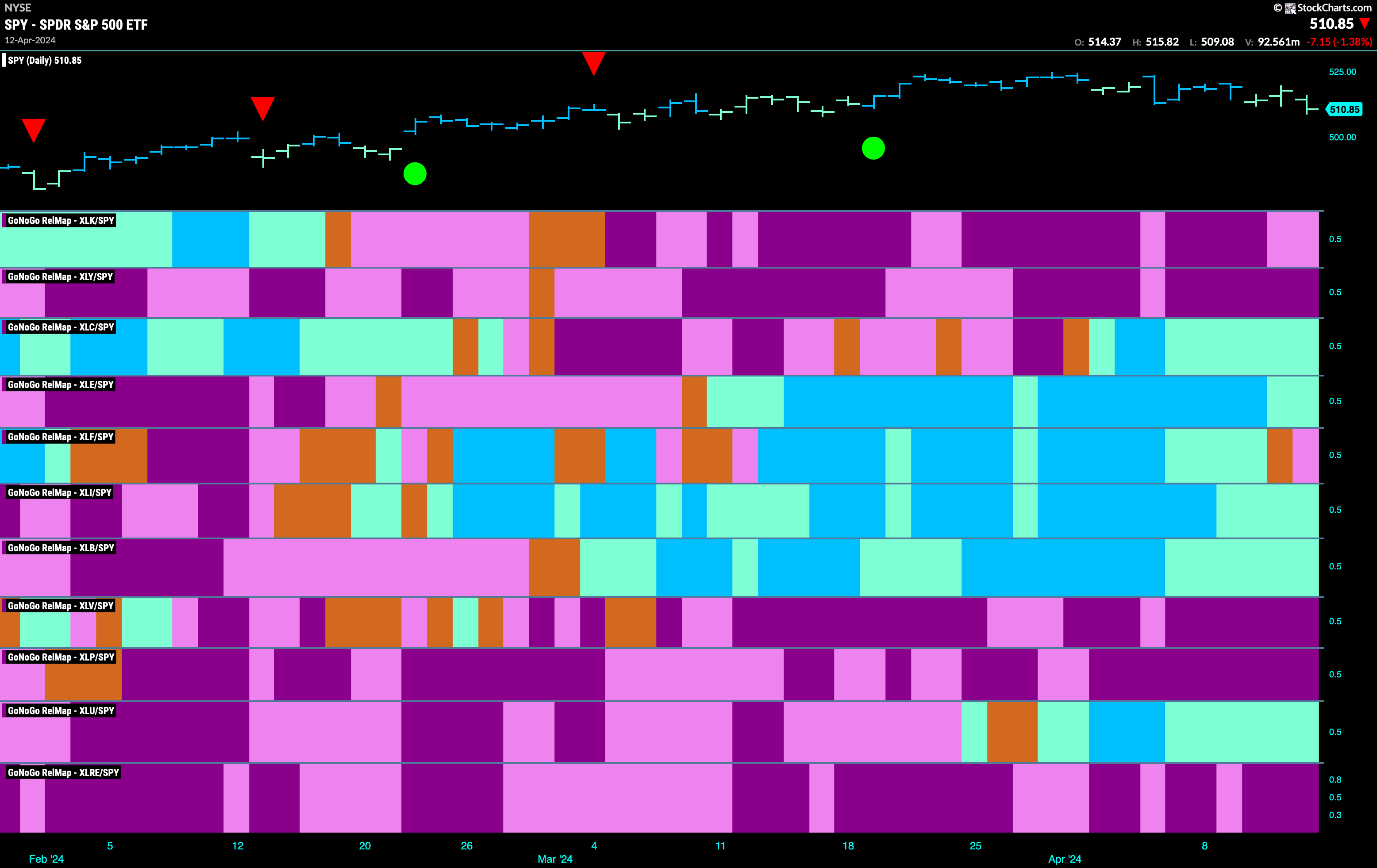

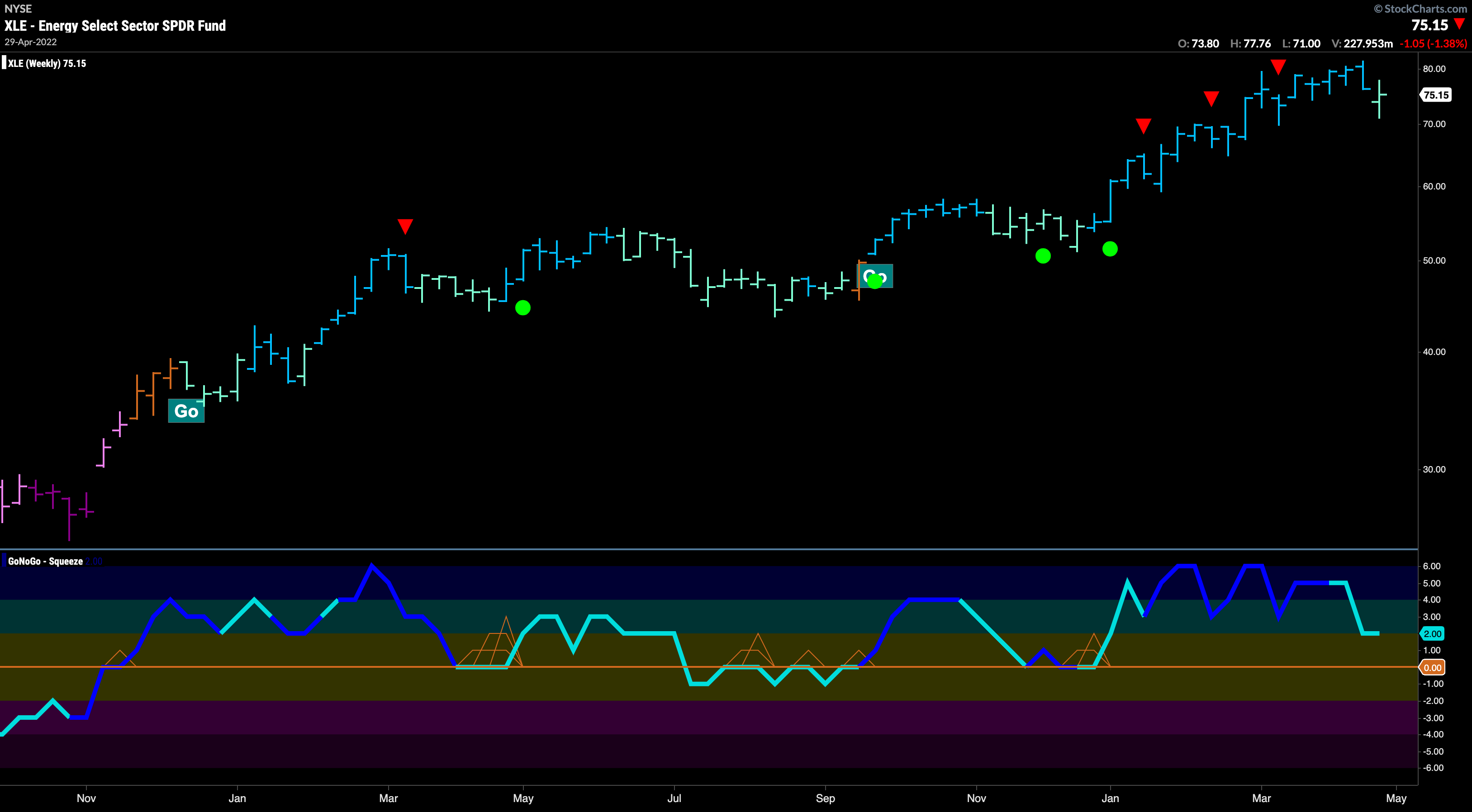

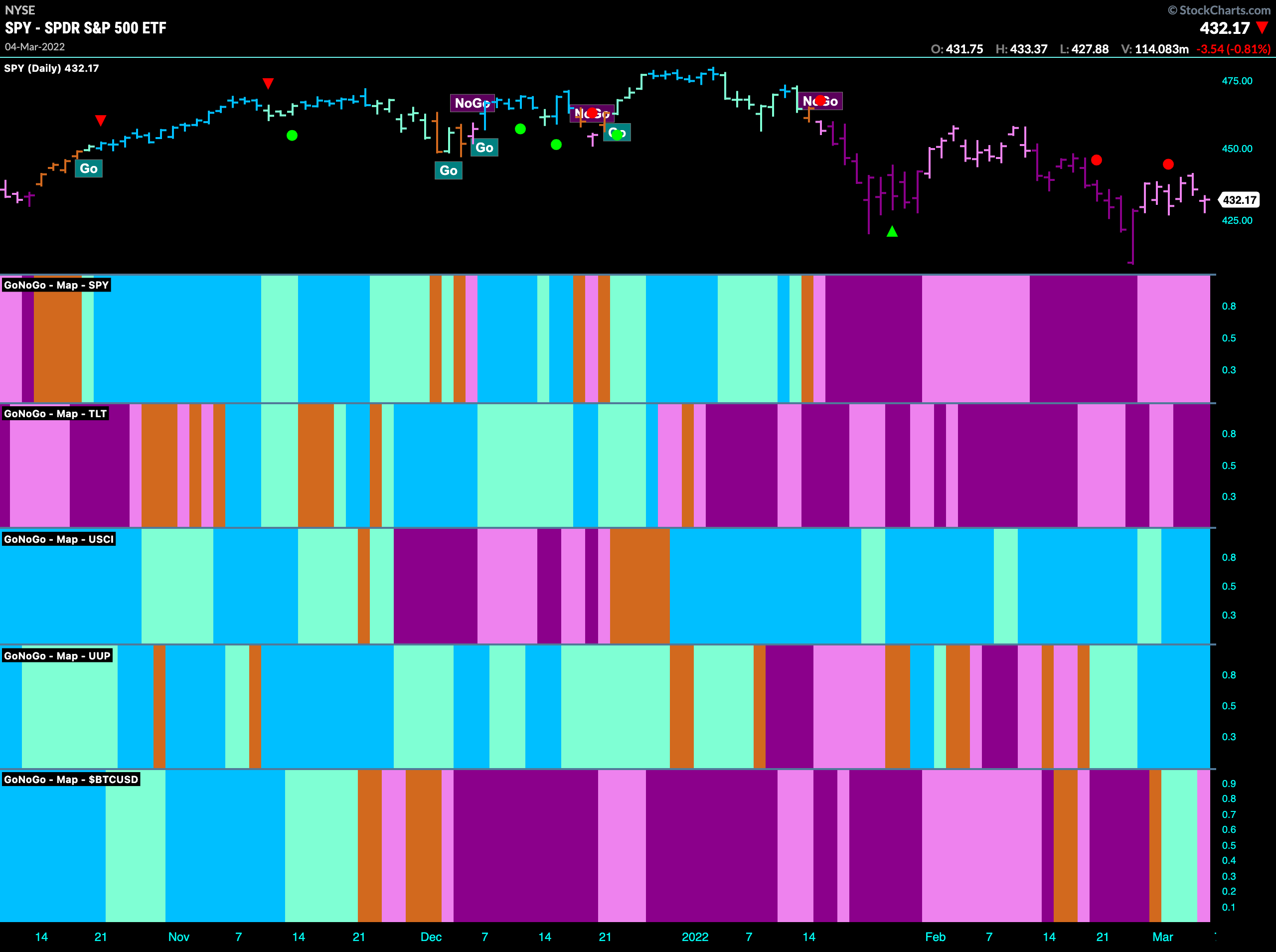

Feb 21, 2022

