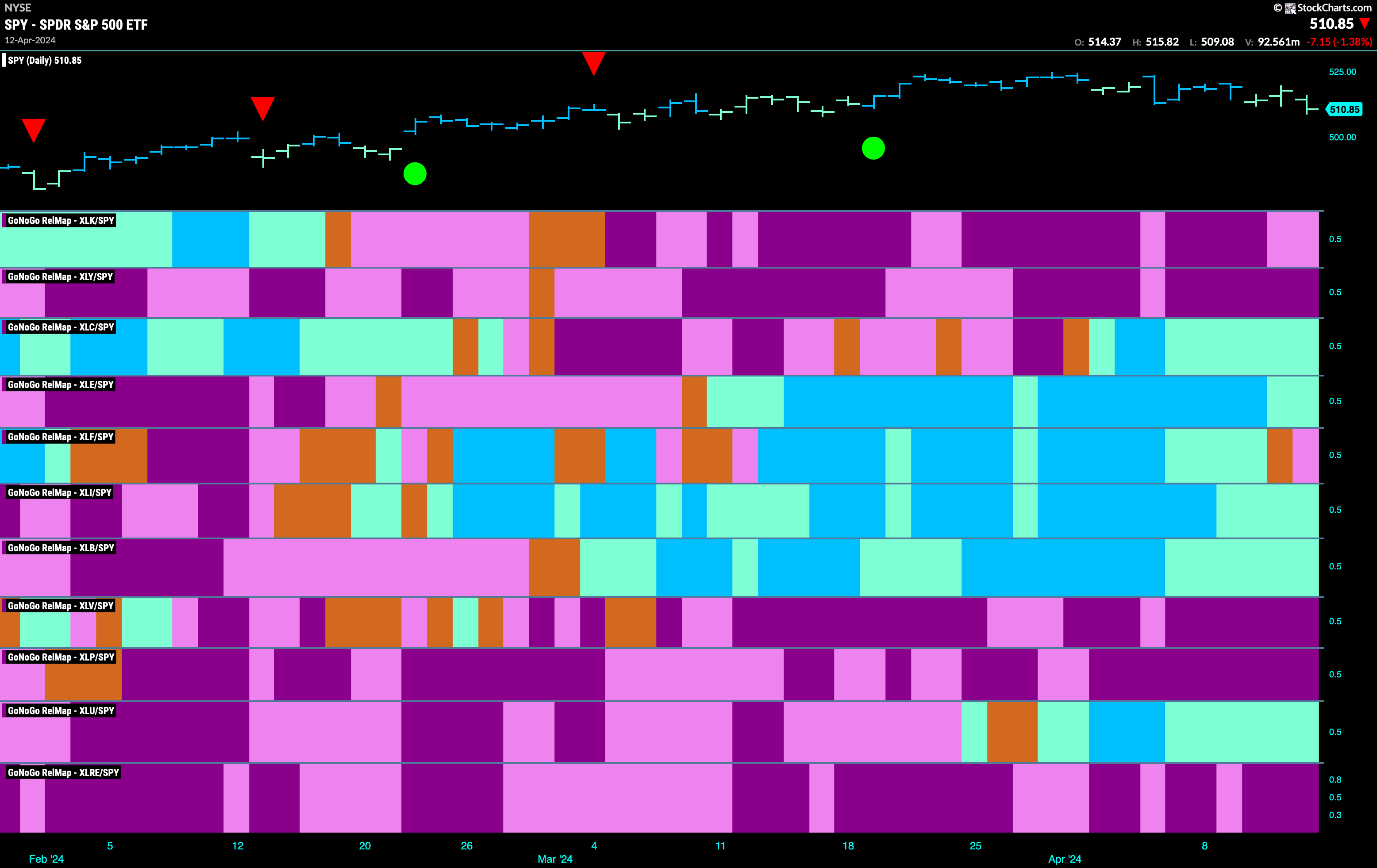