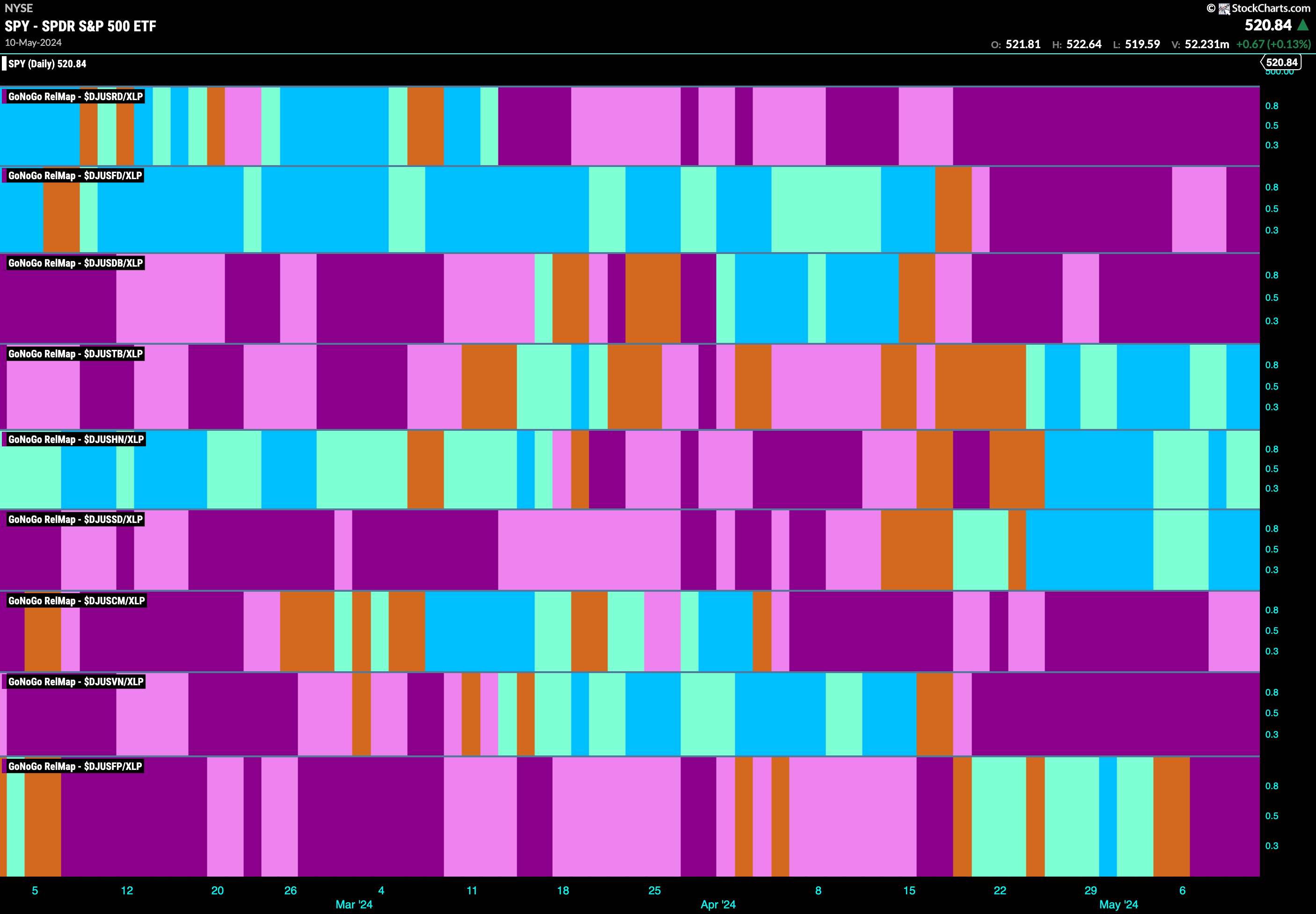

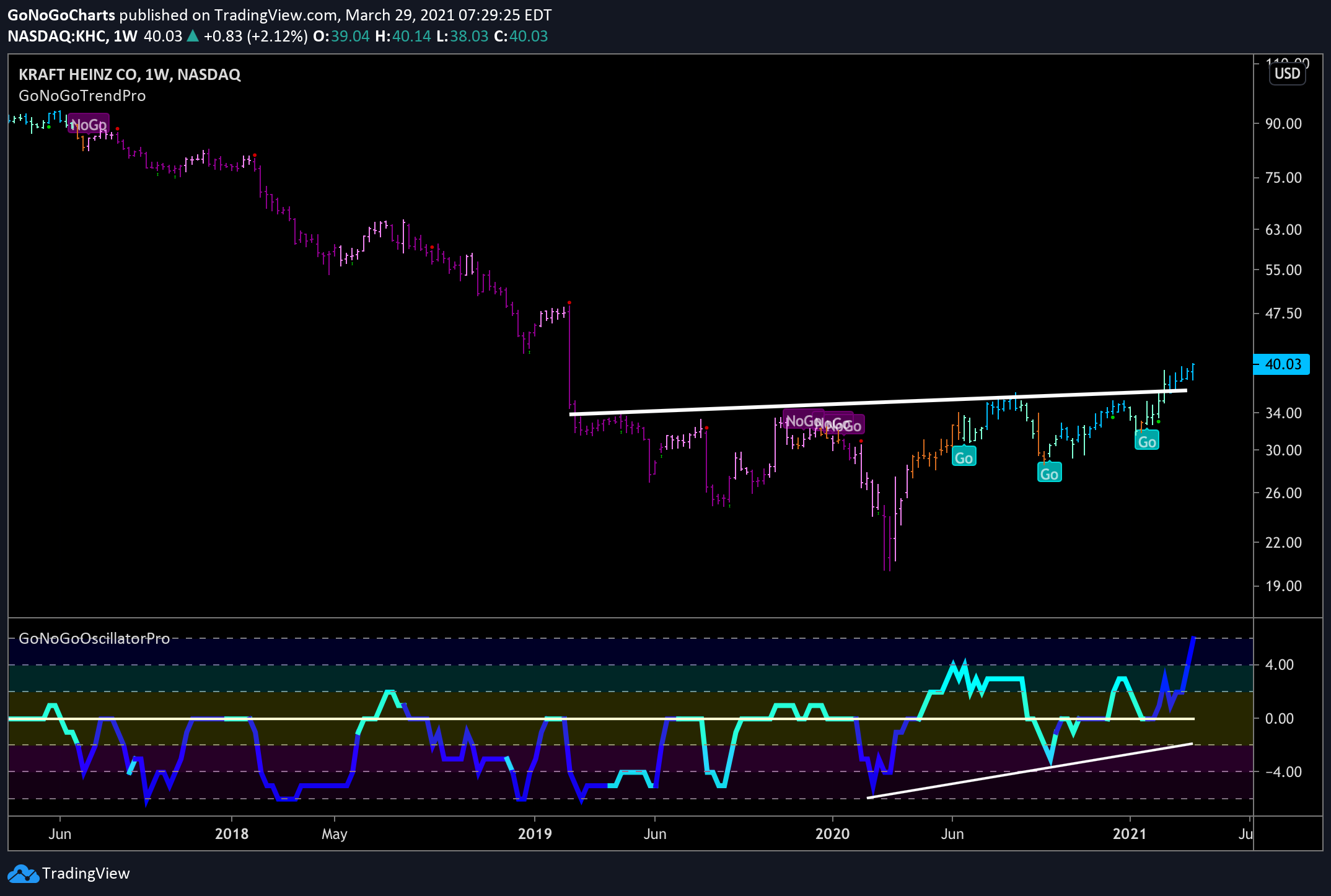

Fish Where the Fish Are

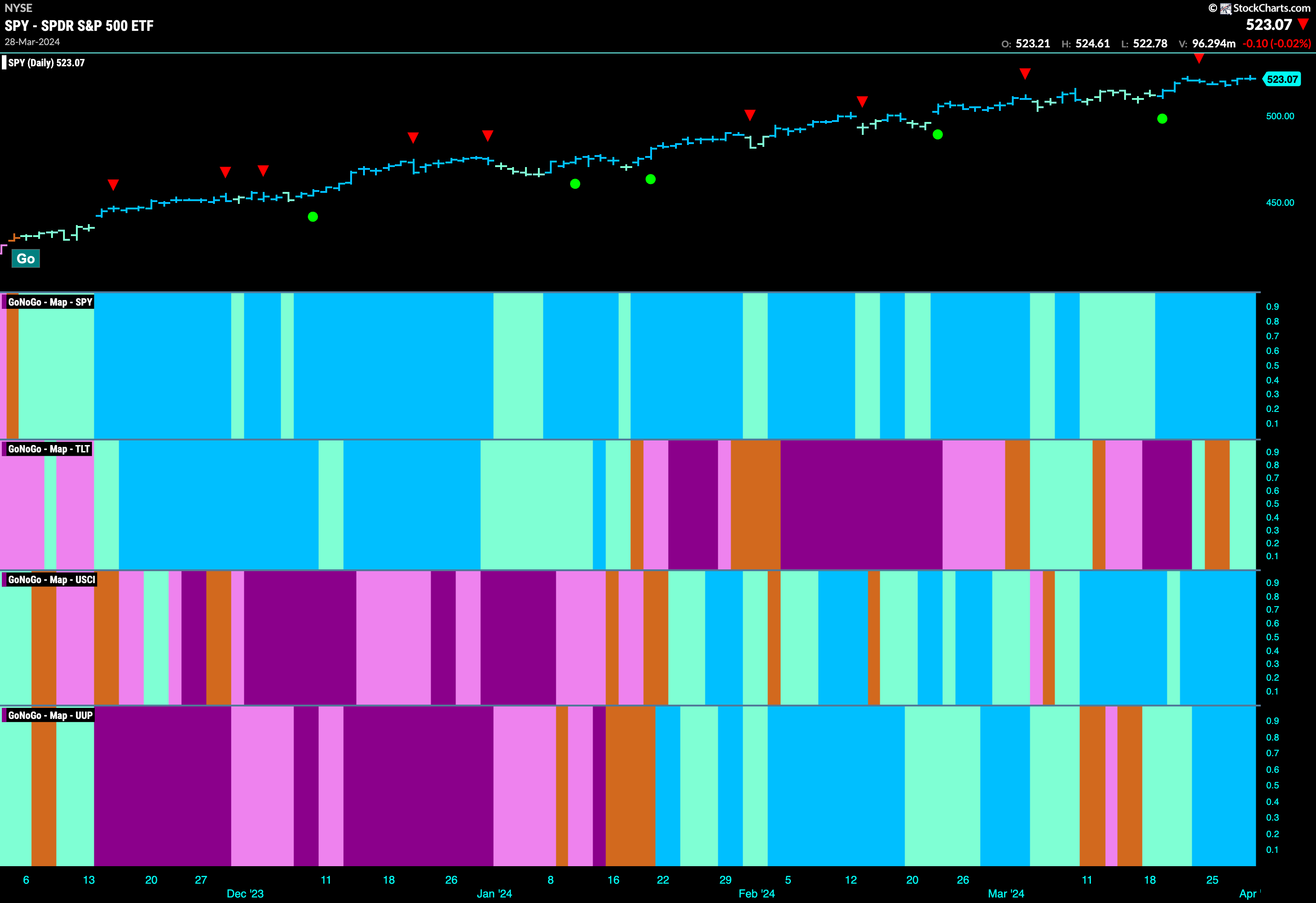

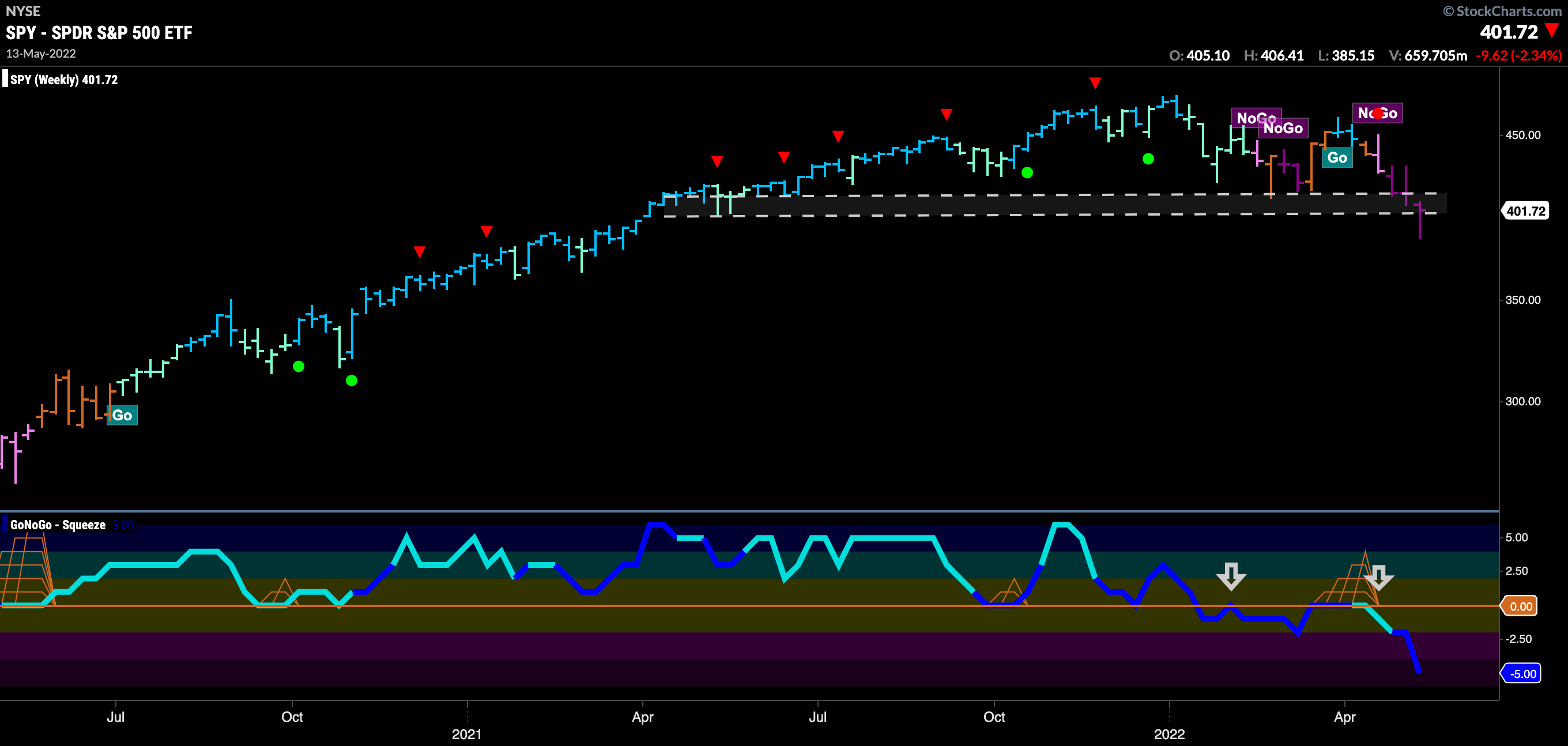

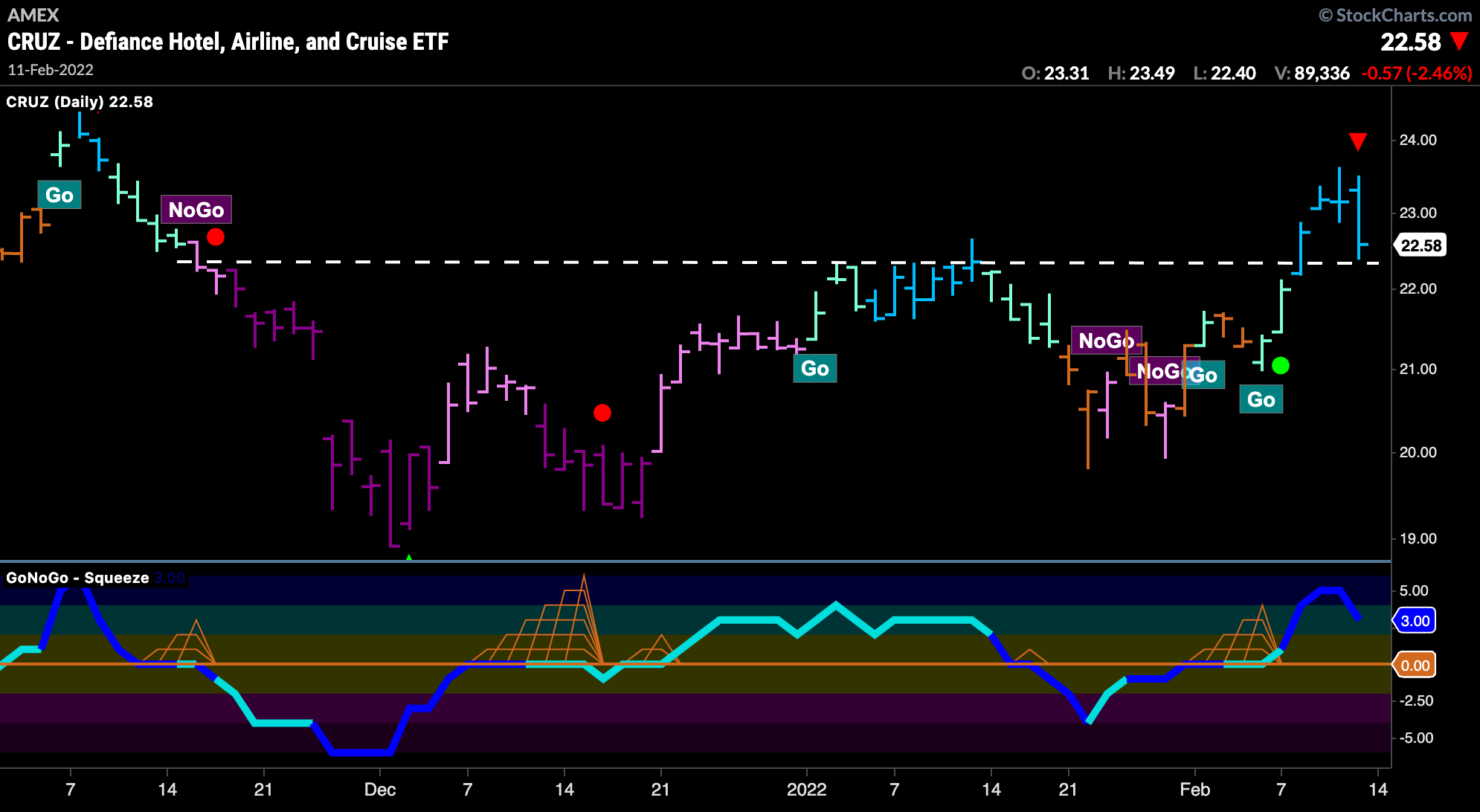

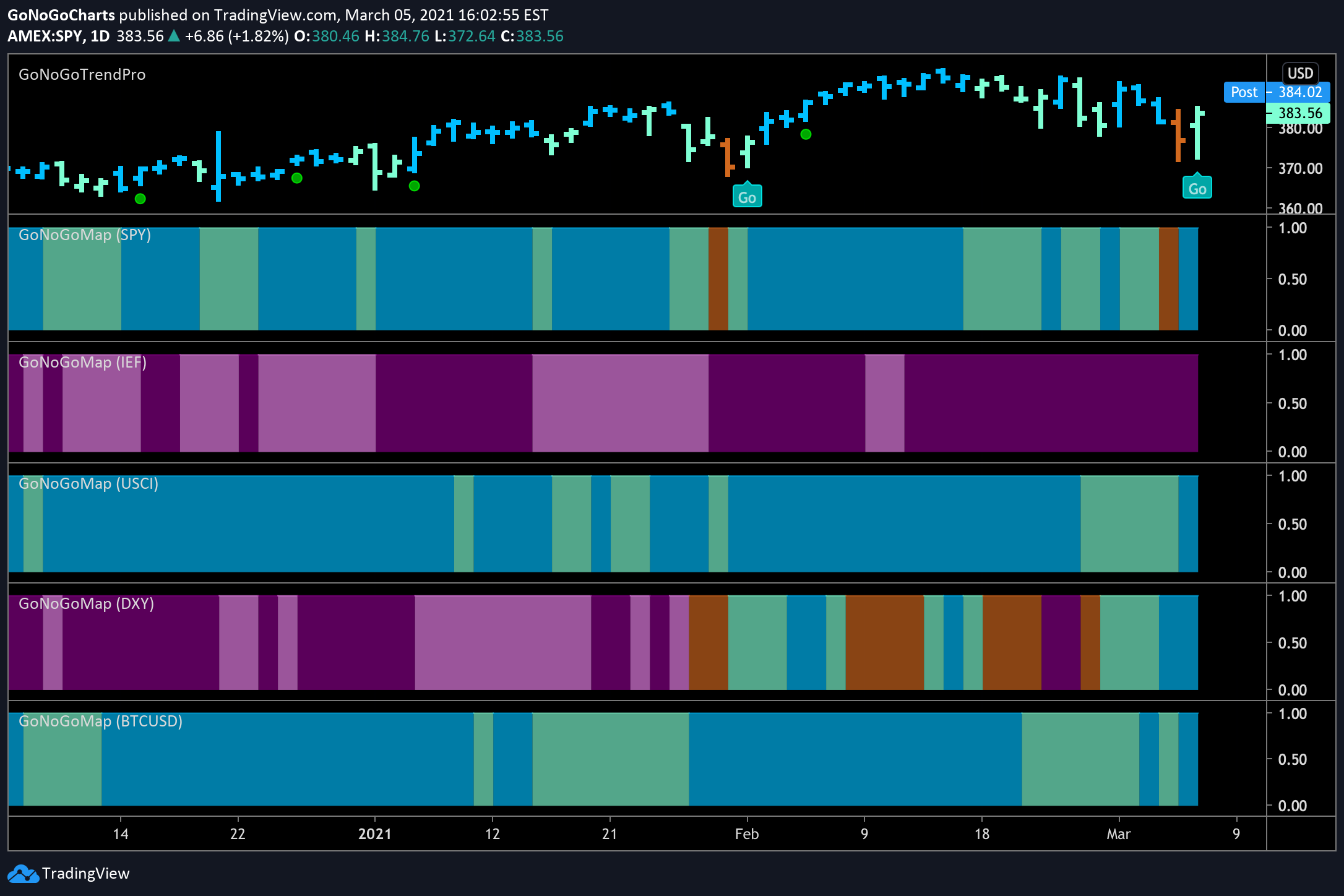

Jan 31, 2022

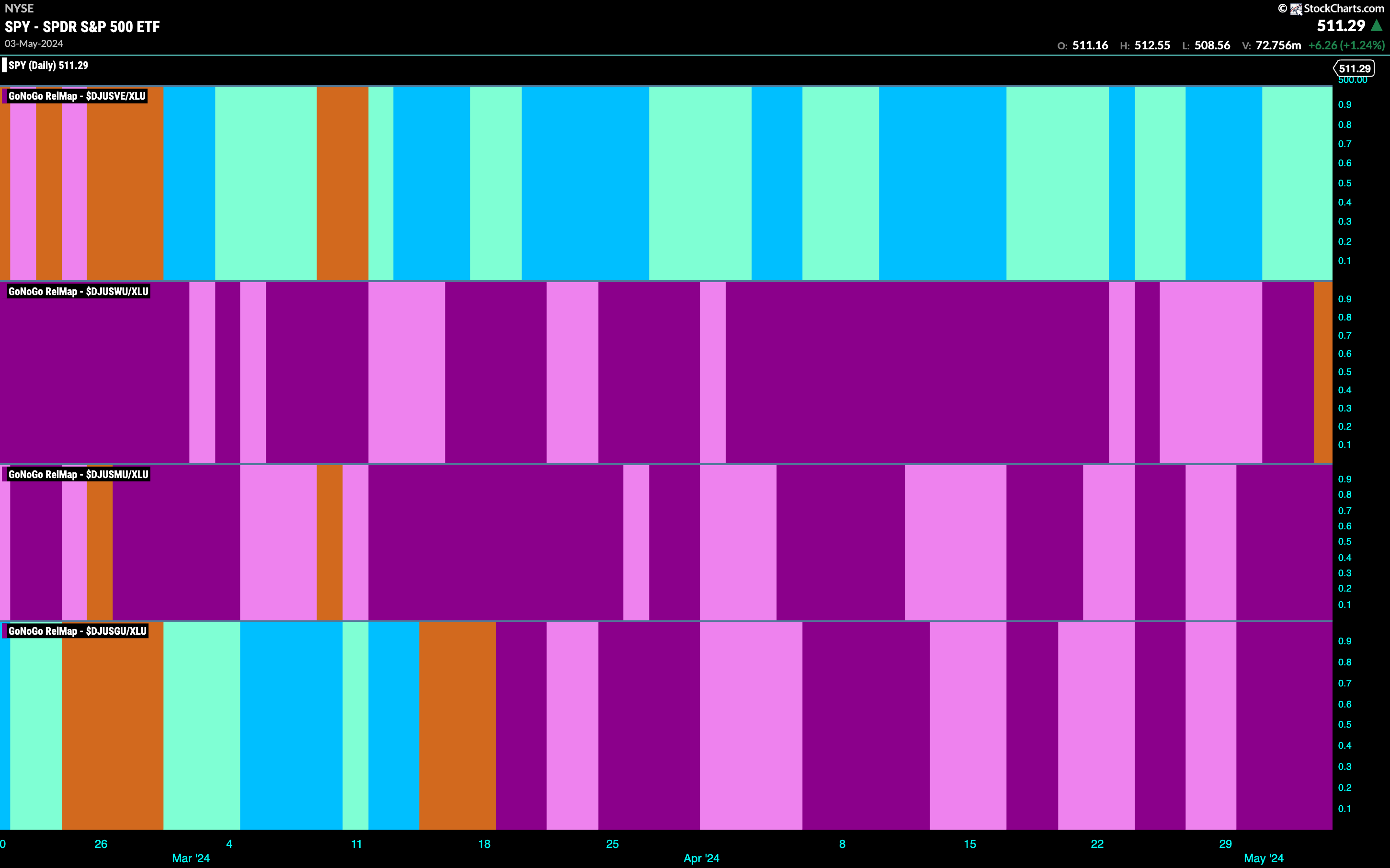