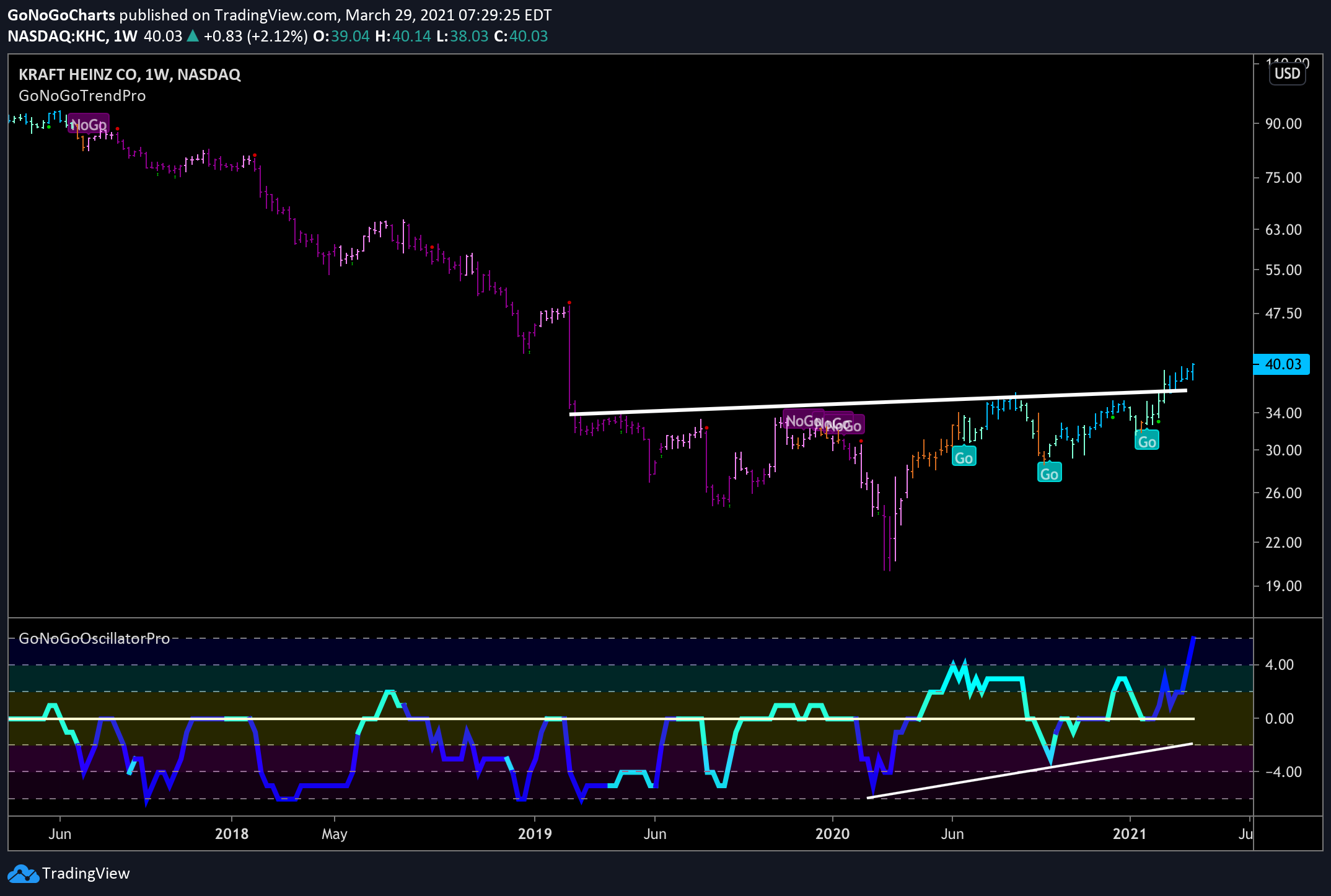

Growth Resumes Go Trend