Flight to Quality

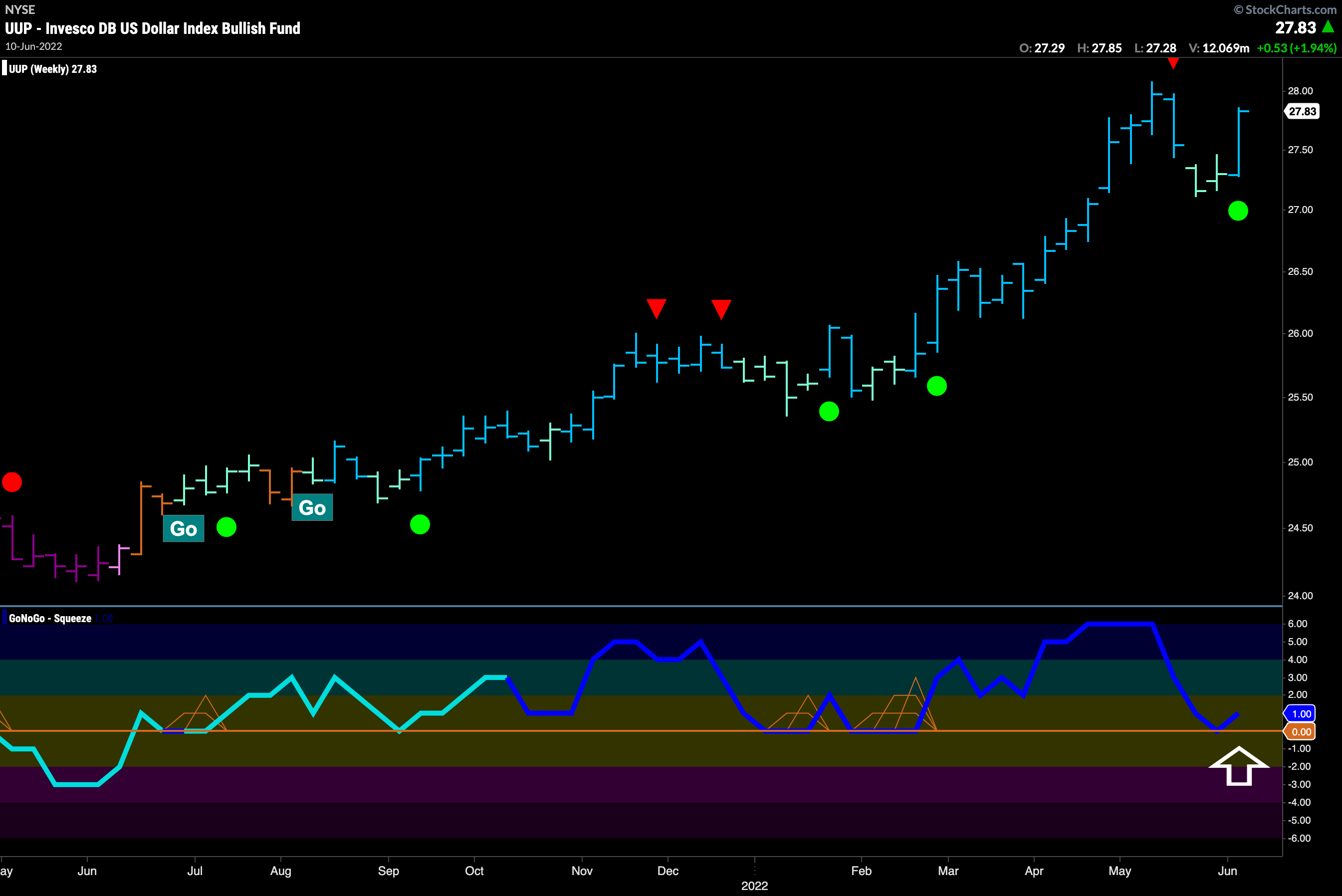

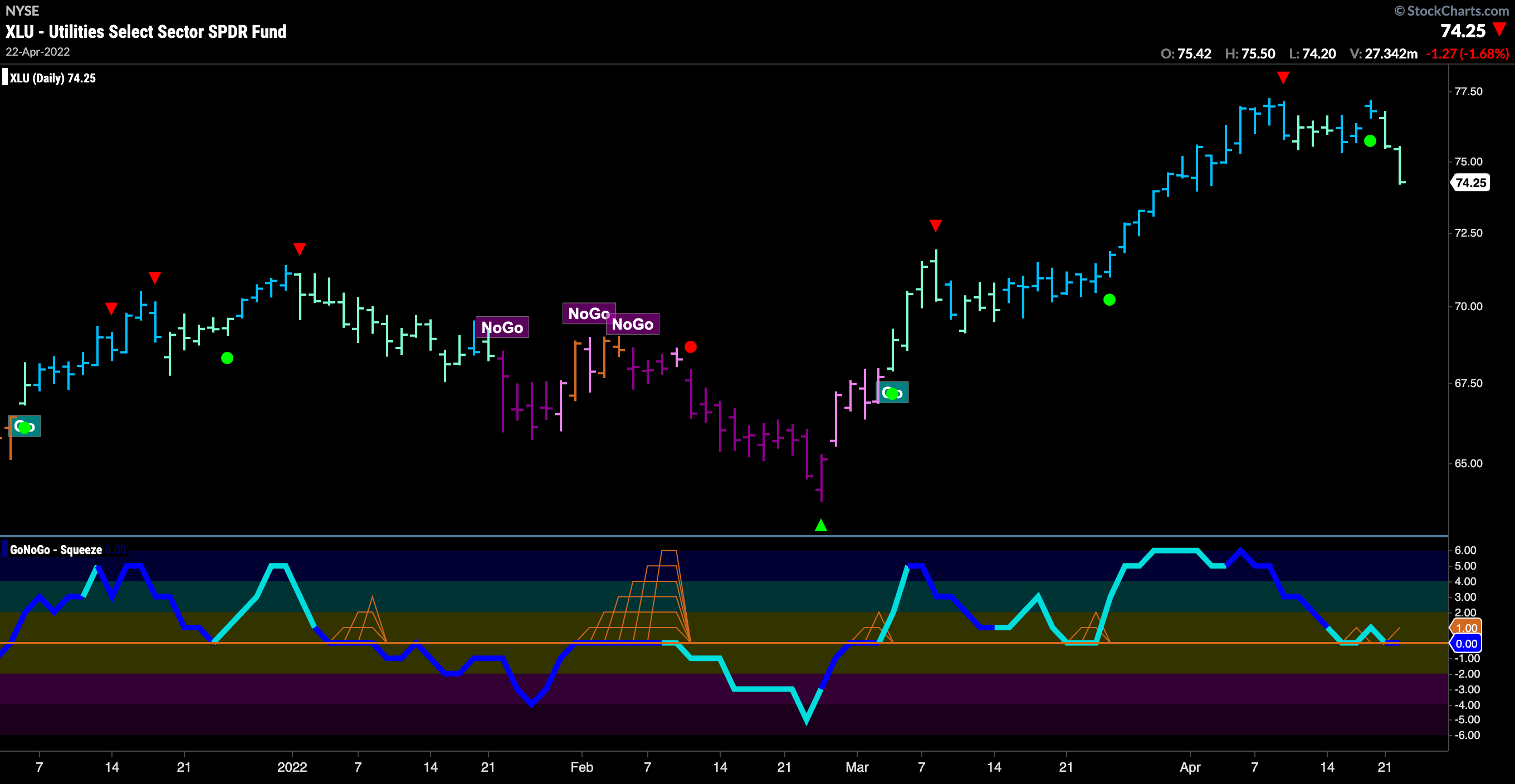

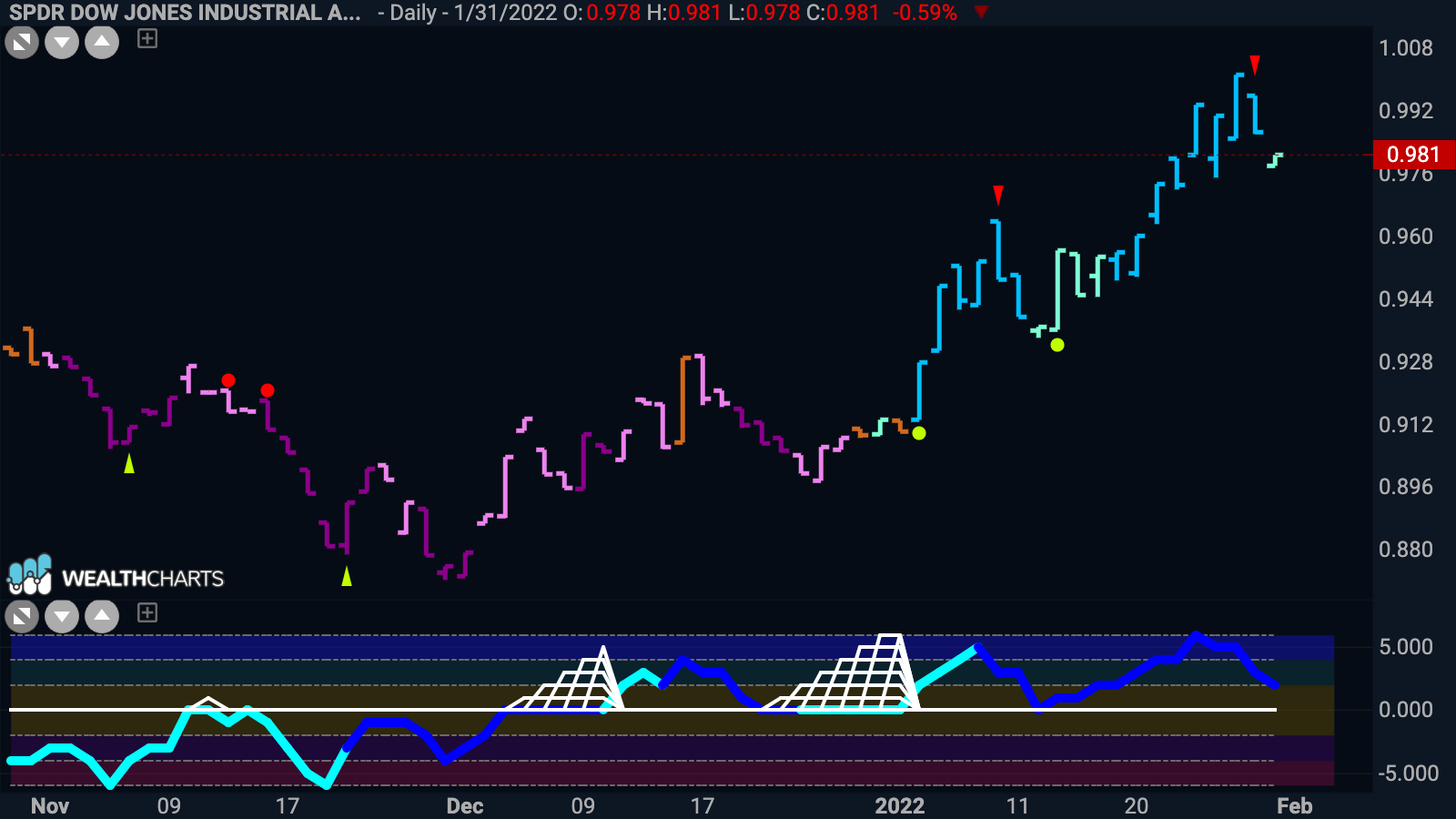

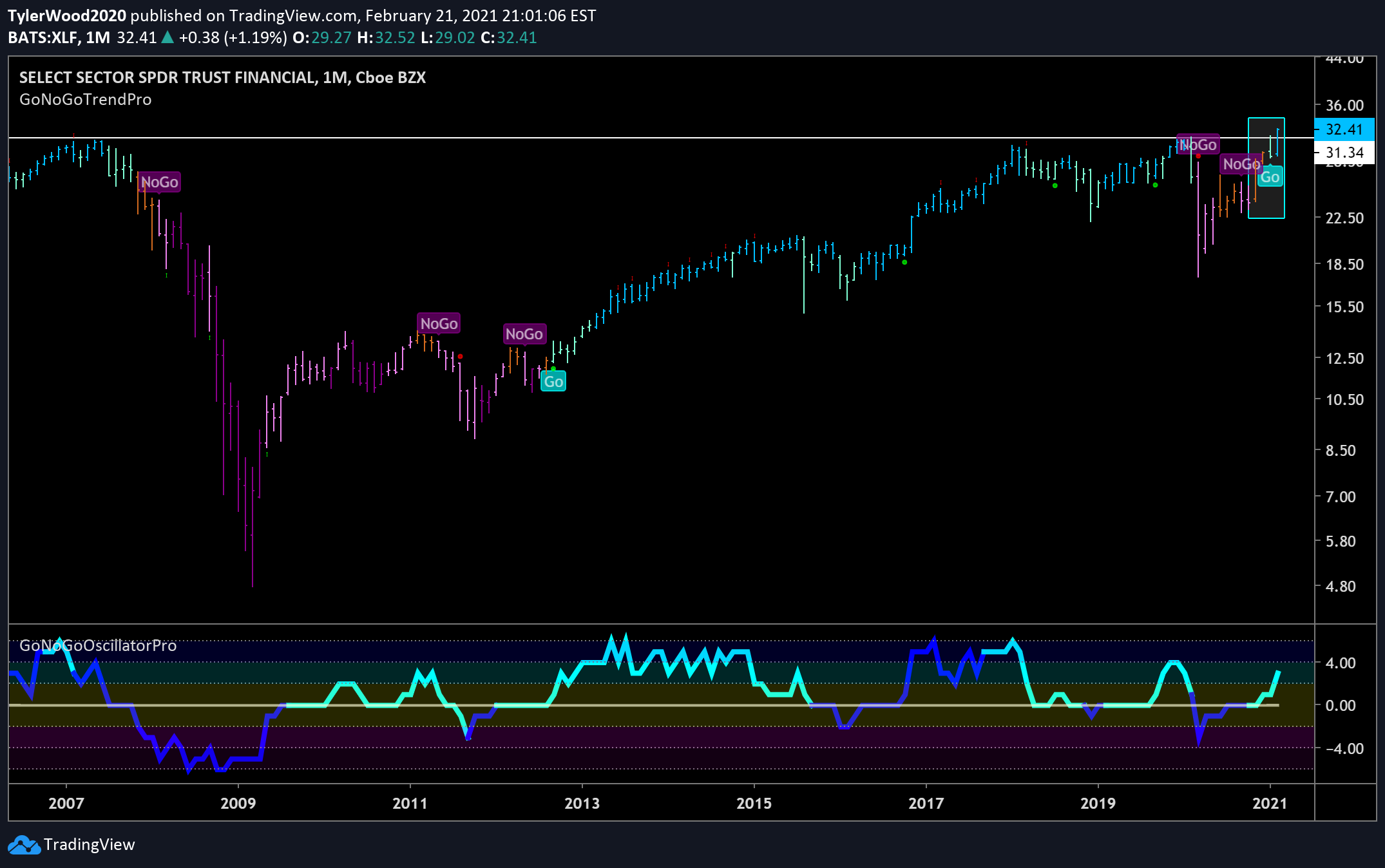

Oct 25, 2021

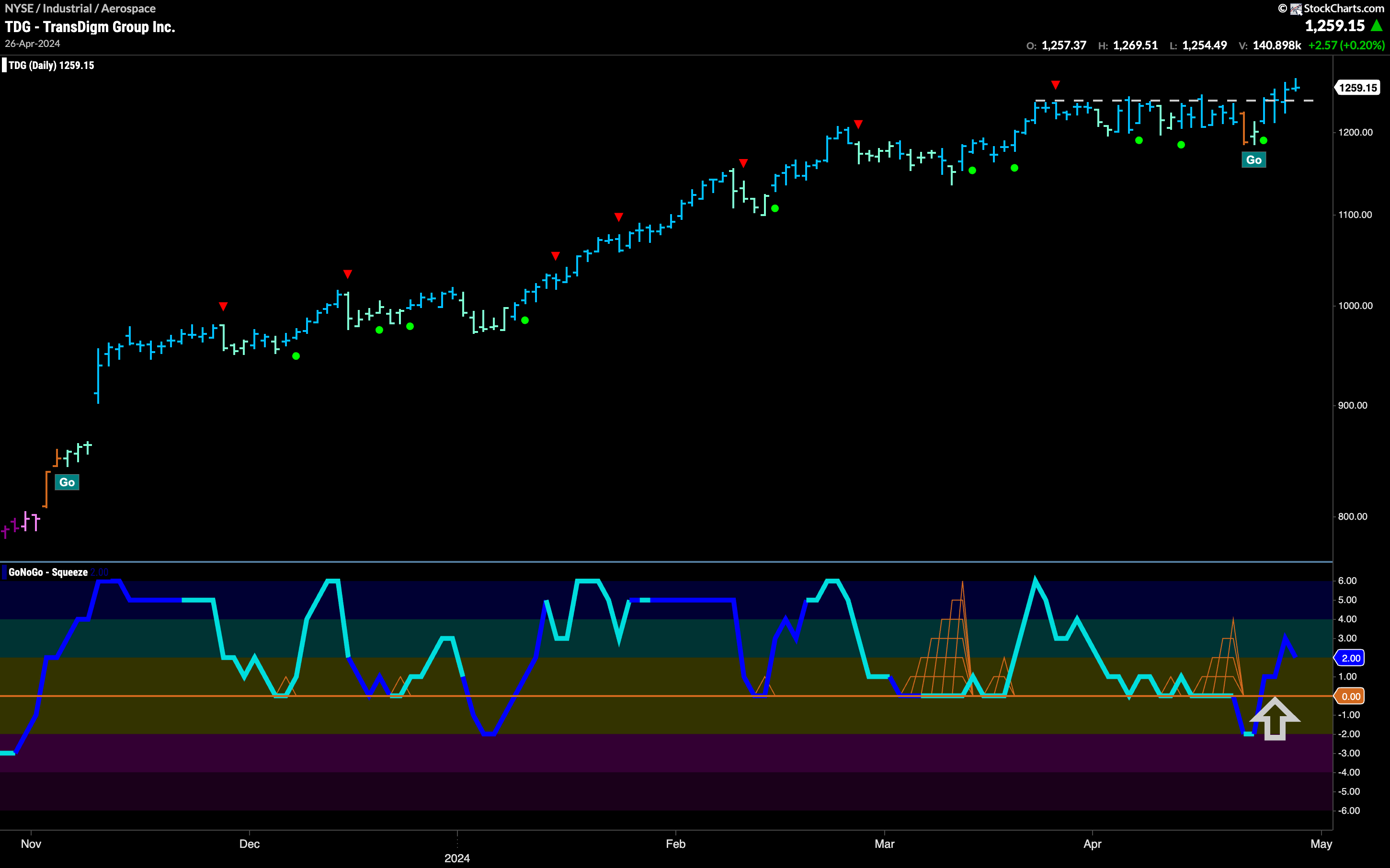

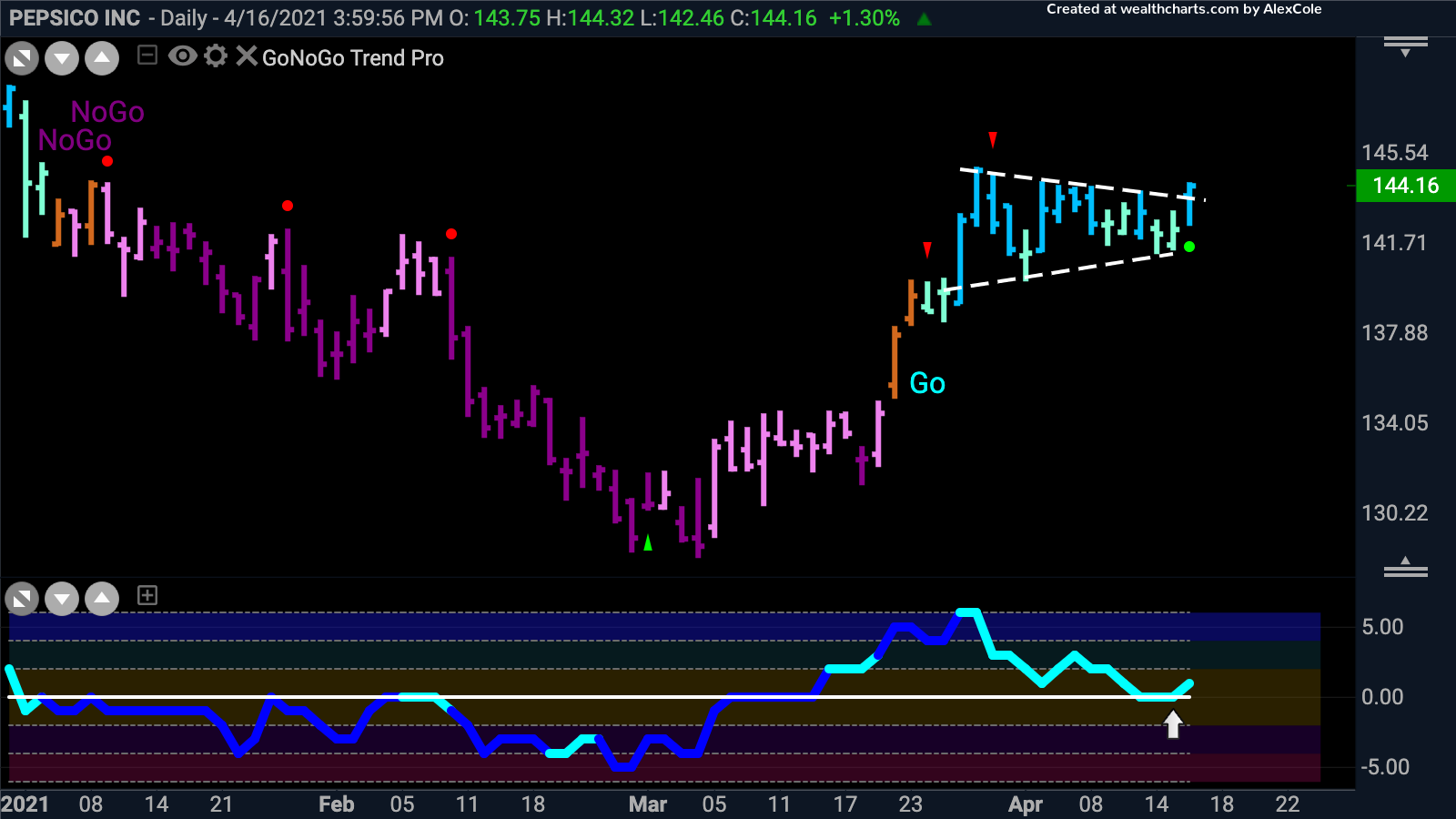

Trading Bonds for Equities