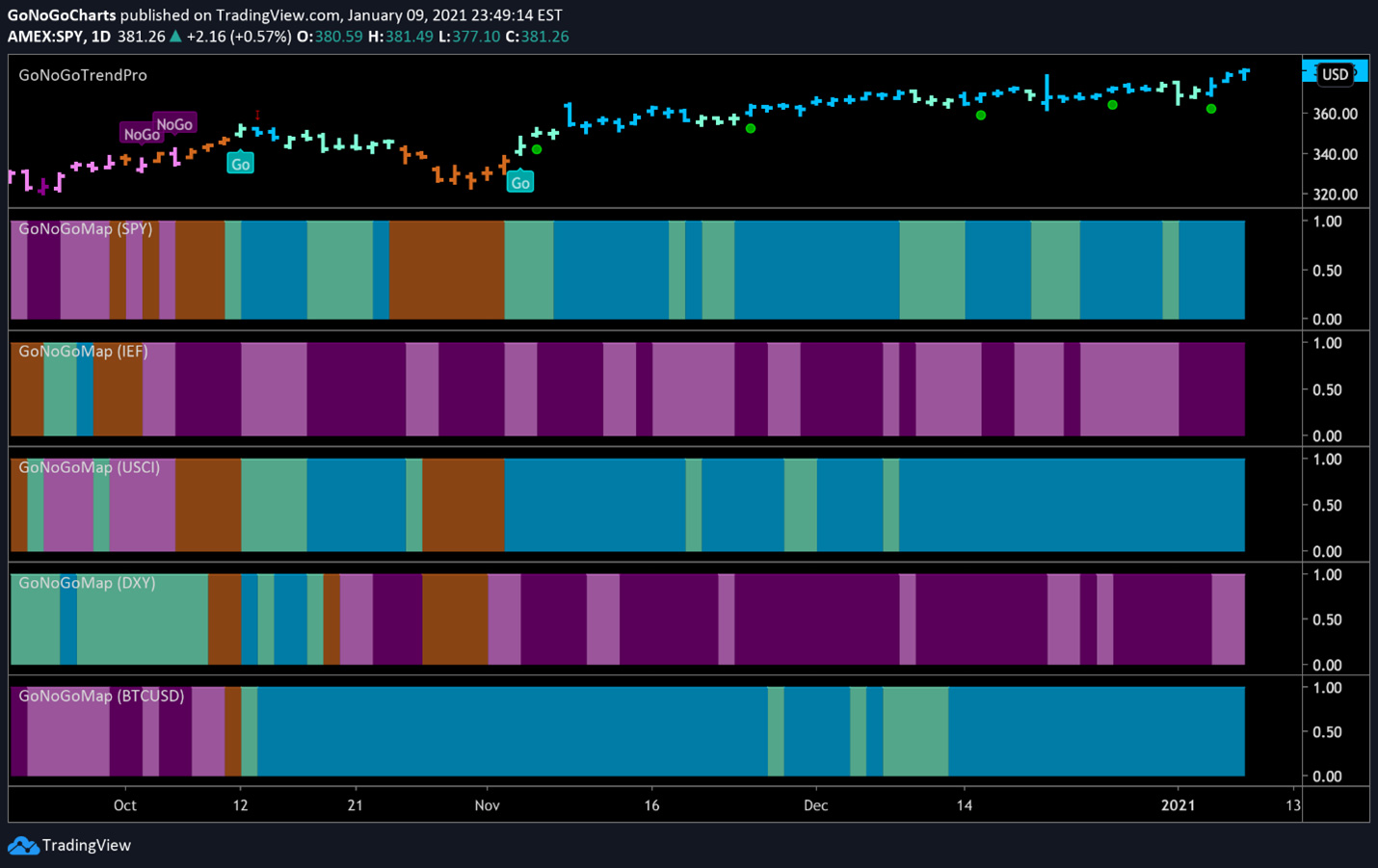

Jan 4, 2021