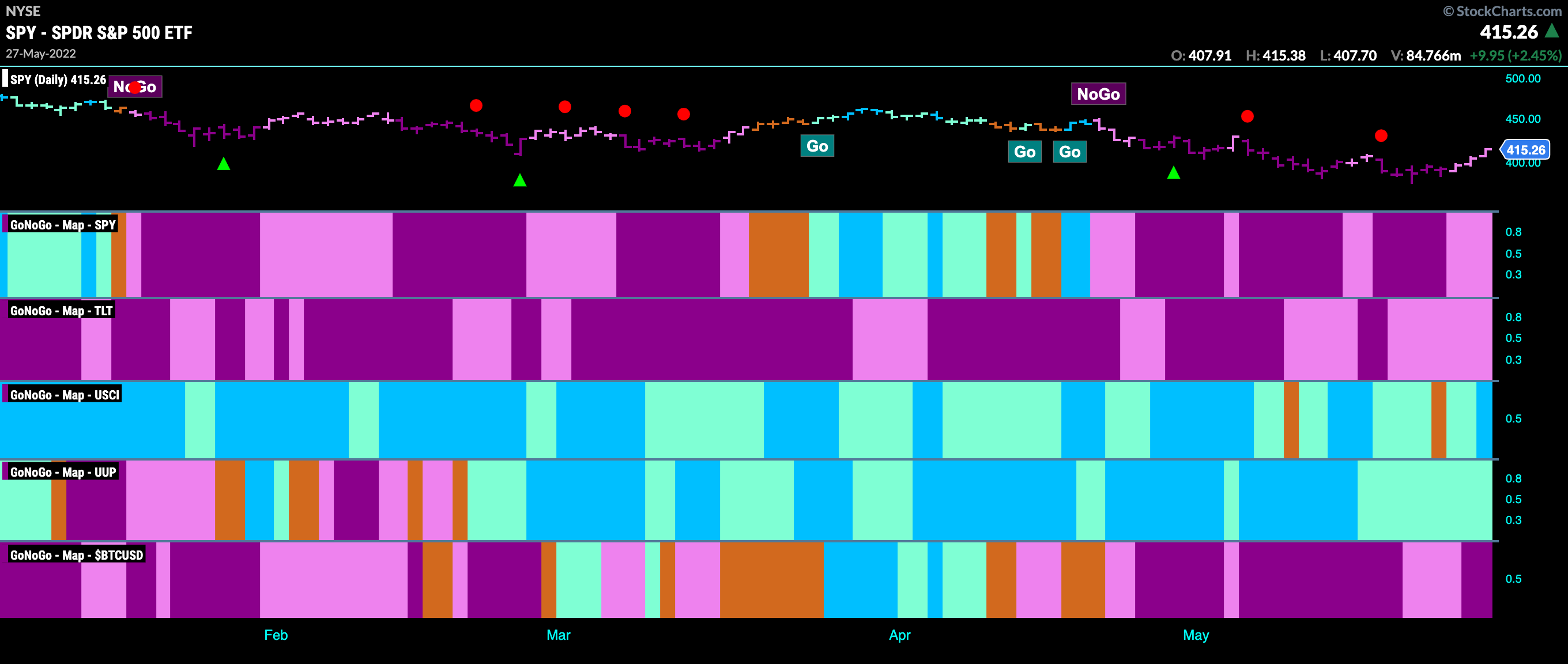

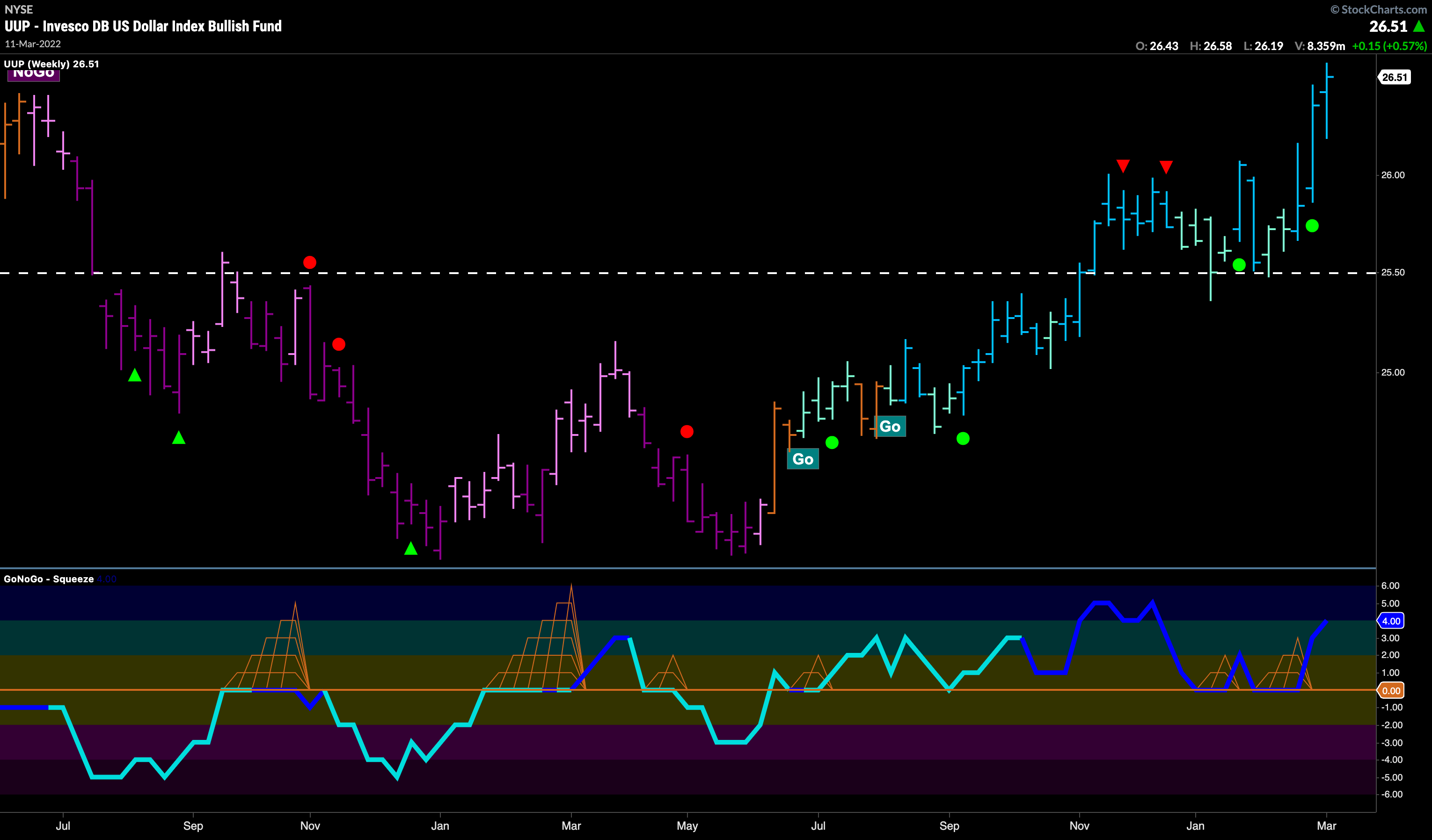

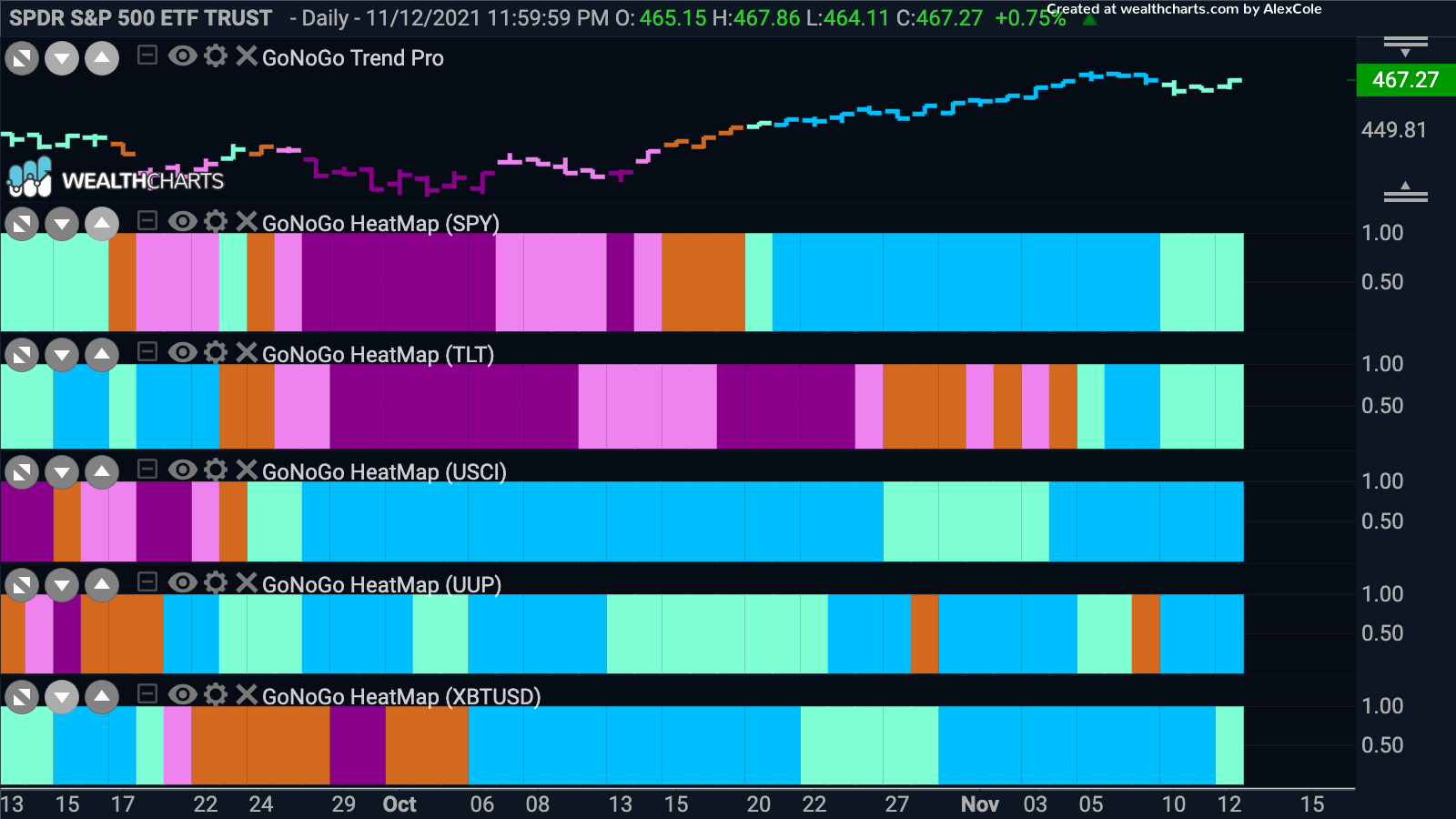

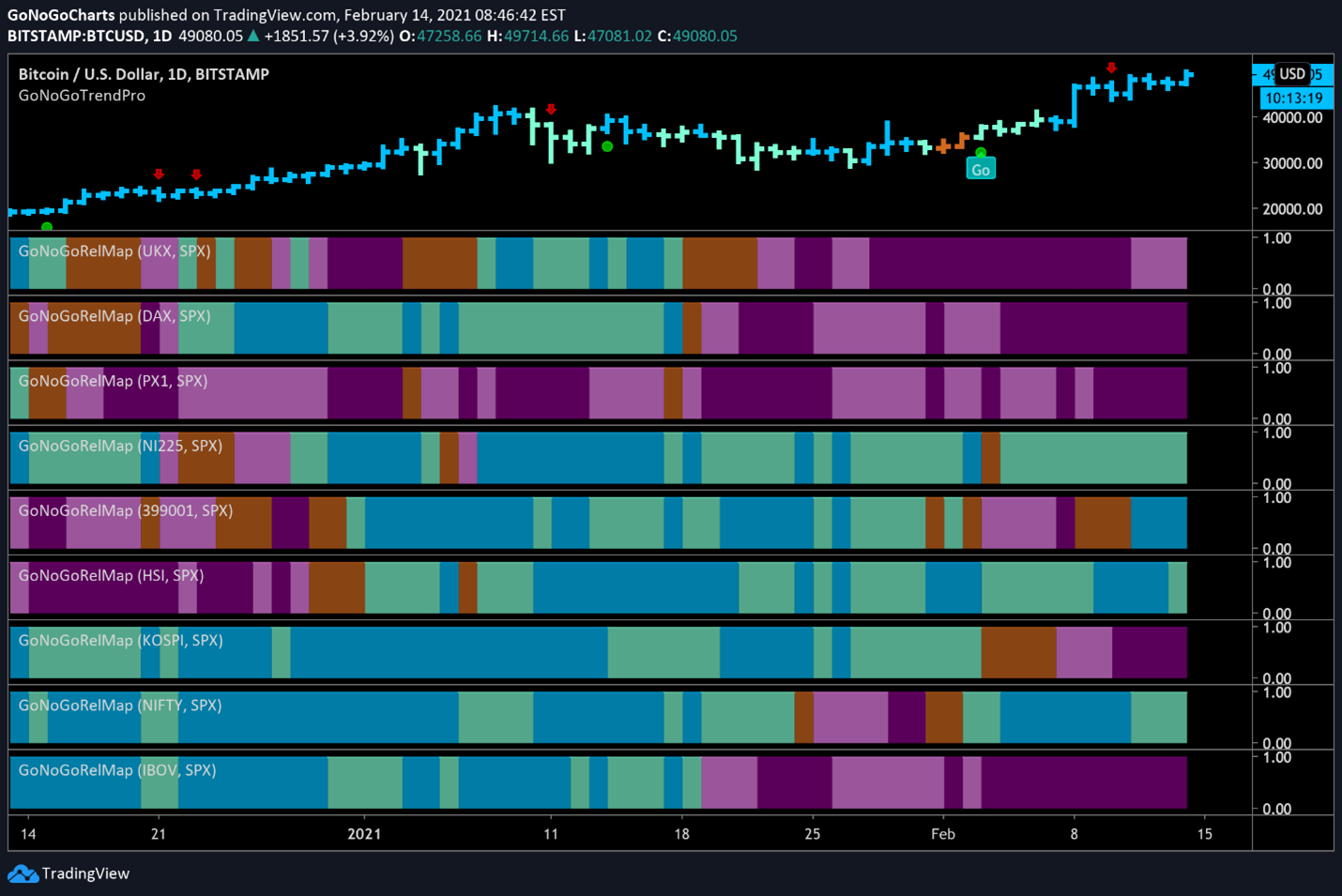

Aug 23, 2021

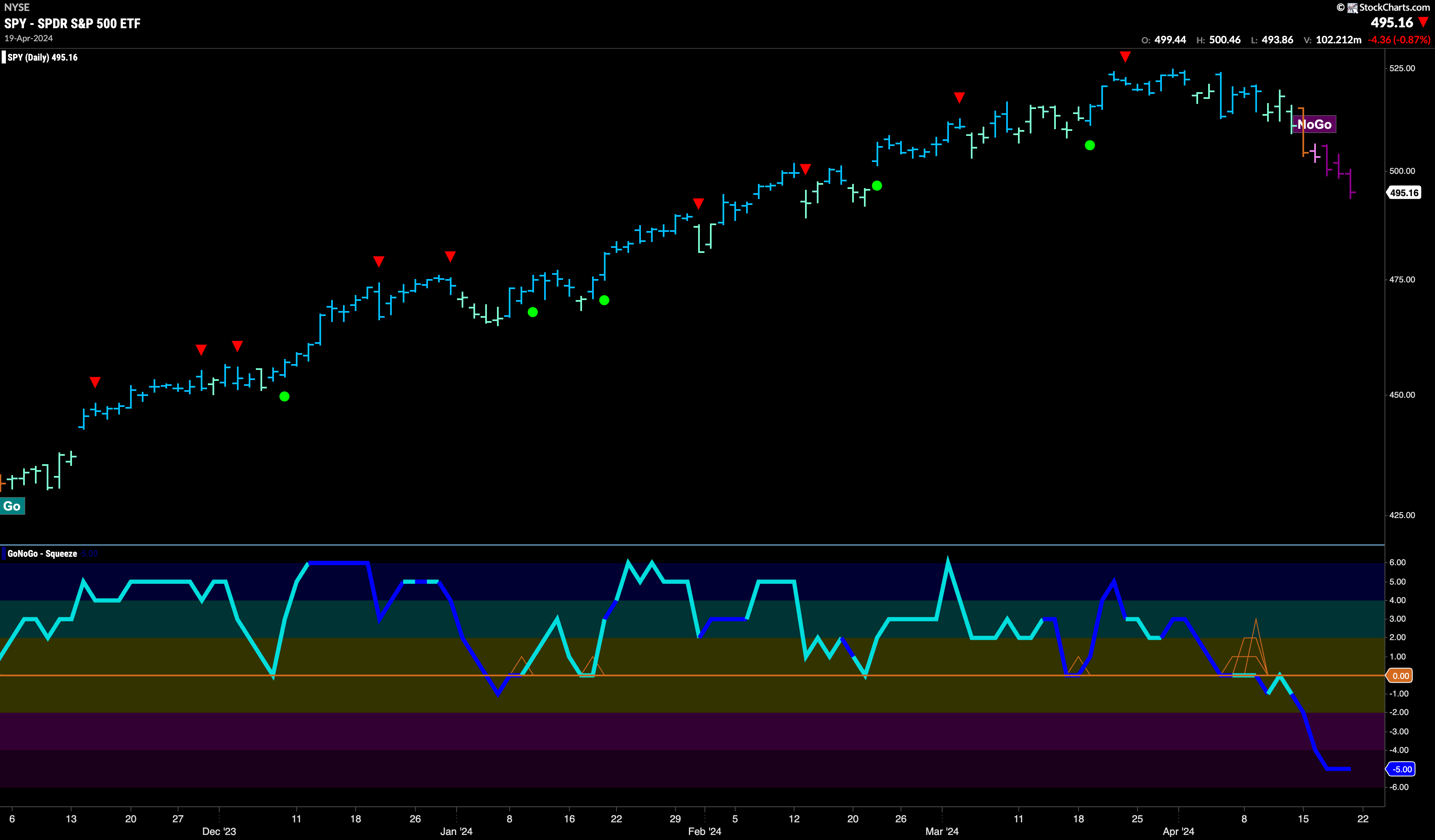

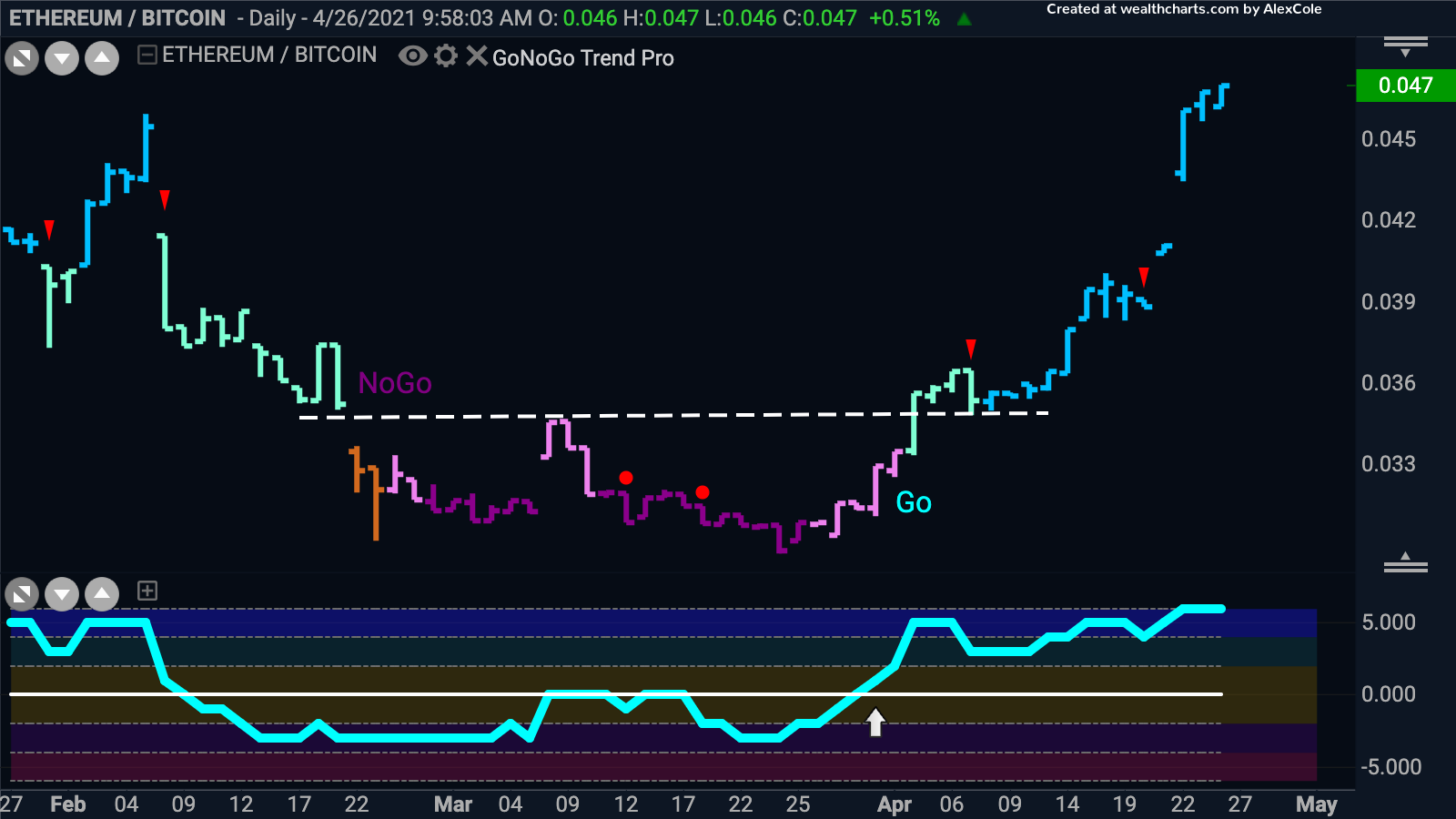

Bitcoin thrives, oil dives

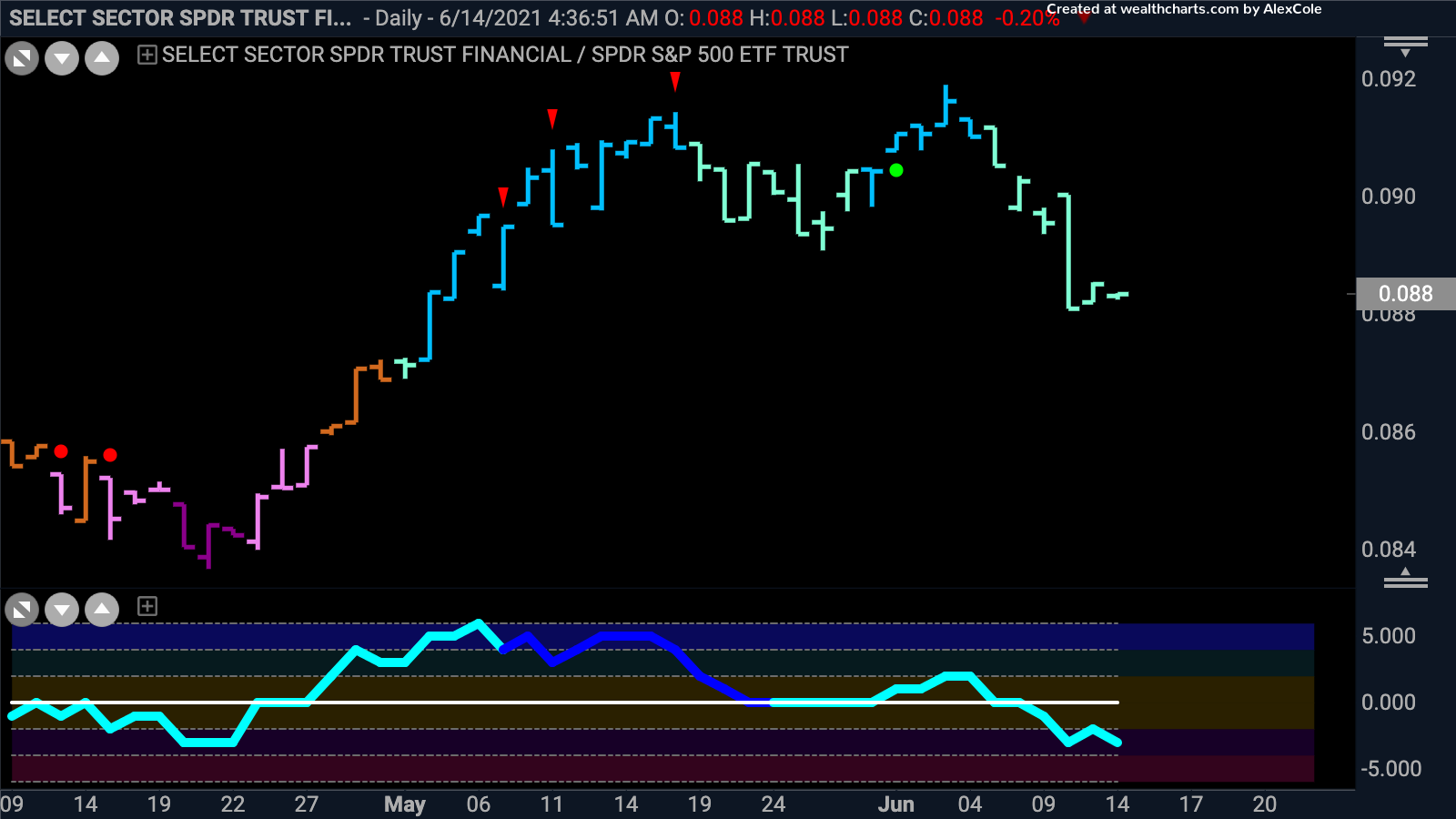

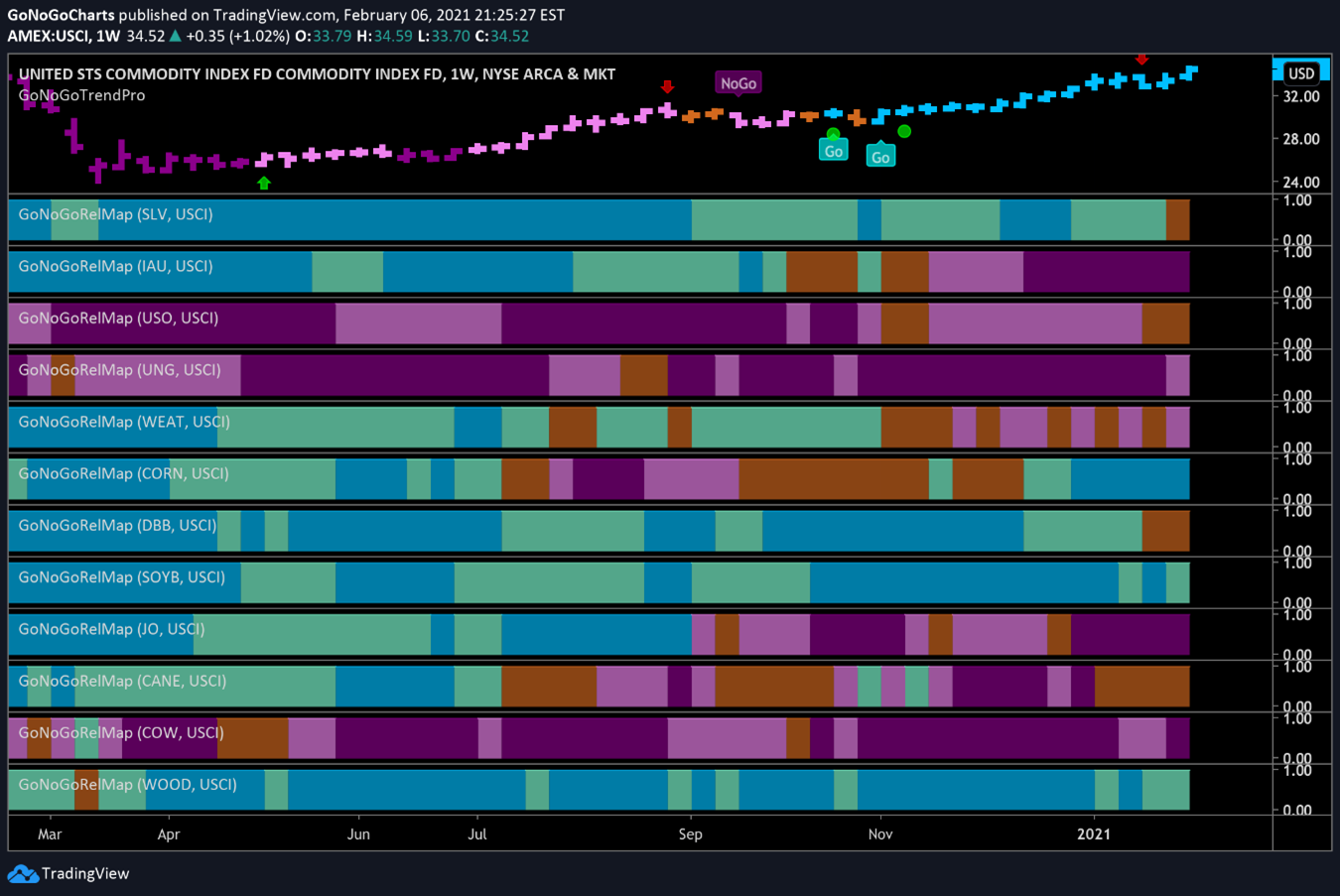

Jun 22, 2021

Growth Resumes Go Trend

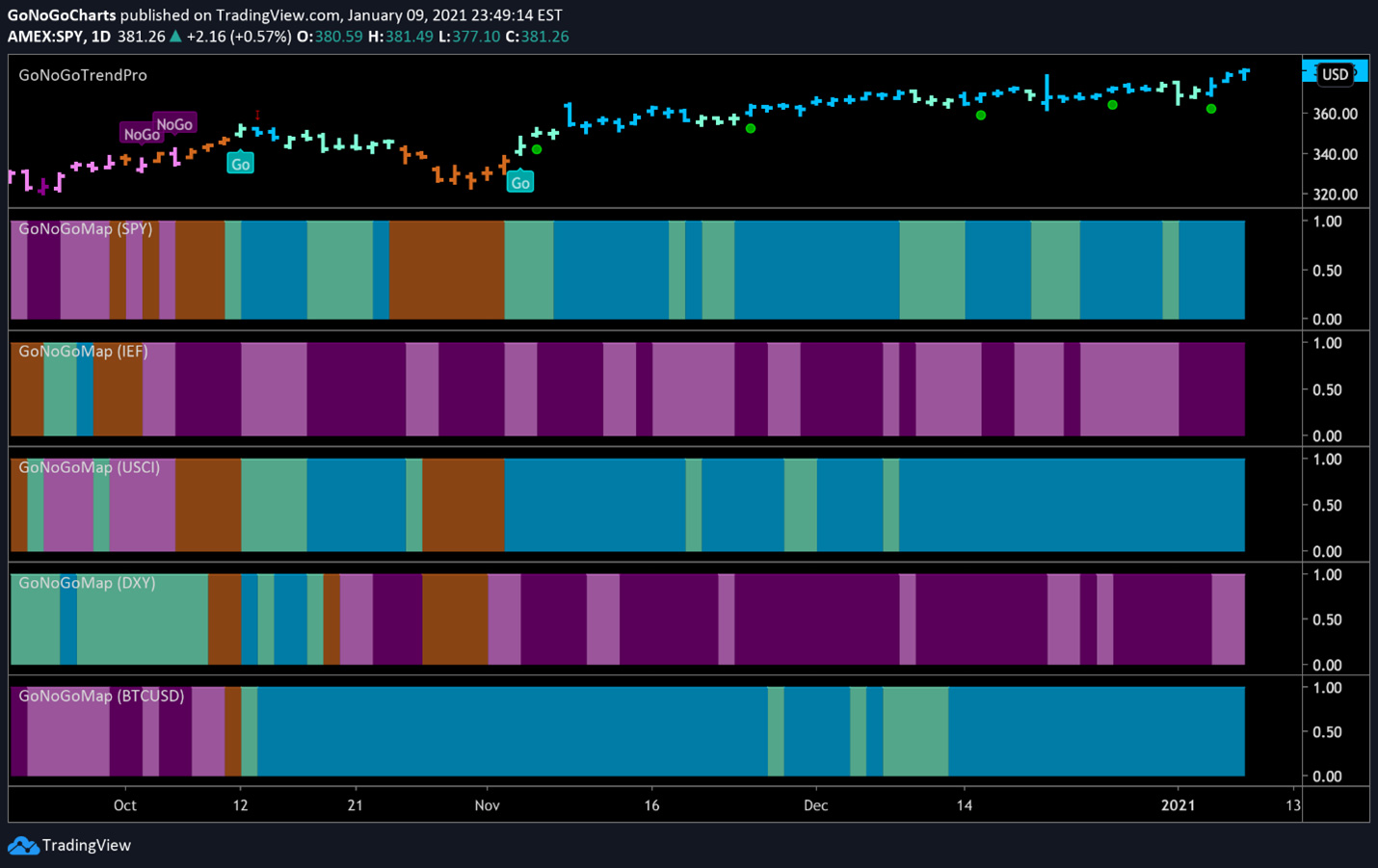

Jan 4, 2021